San Diego, California, Tax Sharing and Disaffiliation Agreement is a legal agreement between the City of San Diego and other local jurisdictions in the region that outlines the principles and procedures for sharing and distributing tax revenue generated within the city. This agreement ensures equitable distribution of tax revenue among the participating entities and promotes cooperation in tax-related matters. Keywords: San Diego, California, tax revenue, tax sharing, disaffiliation agreement, local jurisdictions, legal agreement, distribution, cooperation, tax-related matters. There are different types of San Diego, California, Tax Sharing and Disaffiliation Agreements based on specific tax categories and jurisdictions involved. Some of these agreements may include: 1. Sales Tax Sharing Agreement: This type of agreement focuses on sharing sales tax revenue generated within San Diego among the participating entities. The agreement determines the percentage or formula for distributing sales tax revenue based on specific criteria like population, sales volume, or other predetermined factors. 2. Property Tax Disaffiliation Agreement: This agreement enables the disaffiliation of certain properties within San Diego from the jurisdiction they originally belong to for tax purposes. This can occur when a property is transferred to another jurisdiction or when a new jurisdiction is established. The agreement defines the terms and conditions for transitioning tax responsibilities between jurisdictions. 3. Transient Occupancy Tax Revenue Sharing Agreement: This agreement pertains to the sharing of transient occupancy tax revenue, which is collected from visitors staying in hotels and other lodging establishments. It outlines the percentage or formula for distributing this tax revenue among San Diego and other participating cities or regions. 4. Business Tax Sharing Agreement: This agreement focuses on sharing revenue generated from business taxes or licenses among different jurisdictions within San Diego. It outlines the distribution criteria and procedures to ensure fairness in the allocation of business tax revenue. These are a few examples of the various types of Tax Sharing and Disaffiliation Agreements that can exist in San Diego, California, depending on the specific tax categories and jurisdictions involved. Each agreement aims to establish a fair and cooperative framework for tax revenue sharing and distribution among the participating entities.

San Diego California Tax Sharing and Disaffiliation Agreement

Description

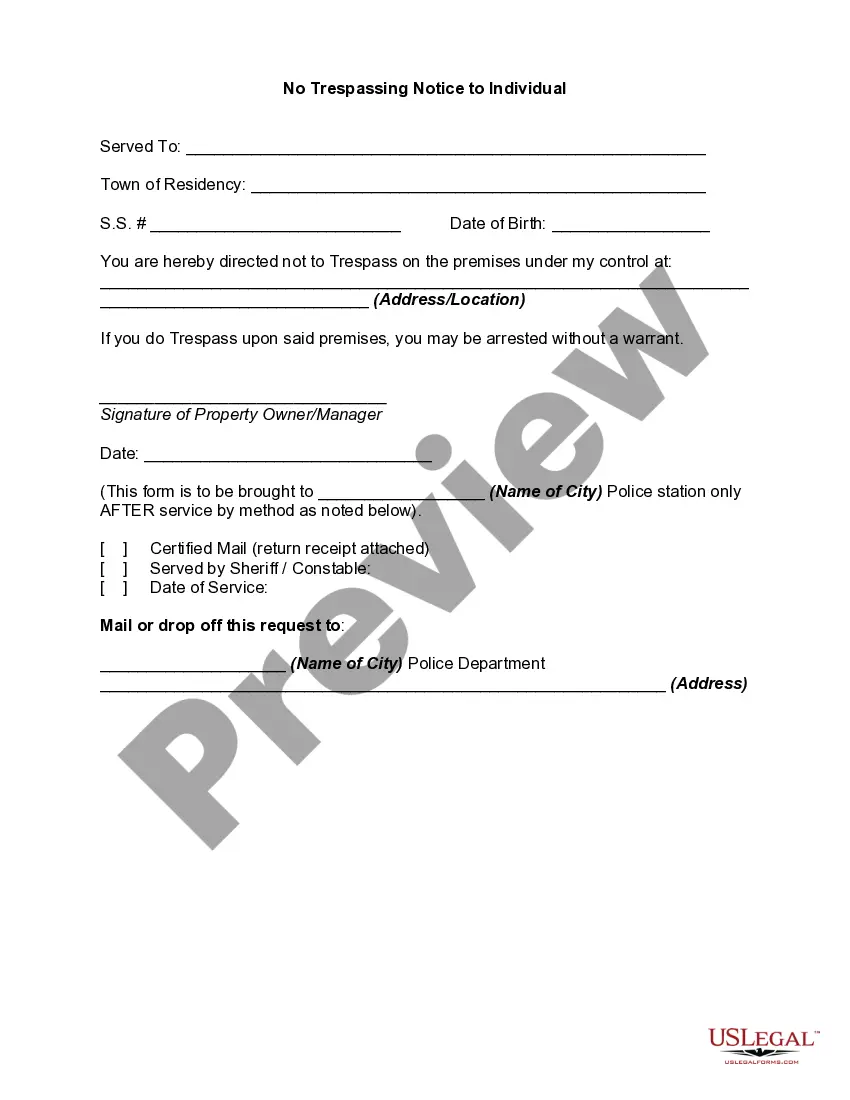

How to fill out San Diego California Tax Sharing And Disaffiliation Agreement?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, locating a San Diego Tax Sharing and Disaffiliation Agreement suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the San Diego Tax Sharing and Disaffiliation Agreement, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your San Diego Tax Sharing and Disaffiliation Agreement:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Tax Sharing and Disaffiliation Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

You may be eligible for property tax assistance if you are 62 years of age or older, blind or disabled, own and live in your own home, and meet certain household income limitations. For additional information regarding homeowner property tax assistance, contact the California Franchise Tax Board at 1-800-868-4171.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home's purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

If you do not receive your annual tax bill by November 1, you should request one. You will need your PIN number, which you can find on a previous year's tax bill, or the address of the property. You may request a bill via our online payment system or call (951) 955-3900.

For a copy of the original Secured Property Tax Bill, please email us at info@ttc.lacounty.gov, be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 888.807. 2111 or 213.974. 2111, press 1, 2, and then press 9 to reach an agent Monday Friday, a.

It must meet qualifying criteria such as significant architecture, association with a historically significant event or person, or location in a historic district, such as Marston Hills. Once designated as a historical site, the owner can then enter into a voluntary contract with that city.

The Treasurer and Tax Collector mails the Annual Secured Property Tax Bills each year in October to every owner listed on the Secured Tax Roll. Per State law, we mail all property tax bills no later than November 1.

Where can I obtain a copy of my tax bill? You may call the Tax Collector's Office at (877) 829-4732 or email taxman@sdcounty.ca.gov for information.

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $49,017 or less

PROPERTY TAX POSTPONEMENT PROGRAM This program gives seniors (62 or older), blind, or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual moves, sells the property, dies, or the title is passed to an ineligible person.