Alameda California Share Exchange Agreement is a legal document governing the exchange of shares between shareholders. This agreement is specific to Alameda, California and encompasses the exchange of exchangeable nonvoting shares of capital stock. The Share Exchange Agreement is designed to outline the terms, conditions, and procedures for the exchange of shares between shareholders of a company. It serves as a contractual agreement that facilitates the shareholders' transfer of their existing shares for exchangeable nonvoting shares of capital stock. The main purpose of the Share Exchange Agreement is to provide shareholders with the opportunity to convert their voting shares into nonvoting shares while maintaining their ownership stake in the company. This exchange allows shareholders to retain their economic interest in the company's financial performance while relinquishing their voting rights. This agreement typically contains several key provisions, including the terms of the share exchange, the procedures for transferring shares, the rights and obligations of the exchanging parties, and any conditions or restrictions associated with the exchange. Furthermore, the Alameda California Share Exchange Agreement may include different types, depending on the specific terms agreed upon by the shareholders. These types may vary based on factors such as the percentage of shares being exchanged, the valuation of the exchangeable nonvoting shares, or any additional rights or benefits afforded to shareholders participating in the exchange. Some common types of Alameda California Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock may include: 1. Standard Share Exchange Agreement: This type follows a conventional structure, outlining the basic terms and conditions of the share exchange. 2. Reverse Share Exchange Agreement: In this type, the exchange involves the acquisition of a majority of the target company's shares by the acquiring company, resulting in a reverse merger. 3. Conditional Share Exchange Agreement: This type includes specific conditions that must be met before the share exchange can take place. These conditions may relate to regulatory approvals, financial performance, or other predetermined milestones. Overall, the Alameda California Share Exchange Agreement provides a comprehensive framework for shareholders to exchange their existing shares for exchangeable nonvoting shares of capital stock. It ensures transparency, protects the rights of all parties involved, and facilitates the smooth execution of the share exchange process.

Alameda California Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

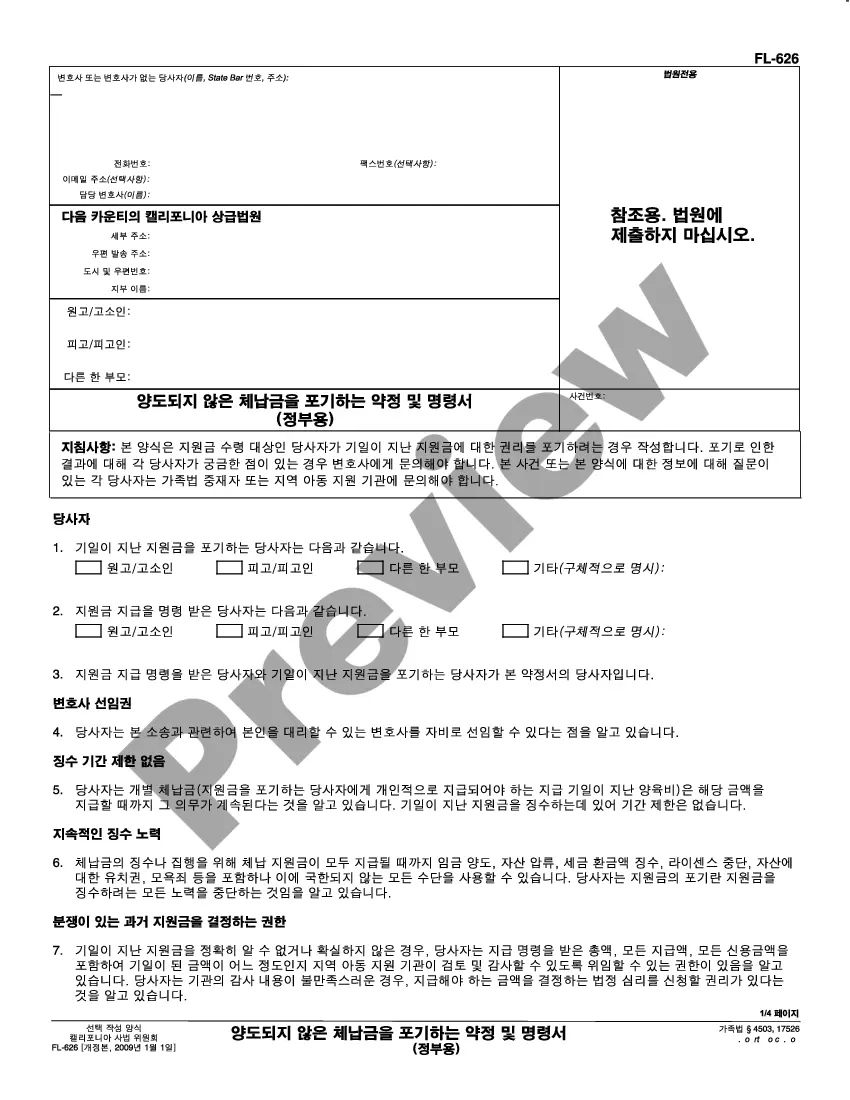

How to fill out Alameda California Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Alameda Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Alameda Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Alameda Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

A Shareholder's Agreement (SHA) is contractual arrangement inter-se the shareholders of a company and has gained huge popularity in a way that these agreements are specifically drafted to provide specific rights, impose definite restrictions over and above those provided by the Companies Act, 2013 (2013 Act).

