Contra Costa California Share Exchange Agreement is a legal contract that outlines the terms and conditions for the exchange of nonvoting shares of capital stock among shareholders. This agreement is specific to Contra Costa County, California, and governs the process of exchanging shares between shareholders without voting rights. The Share Exchange Agreement aims to establish a framework for the fair and equitable exchange of nonvoting shares. It defines the procedures, responsibilities, and rights of shareholders involved in the exchange, ensuring transparency and protection for all parties. This agreement outlines the criteria for eligibility to participate in the share exchange, such as minimum shareholding requirements, and establishes the valuation methods for determining the exchange ratio. The exchange ratio determines the proportion of nonvoting shares that will be exchanged for each shareholder's existing capital stock. Furthermore, the Contra Costa California Share Exchange Agreement includes provisions for any potential restrictions or limitations on the transferability of exchanged shares. It addresses the terms of issuance, redemption, and conversion of nonvoting shares, allowing shareholders to have a clear understanding of their rights and options. Different types of Contra Costa California Share Exchange Agreements regarding shareholders issued exchangeable nonvoting shares of capital stock may include: 1. Ordinary Share Exchange Agreement: This is a standard agreement that covers the general exchange of nonvoting shares of capital stock among eligible shareholders. 2. Preferred Share Exchange Agreement: This agreement is specific to the exchange of preferred nonvoting shares, which may have different rights and privileges compared to ordinary shares. 3. Restricted Share Exchange Agreement: This type of agreement includes additional restrictions and conditions on the exchange of nonvoting shares, such as lock-up periods or limitations on resale. 4. Contingent Share Exchange Agreement: This agreement incorporates contingency clauses that outline the circumstances under which the exchange of nonvoting shares will occur. These contingencies could be triggered by specific events, financial performance, or other predefined factors. These various types of Contra Costa California Share Exchange Agreements cater to shareholders' diverse needs and circumstances, providing flexibility in structuring nonvoting share exchanges in accordance with applicable laws and regulations.

Contra Costa California Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

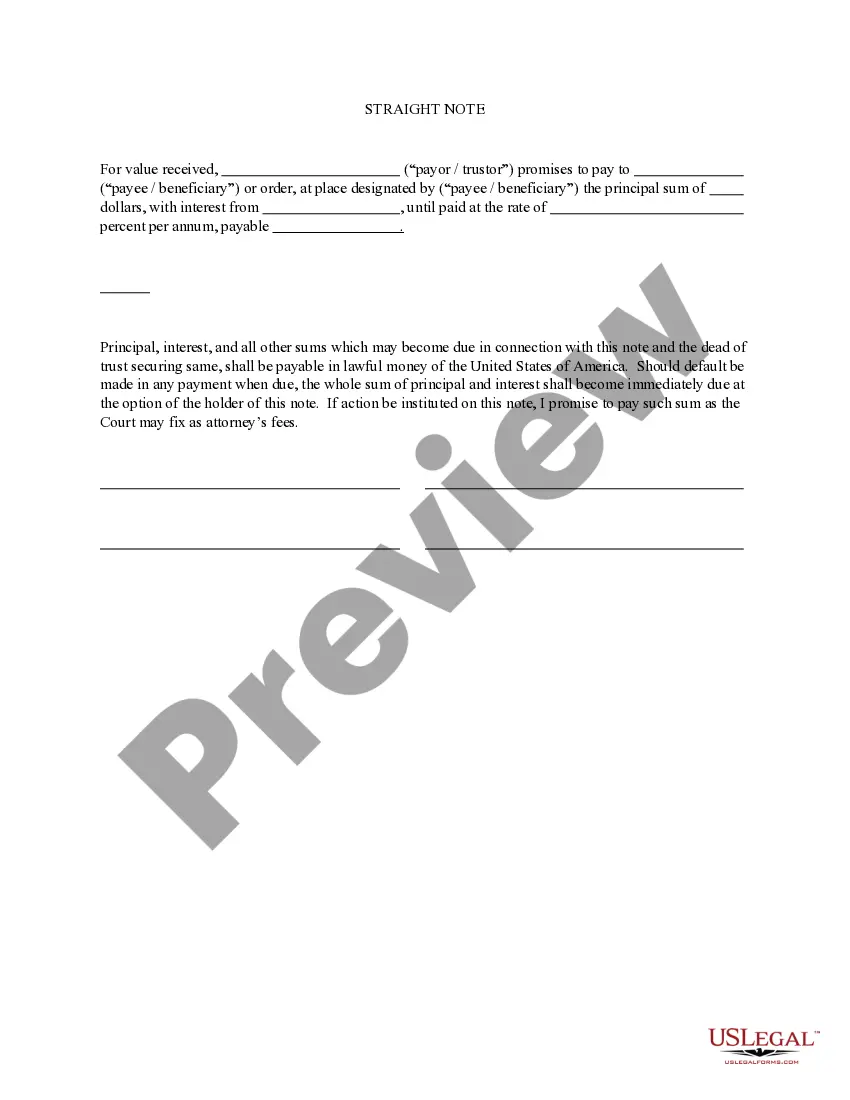

How to fill out Contra Costa California Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Draftwing paperwork, like Contra Costa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, to manage your legal matters is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Contra Costa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Contra Costa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock:

- Ensure that your form is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Contra Costa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!