Travis Texas Tax Sharing and Disaffiliation Agreement is a contractual agreement between the Travis County, Texas, and the various taxing entities within the county. This agreement outlines the terms and conditions for sharing tax revenues and disaffiliation of taxing entities from the county's tax base. The primary objective of the Travis Texas Tax Sharing and Disaffiliation Agreement is to establish a fair and equitable framework for distributing tax revenue among the different entities that provide essential public services within the county. This ensures that resources are allocated efficiently and transparently, benefiting both the government and the taxpayers. Under this agreement, participating taxing entities, such as school districts, municipalities, and emergency service districts, agree to pool their tax revenues with the county. These entities contribute a certain percentage of their collected taxes to create a shared revenue pool. The distribution of tax revenue from this pool is then determined based on predefined formulas, taking into account factors such as population, assessed property value, and service demands. Apart from revenue sharing, the agreement also addresses the disaffiliation process. Disaffiliation refers to the process by which a taxing entity seeks to withdraw from the revenue-sharing arrangement with the county. It typically occurs when an entity believes it can better serve its constituents by independently administering its own tax base without sharing revenues with other entities. There are various types of Travis Texas Tax Sharing and Disaffiliation Agreements depending on the specific taxing entities involved and their respective needs. For example, there may be agreements between the county and municipal governments, agreements between the county and school districts, or agreements involving multiple entities collectively. The creation and implementation of these agreements help foster cooperation and collaboration among the taxing entities within Travis County, ensuring an efficient and equitable distribution of tax resources. They provide a mechanism for revenue sharing and allow flexibility for disaffiliation if necessary. Ultimately, these agreements play a vital role in supporting the county's overall financial management and public service delivery.

Travis Texas Tax Sharing and Disaffiliation Agreement

Description

How to fill out Travis Texas Tax Sharing And Disaffiliation Agreement?