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

A stock exchange brings companies and investors together. A stock exchange helps companies raise capital or money by issuing equity shares to be sold to investors. The companies invest those funds back into their business, and investors, ideally, earn a profit from their investment in those companies.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

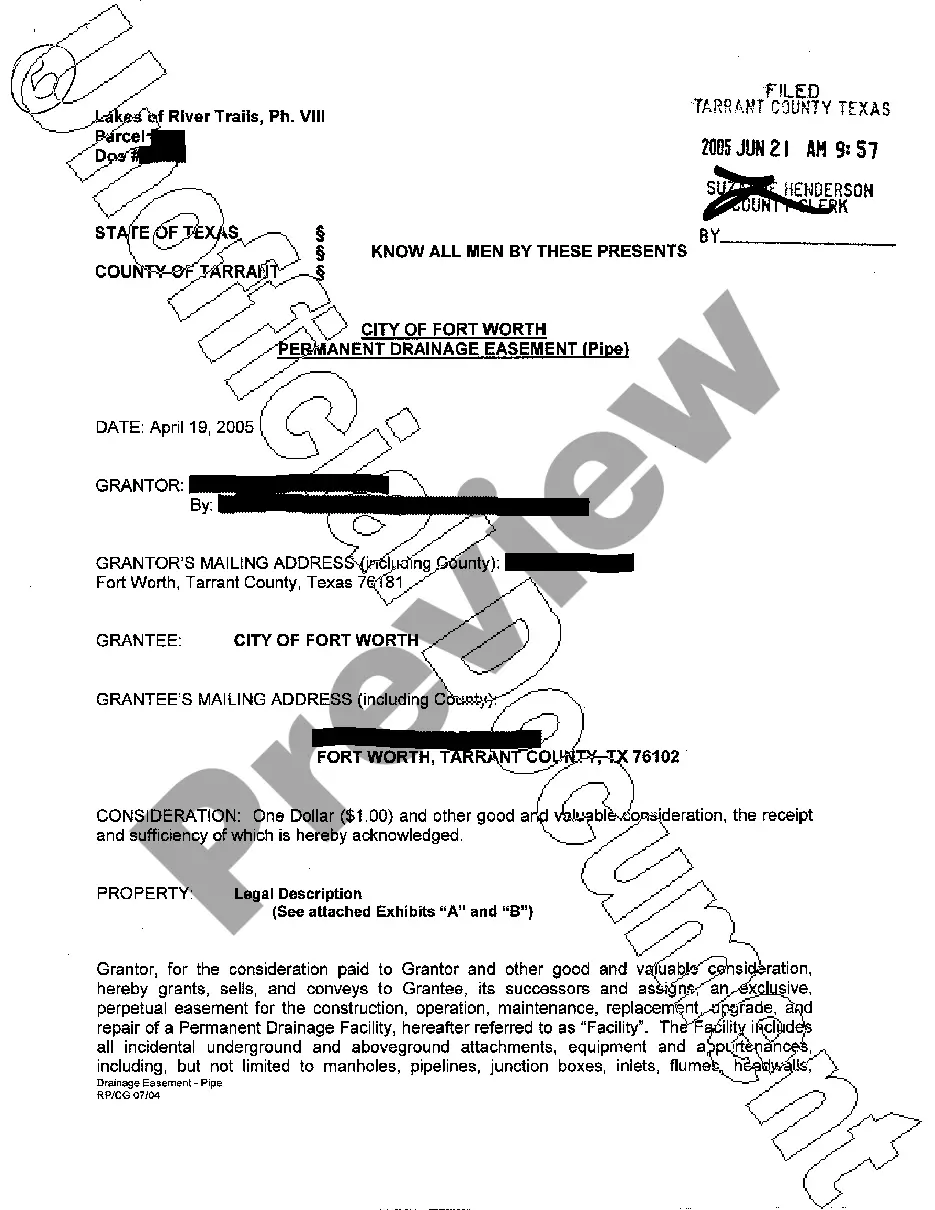

An exchange agreement, also called the exchange contract, is a written agreement between the exchanger and the Qualified Intermediary (QI) defining the transfer of the relinquished property, the ensuing purchase of the replacement property, and the restrictions on the exchange proceeds during the exchange period.

Contents of a Share Purchase Agreement Par value of shares. Name of purchaser. Warranties and representations made by seller and purchaser. Employee benefits and bonuses.

This agreement sets out the terms and conditions by which a management equityholder rolls over exiting equity in the target portfolio company and receives equity in a newly-formed holding company in a tax beneficial exchange.

Share Purchase Agreement is an agreement entered into between the buyer and seller(s) of shares of a target company. Usually Share Purchase Agreements entail that the buyer would be taking over whole or significantly whole of the undertaking of the company.

A shareholders' agreement is an agreement between the shareholders of a company which generally sets out the shareholders' rights, privileges and obligations along with the foundation of how the corporation will be set up, managed and run.

A share exchange is a type of business transaction governed by statutory law in which all or part of one corporation's shares are exchanged for those of another corporation, but both companies remain in existence.