San Jose, California Share Exchange Agreement is a legally binding contract that governs the exchange of nonvoting shares of capital stock among shareholders within the jurisdiction of San Jose, California. This agreement outlines the terms and conditions under which shareholders can exchange their existing nonvoting shares for new shares of capital stock. The purpose of this agreement is to provide shareholders with flexibility, enabling them to adjust their holdings based on their individual investment strategies and preferences. It allows shareholders to exchange their existing nonvoting shares for new shares, providing an opportunity for portfolio diversification or liquidation. Keywords: San Jose, California, Share Exchange Agreement, shareholders, exchangeable nonvoting shares, capital stock, legally binding, contract, terms and conditions, flexibility, investment strategies, preferences, portfolio, diversification, liquidation. Different types of San Jose, California Share Exchange Agreements regarding shareholders issued exchangeable nonvoting shares of capital stock may include: 1. Standard Share Exchange Agreement: This is the basic type of agreement that facilitates the exchange of nonvoting shares for new shares of capital stock. It establishes the terms, conditions, and procedures for the exchange. 2. Restricted Share Exchange Agreement: This type of agreement imposes certain restrictions on the exchange of nonvoting shares. It may specify restrictions based on time, ownership percentage, or other criteria deemed relevant by the shareholders or the company. 3. Merger Share Exchange Agreement: In cases where a merger or acquisition occurs, this type of agreement governs the exchange of nonvoting shares between the acquiring company and the target company's shareholders. It ensures a smooth transition of ownership and clarifies the terms of the exchange. 4. Voluntary Share Exchange Agreement: This agreement provides an optional mechanism for shareholders to exchange their nonvoting shares. It is typically initiated by individual shareholders who wish to alter their shareholdings. 5. Compulsory Share Exchange Agreement: In some cases, a company may require all shareholders to participate in a share exchange program. This agreement outlines the mandatory exchange of nonvoting shares, usually due to specific corporate actions or restructuring. Keywords: Standard, Restricted, Merger, Voluntary, Compulsory, Share Exchange Agreement