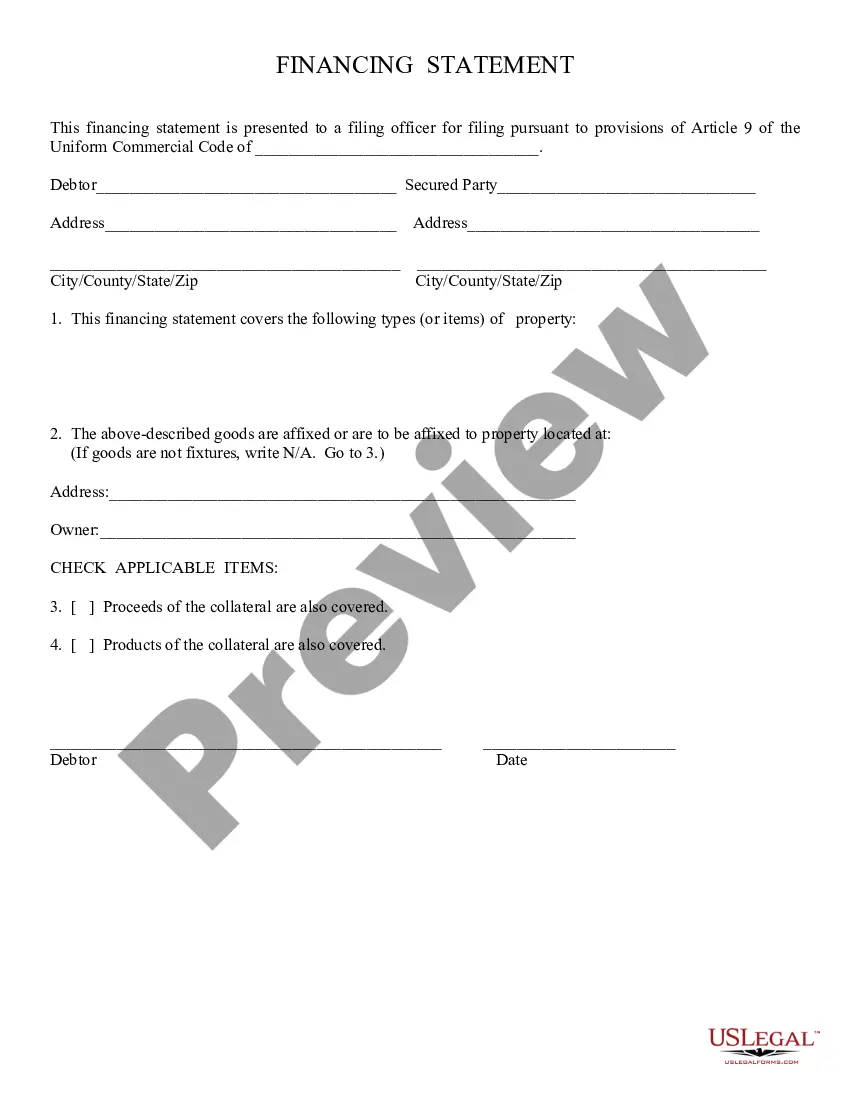

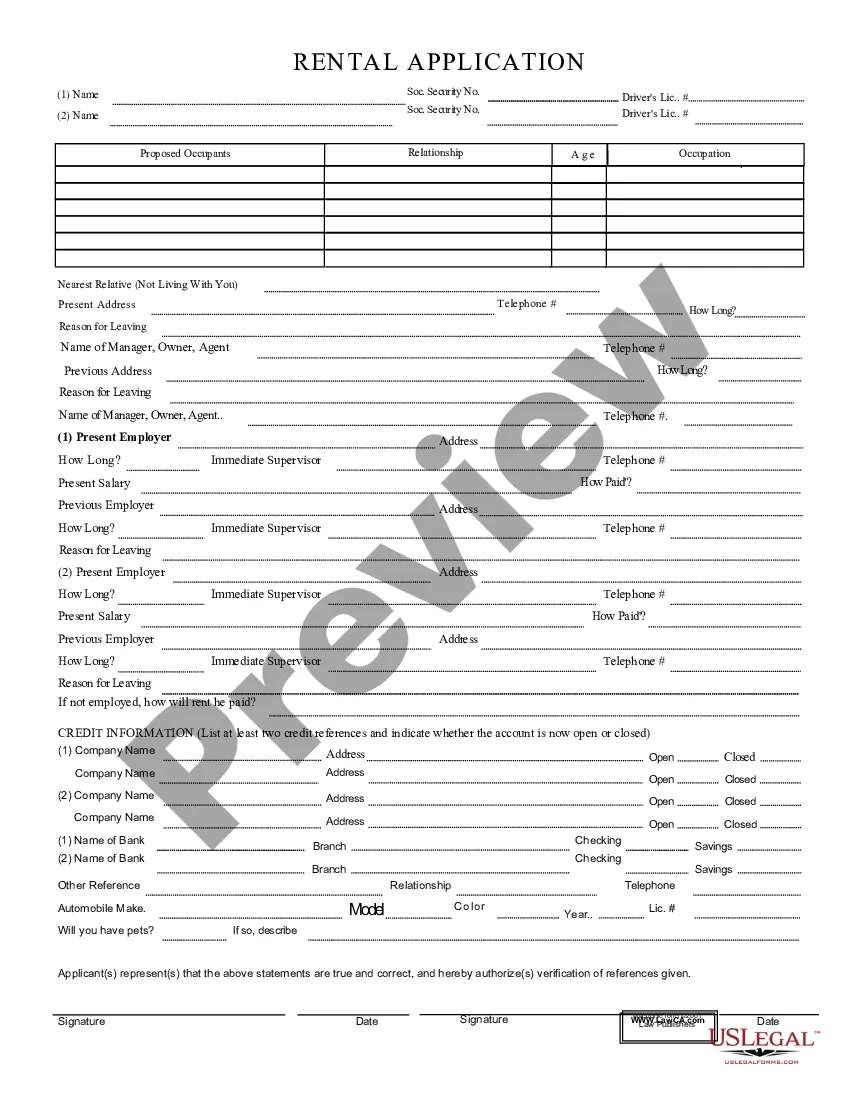

If you need to find a trustworthy legal document supplier to find the Travis Tax Sharing and Disaffiliation Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it simple to find and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse Travis Tax Sharing and Disaffiliation Agreement, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Travis Tax Sharing and Disaffiliation Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first business, arrange your advance care planning, draft a real estate contract, or execute the Travis Tax Sharing and Disaffiliation Agreement - all from the comfort of your home.

Sign up for US Legal Forms now!