Hennepin Minnesota Tax Sharing and Disaffiliation Agreement

Description

How to fill out Tax Sharing And Disaffiliation Agreement?

A paperwork routine invariably accompanies any legal endeavor you undertake.

Establishing a business, seeking or accepting a job proposition, shifting ownership, and numerous other life circumstances require you to prepare formal paperwork that varies across the nation.

This is why having everything assembled in one location is extremely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the easiest and most reliable method to procure legal paperwork. All templates found in our library are professionally crafted and validated for compliance with local laws and regulations. Organize your documents and manage your legal matters efficiently with US Legal Forms!

- On this site, you can effortlessly find and download a document for any personal or business purpose relevant to your region, including the Hennepin Tax Sharing and Disaffiliation Agreement.

- Finding examples on the site is remarkably simple.

- If you already possess a subscription to our service, Log In to your account, search for the example using the search bar, and click Download to save it on your device.

- Following that, the Hennepin Tax Sharing and Disaffiliation Agreement will be accessible for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this simple guide to acquire the Hennepin Tax Sharing and Disaffiliation Agreement.

- Ensure you have opened the correct page with your localized form.

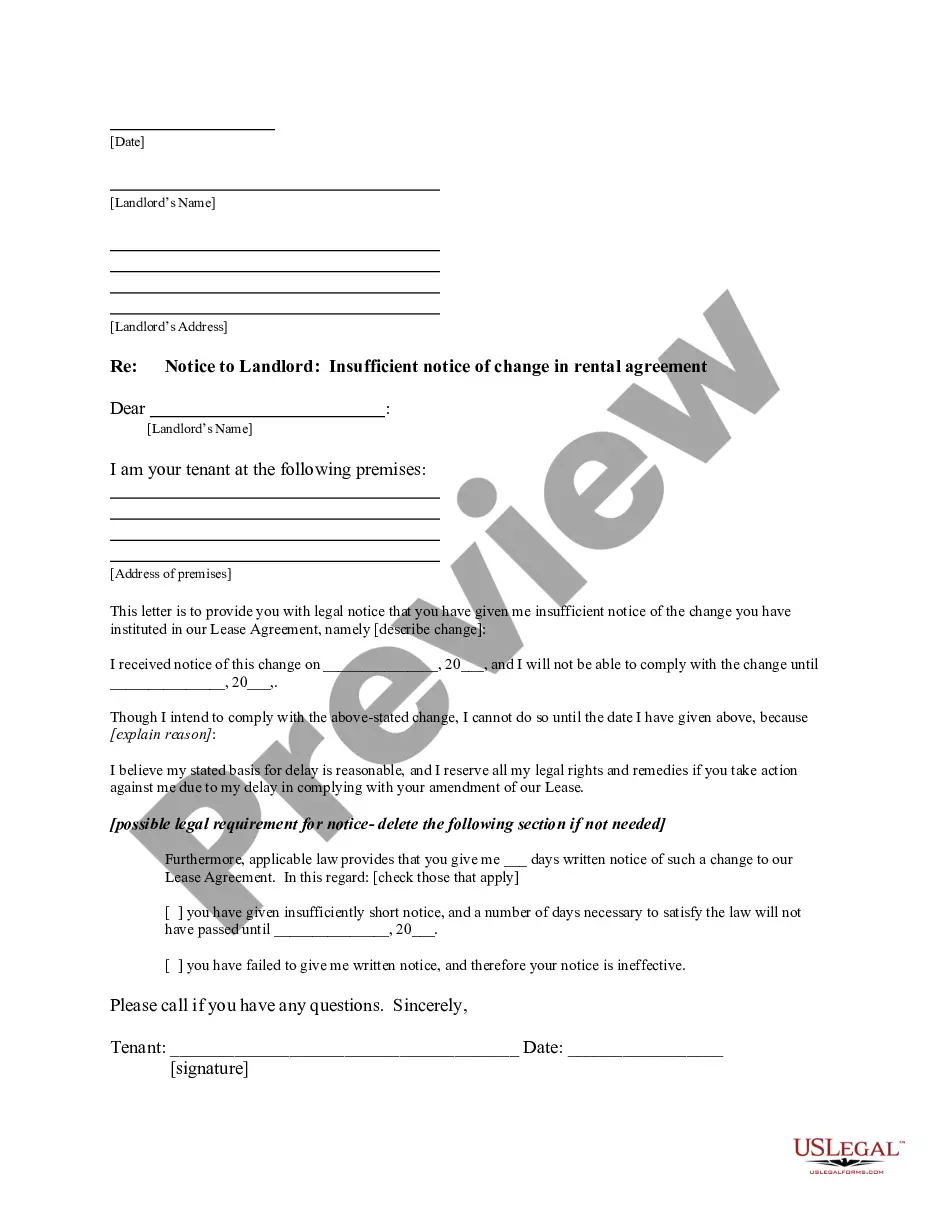

- Utilize the Preview mode (if available) and browse through the example.

- Examine the description (if any) to confirm the form meets your needs.

- Search for another document via the search feature if the example does not suit you.

- Click Buy Now once you find the necessary template.

Form popularity

FAQ

To apply for the residential homestead classification, you must: Complete a manufactured homestead application (PDF). Provide the Assessor's office with a copy of your proof of ownership, such as a purchase agreement, or bill of sale and Certificate of Title.

Steps to appeal Call your assessor at the number listed on your valuation notice. Often you can resolve issues by contacting your assessor. Further dispute your valuation or classification.Attend the county board of appeal and equalization meeting.Appeal to the Minnesota Tax Court.

You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.gov.

Homesteads. Homestead is a program to reduce property taxes for owners who also occupy their home and are a Minnesota resident. You can qualify for this tax reduction if you own and occupy your house as your main place of residence or are a relative of an owner living in the owner's house.

Real estate taxes are the same as real property taxes. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes (or real property taxes) are typically used to help pay for local and state services.

Hennepin County's 1.28% average effective property tax rate is higher than Minnesota's state average effective rate of 1.08%. The median home value in Hennepin County is $260,300, and the median annual property tax payment is $3,336.

How do I appeal to Minnesota Tax Court? To appeal your property's value or classification, you complete and file Minnesota Tax Court Form 7, Real Property Tax Petition. You must file your appeal by April 30 of the year the tax becomes payable. For example, you must appeal your 2018 assessment by April 30, 2019.

Real property tax rates at 1% to 2% of assessed value Under Section 233 of the Local Government Code of 1991, the following rates of basic real property tax are prescribed based on assessed values of real properties in the Philippines: 1% for province; and, 2% for city or municipality within Metro Manila area.

The redemption period is usually three years but depends on a few factors, including the use and location of the property. Three-year redemption period. In Minnesota, the redemption period is typically three years from the time of the tax judgment sale.

Property taxes are calculated using the Current Value Assessment of a property, as determined by the Municipal Property Assessment Corporation (MPAC), and multiplying it by the combined municipal and education tax rates for the applicable class of property.