Keywords: Wake North Carolina, tax sharing agreement, disaffiliation agreement Detailed description: A Wake North Carolina Tax Sharing and Disaffiliation Agreement is a legal arrangement between two or more municipalities within Wake County, North Carolina. This agreement primarily focuses on the distribution and sharing of tax revenues among these municipalities. The purpose of a tax sharing agreement is to establish a fair and equitable system for allocating tax revenue generated within Wake County, specifically between the participating municipalities. By entering into this agreement, these municipalities aim to promote cooperation and foster economic growth while ensuring a balanced distribution of financial resources. The Wake North Carolina Tax Sharing and Disaffiliation Agreement outlines the specific terms and conditions related to the sharing of tax revenue. These terms include the percentage or ratio by which revenue is distributed among the municipalities, the methods for calculating tax allocation, and the frequency of distributing funds. Furthermore, the agreement may also cover provisions related to the disaffiliation of a municipality from the tax sharing arrangement. Disaffiliation refers to the process by which a municipality decides to exit the agreement and no longer participate in the sharing of tax revenue. This could occur due to changes in local economic priorities, financial stability, or various other factors. The disaffiliation process may involve specific procedures and notice requirements that need to be followed by the departing municipality. While there may not be different types of Wake North Carolina Tax Sharing and Disaffiliation Agreements, individual agreements may vary in terms of specific provisions and details. Each agreement is unique and tailored to the respective municipalities involved. In conclusion, a Wake North Carolina Tax Sharing and Disaffiliation Agreement is a legal document that establishes a framework for the sharing of tax revenues among municipalities within Wake County. This agreement promotes fairness, cooperation, and economic growth while providing a mechanism for municipalities to disaffiliate if needed.

Wake North Carolina Tax Sharing and Disaffiliation Agreement

Description

How to fill out Wake North Carolina Tax Sharing And Disaffiliation Agreement?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Wake Tax Sharing and Disaffiliation Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Wake Tax Sharing and Disaffiliation Agreement. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

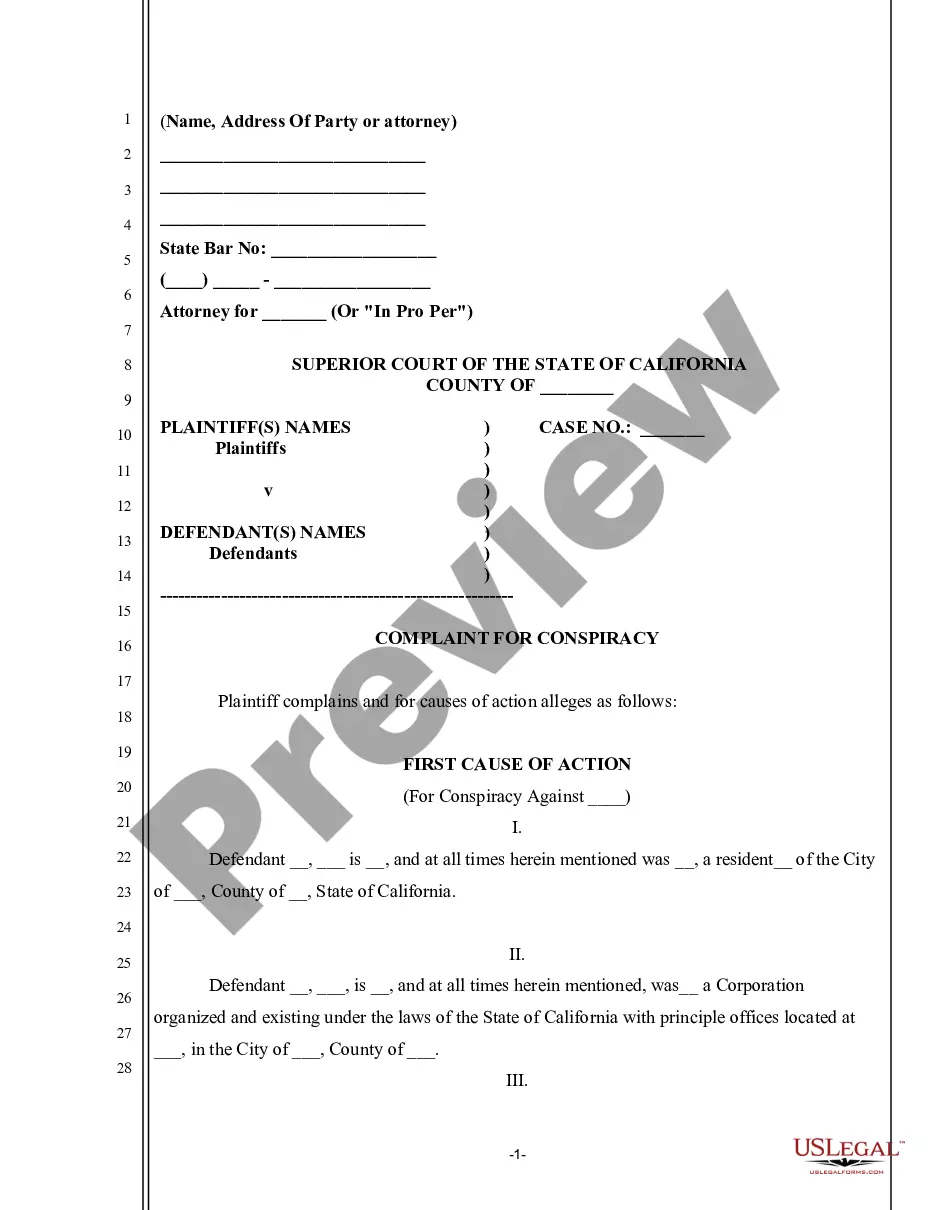

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wake Tax Sharing and Disaffiliation Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

It is a core doctrine of the denominations of the Anabaptist, Moravian, Methodist, Quaker, Baptist, Plymouth Brethren and Pentecostal Churches along with all other evangelical Christian denominations.

Well over 100 churches (out of our 650 congregations) are currently considering disaffiliation from the United Methodist Church.

We affirm our long-standing conviction and recommendation that abstinence from alcoholic beverages is a faithful witness to God's liberating and redeeming love. This witness is especially relevant because excessive, harmful, and dangerous drinking patterns are uncritically accepted and practiced.

The decision to disaffiliate from The United Methodist Church must be approved by a two-thirds (2/3) majority vote of the professing members of the local church present at the church conference.

United Methodists believe in actualizing their faith in community ? actions speak louder than words. The three simple rules are: ?Do no harm. Do good. Stay in love with God.? Some beliefs we share with other Christians are the Trinity (God as Father, Son and Holy Spirit) and Jesus' birth, death and Resurrection.

#BeUMC honors the core values that connect the people of The United Methodist Church (The UMC). This grassroots campaign, built upon powerful stories of congregations and people living their faith, celebrates what draws us to The UMC and what we aspire to be.

The United Methodist Church is facing a theological split over sexuality. The prospect of permitting same-sex marriages and the ordination of openly gay clergy has not been received well by some conservatives.

The decision to disaffiliate from The United Methodist Church must be approved by a two-thirds (2/3) majority vote of the professing members of the local church present at the church conference.

A vote to disaffiliate is a vote to leave relationships with other people and institutions that have helped congregation members grow in Christ over the years. In other denominations, such votes have resulted in people leaving the church.