Maricopa Arizona Share Exchange Agreement is a legal document that outlines the terms and conditions regarding the exchange of nonvoting shares of capital stock among shareholders. This agreement is designed to facilitate the exchange of shares between parties and provide clarity on the rights and obligations of each shareholder involved. Under the Maricopa Arizona Share Exchange Agreement, shareholders are issued exchangeable nonvoting shares of capital stock. These shares can be exchanged for other shares or securities of the company or any affiliated entities. However, it is important to note that these nonvoting shares do not provide the same voting rights as regular shares of capital stock. The exchange agreement typically includes provisions regarding the number of shares to be exchanged, the price or valuation of the shares, and the timeline within which the exchange must take place. It also covers any restrictions or limitations on the exchange, such as a minimum holding period or consent requirements from other shareholders. Additionally, the Maricopa Arizona Share Exchange Agreement may include a clause stating that the exchange is subject to regulatory approval or other legal requirements. This ensures that the exchange of shares complies with applicable laws and regulations. It is important to differentiate between different types of Maricopa Arizona Share Exchange Agreements. The variations may include agreements specific to certain industries, such as technology or healthcare, or agreements tailored to different stages of a company's growth, such as early-stage financing rounds or mergers and acquisitions. Each type of agreement may have its own unique set of terms and conditions, which address the specific needs and goals of the shareholders involved. In conclusion, the Maricopa Arizona Share Exchange Agreement is a crucial legal document that governs the exchange of nonvoting shares of capital stock among shareholders. It establishes the framework for the exchange process and outlines the rights and obligations of the parties involved. Familiarity with the specific terms and conditions of this agreement is essential for shareholders wishing to participate in the exchange of nonvoting shares in Maricopa, Arizona.