San Jose California Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

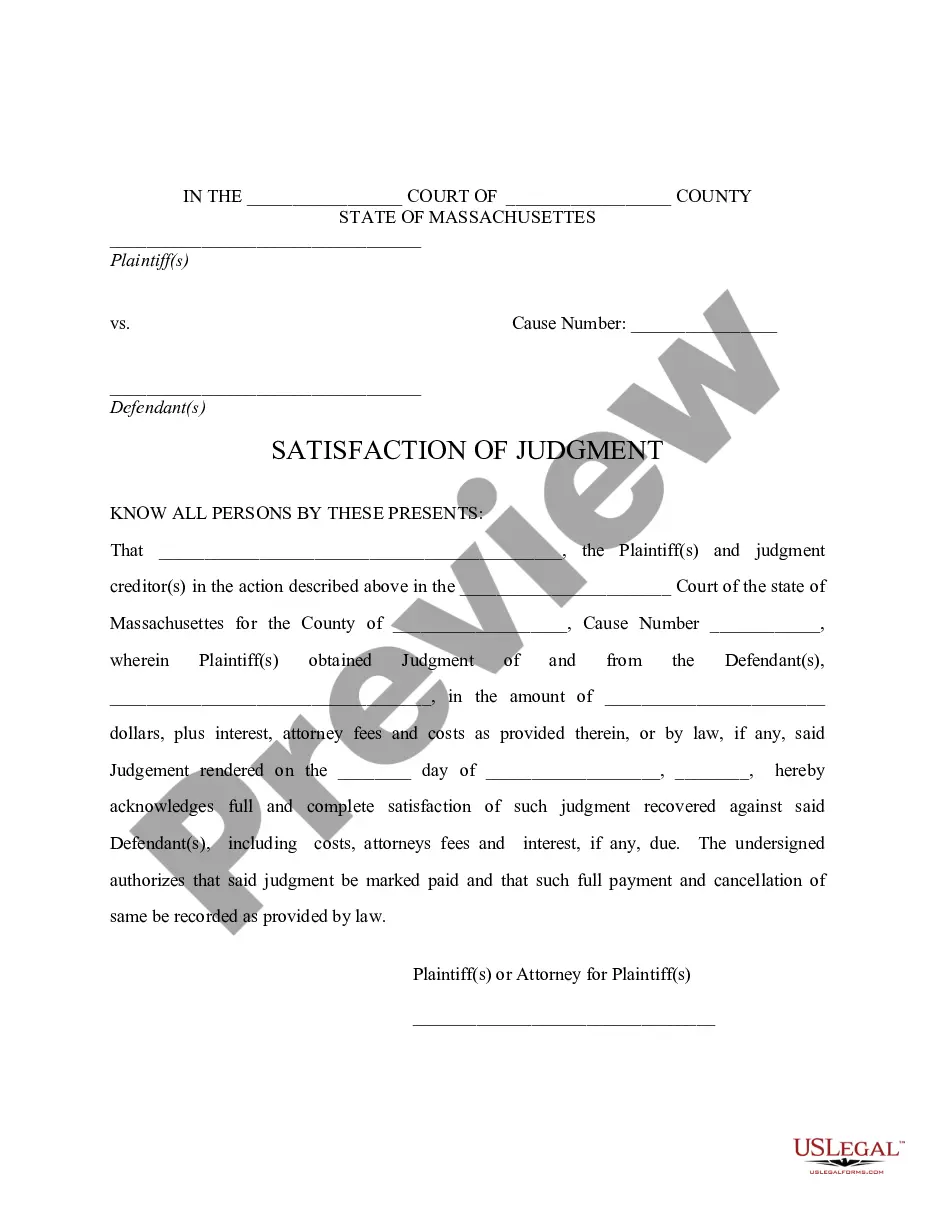

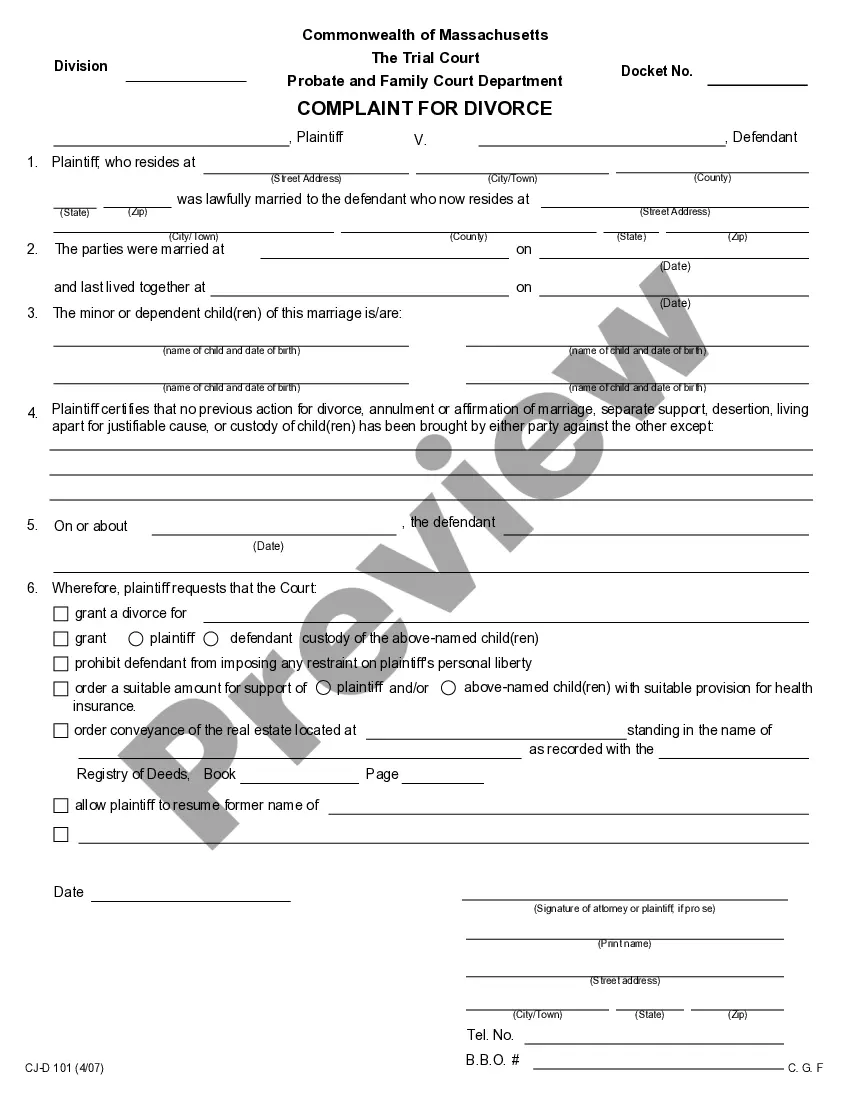

How to fill out San Jose California Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Draftwing forms, like San Jose Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for various scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the San Jose Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading San Jose Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock:

- Make sure that your document is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the San Jose Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!