Maricopa Arizona Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

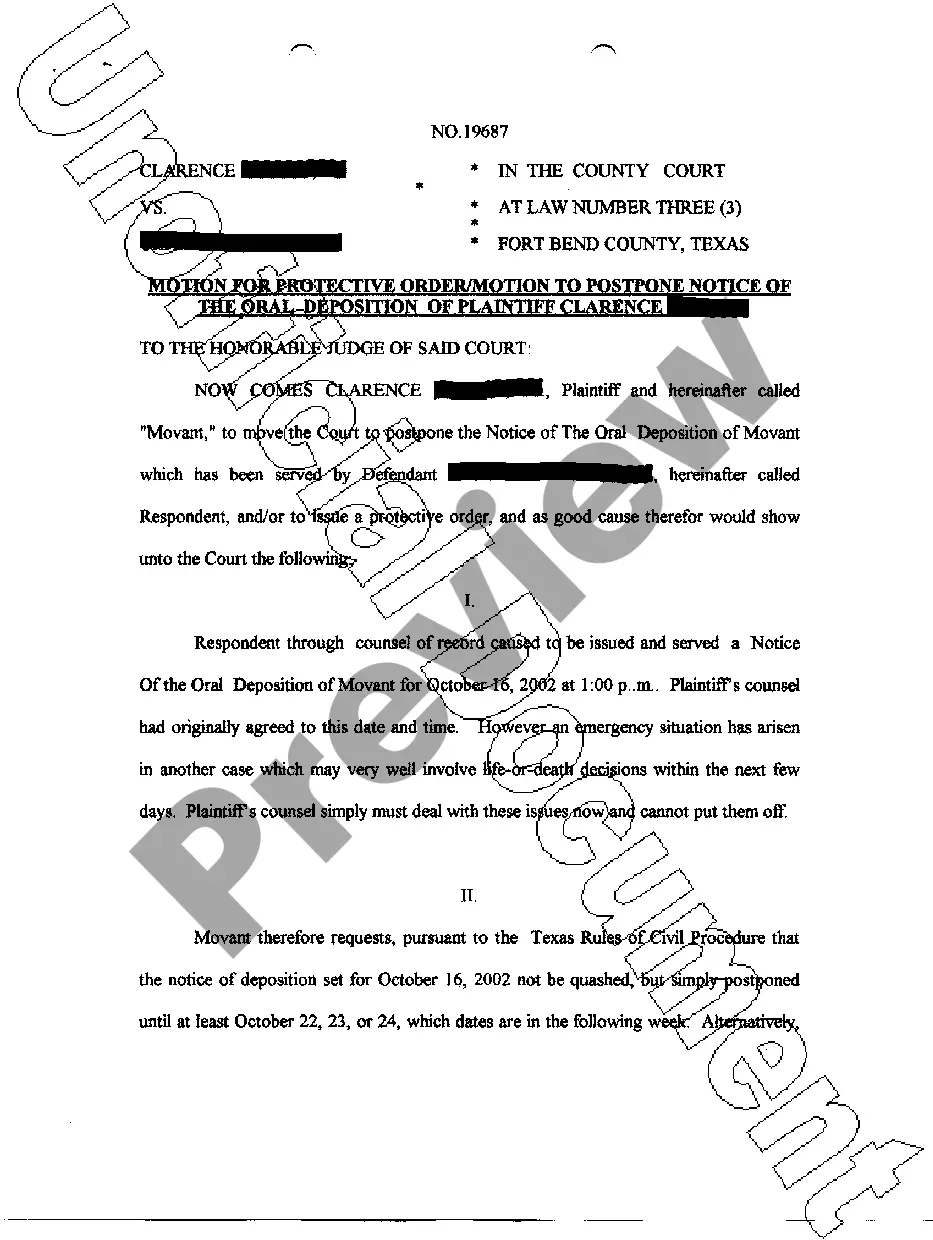

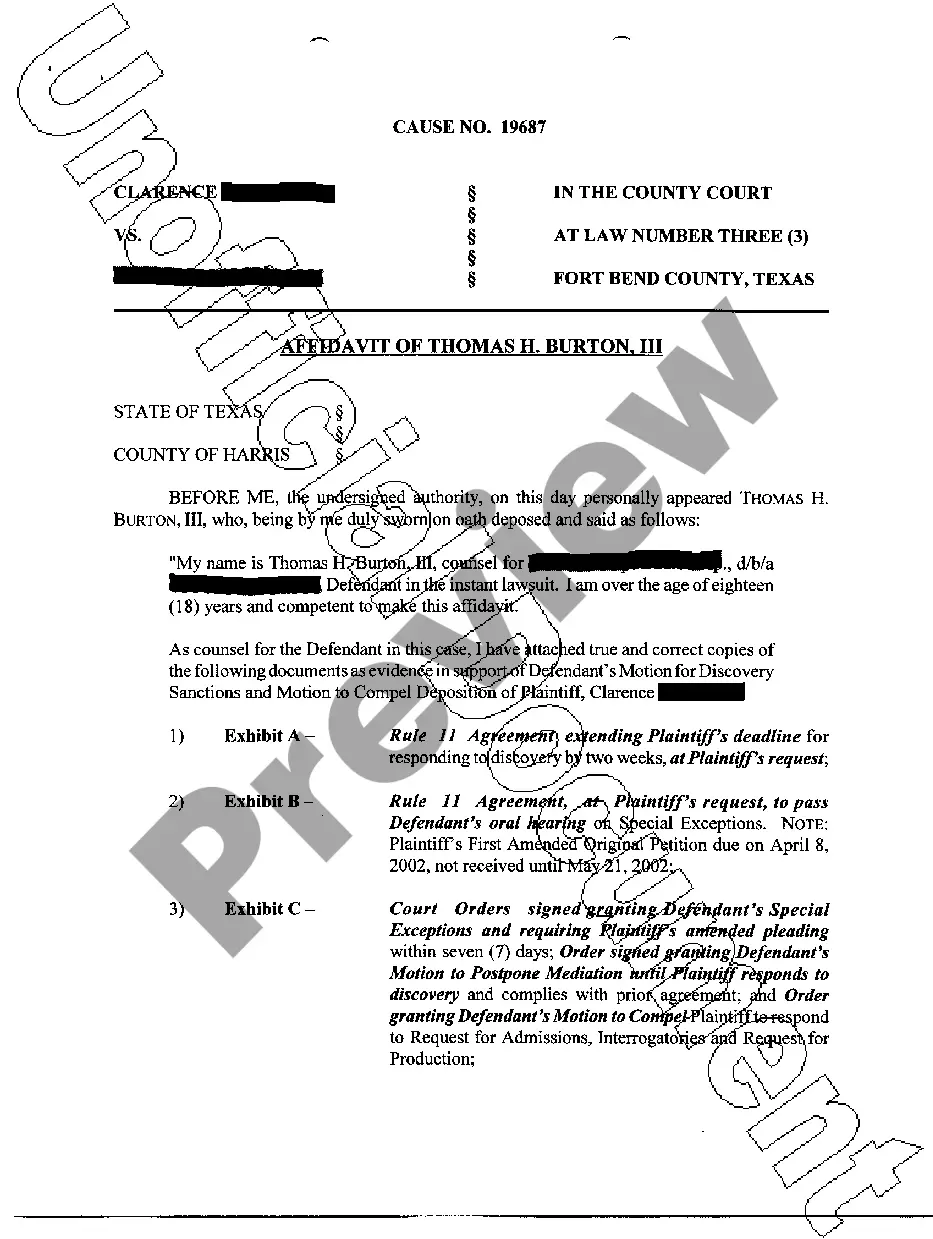

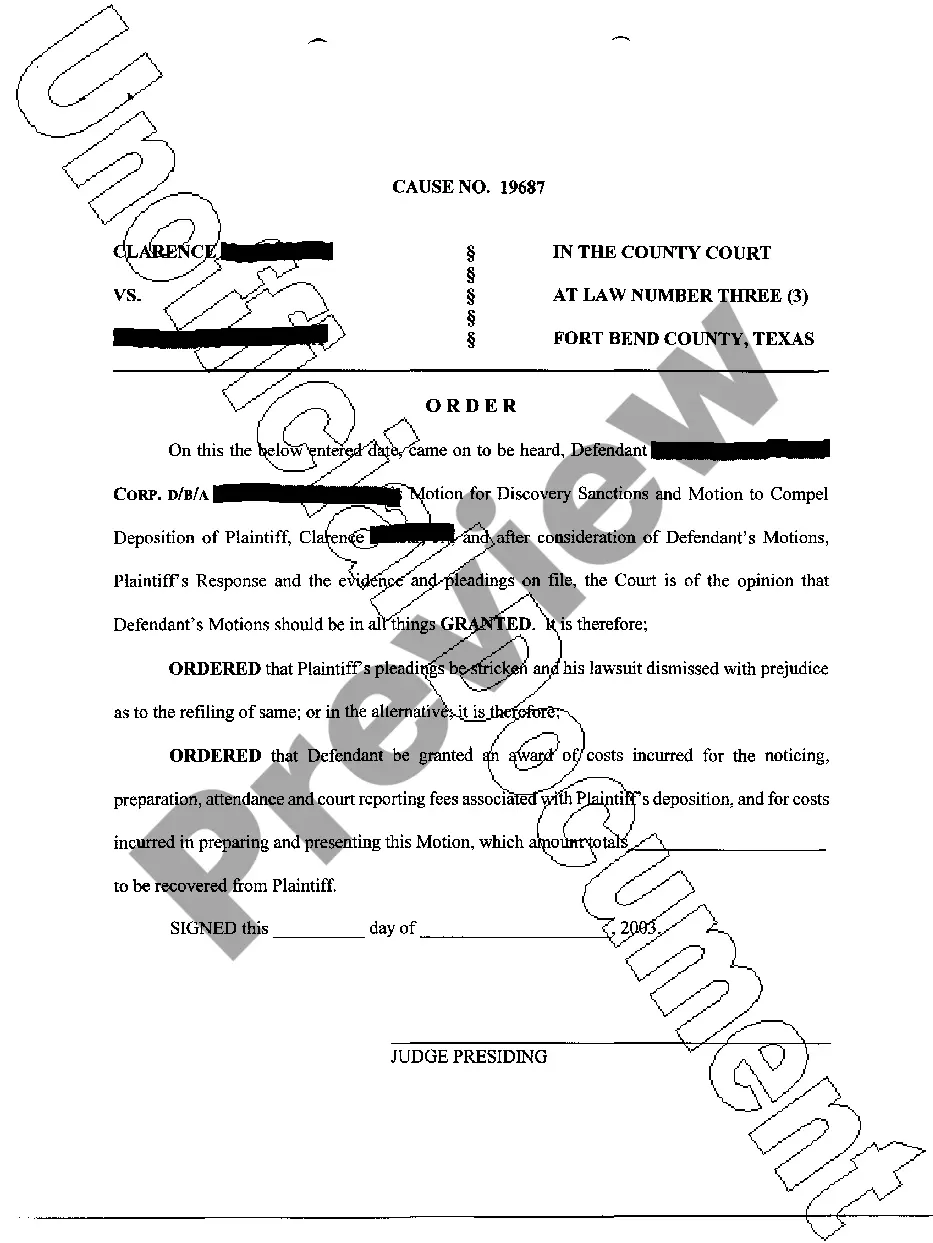

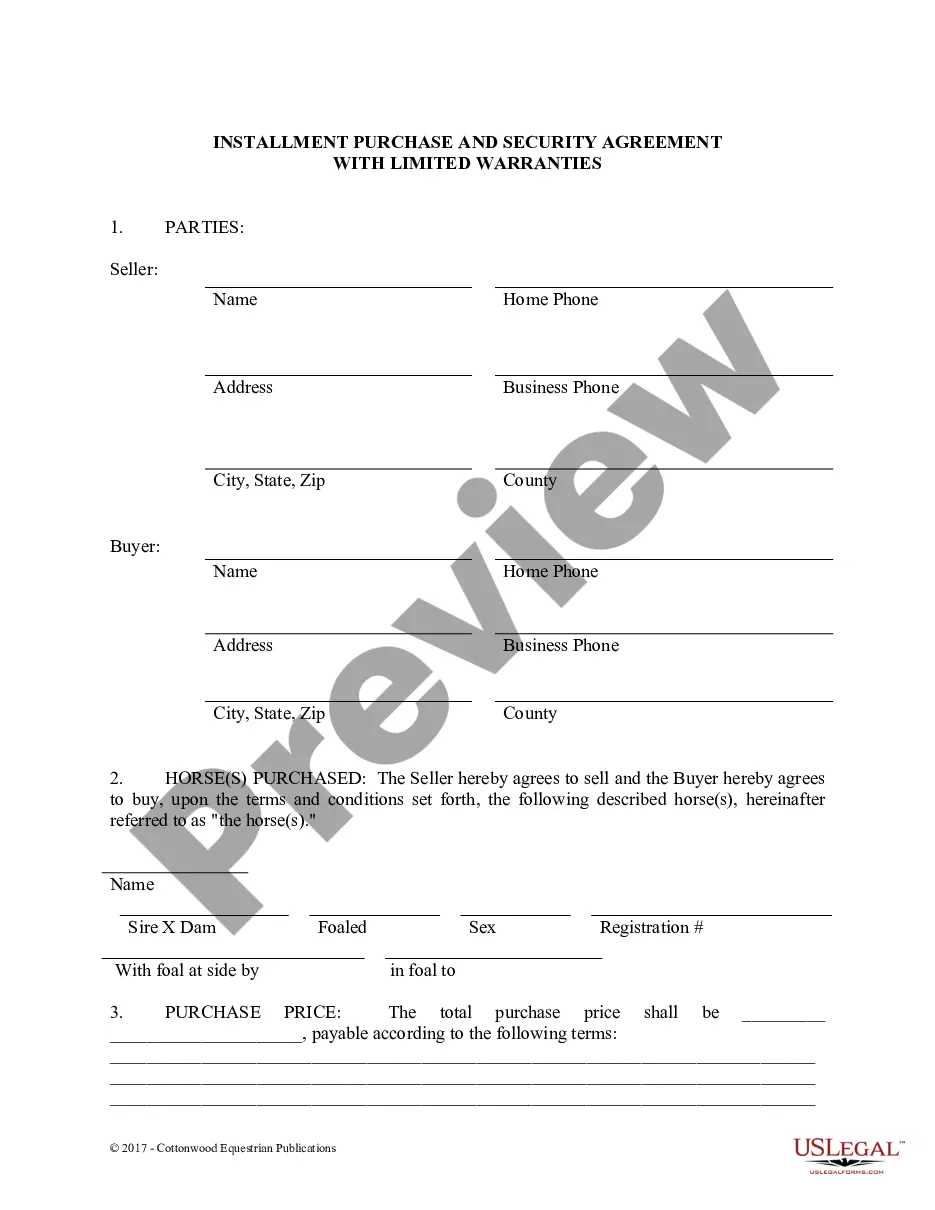

How to fill out Maricopa Arizona Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Maricopa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities related to paperwork completion simple.

Here's how you can locate and download Maricopa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Examine the similar forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Maricopa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Maricopa Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you have to deal with an exceptionally difficult situation, we advise using the services of a lawyer to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!

Form popularity

FAQ

A public company must also have at least one shareholder, but there's no upper limit to how many shareholders it can have. It's common for a company to shift from being proprietary to public because it has more than 50 shareholders. Most companies choose to become a small unlisted public company in that situation.

Since a shareholders' agreement establishes the relationship between the shareholders, without one, you are exposing both shareholders and the company to potential future conflict. This is particularly true in situations where the voting shares in a company are held equally (50% each) by just two people or companies.

A share exchange is a type of business transaction governed by statutory law in which all or part of one corporation's shares are exchanged for those of another corporation, but both companies remain in existence.

A stock swap occurs when shareholders' ownership of the target company's shares is exchanged for shares of the acquiring company. During a stock swap, each company's shares must be accurately valued in order to determine a fair swap ratio between the two shares.

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company is put on top of an existing group. Shareholders give their shares in the old TopCo to NewCo in exchange for shares in NewCo.

Summary. A corporation is not required to have a shareholder agreement, but due to the flexibility of this document and what it can include, it is in the interest of shareholders to legalize such an agreement so as to protect their rights and the success of the corporation.

A written agreement between the exchanger and the Qualified Intermediary (QI) defining the transfer of the relinquished property, the ensuing purchase of the replacement property, and the restrictions on the exchange proceeds during the exchange period.

(1) The plan of merger or share exchange shall be adopted by the board of directors. (2) Except as provided in clause (7) and in section 11.05, after adopting the plan of merger or share exchange the board of directors must submit the plan to the shareholders for their approval.

But while conventional wisdom suggests that U.S. public corporations do not have shareholders agreements, such understanding is inaccurate. Nevertheless, the existing agreements differ from their Brazilian counterparts in that they are usually used in order to achieve a specific cor- porate transaction.

A share purchase agreement is an agreement between two parties in which the seller agrees to sell the stated number of shares to the buyer at a particular price. The agreement is made to prove that both parties agreed to the transaction and includes various other details of the transaction.