The Nassau New York Employee Shareholder Escrow Agreement is a legally binding document that establishes the terms and conditions regarding the allocation and management of funds or assets placed in escrow during mergers, acquisitions, or other transactions involving employee shareholders in Nassau, New York. This agreement aims to protect the interests and rights of all parties involved, ensuring a fair and transparent process. Keywords: Nassau New York, Employee Shareholder Escrow Agreement, escrow, mergers, acquisitions, transactions, employee shareholders, funds, assets, legal document, allocation, management, fair, transparent. There are several types of Nassau New York Employee Shareholder Escrow Agreements, designed to suit specific circumstances: 1. Standard Employee Shareholder Escrow Agreement: This is the most common type, typically used during mergers and acquisitions. It outlines the conditions under which funds or assets will be held in escrow, the duration of the escrow period, and the release criteria upon completion of certain milestones or fulfillment of conditions. 2. Vesting Employee Shareholder Escrow Agreement: This type of agreement is often utilized when employees or shareholders are granted equity or stock options as part of their compensation plans. The BS crowed funds or assets are released gradually, following predetermined vesting schedules, encouraging loyalty and retaining key talent within the company. 3. Reverse Employee Shareholder Escrow Agreement: In certain situations, when employees or shareholders need to sell their ownership stakes or exit the company, this agreement safeguards the interests of all parties involved. The BS crowed funds or assets act as a security arrangement, ensuring the fulfillment of obligations and the protection of the buyer's investment. 4. Earn out Employee Shareholder Escrow Agreement: This type of agreement becomes relevant when the purchase price is contingent upon the future performance of the acquired company. A portion of the funds or assets is held in escrow, and their release is tied to achieving specific financial or operational targets, as agreed upon in the contract. These varying types of Nassau New York Employee Shareholder Escrow Agreements enable the smooth execution of complex transactions while safeguarding the interests of employee shareholders, buyers, and sellers alike. It is crucial for all parties involved to consult legal professionals to draft and review these agreements to ensure their compliance with applicable laws and regulations in Nassau, New York.

Nassau New York Employee Shareholder Escrow Agreement

Description

How to fill out Nassau New York Employee Shareholder Escrow Agreement?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Nassau Employee Shareholder Escrow Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Nassau Employee Shareholder Escrow Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Nassau Employee Shareholder Escrow Agreement:

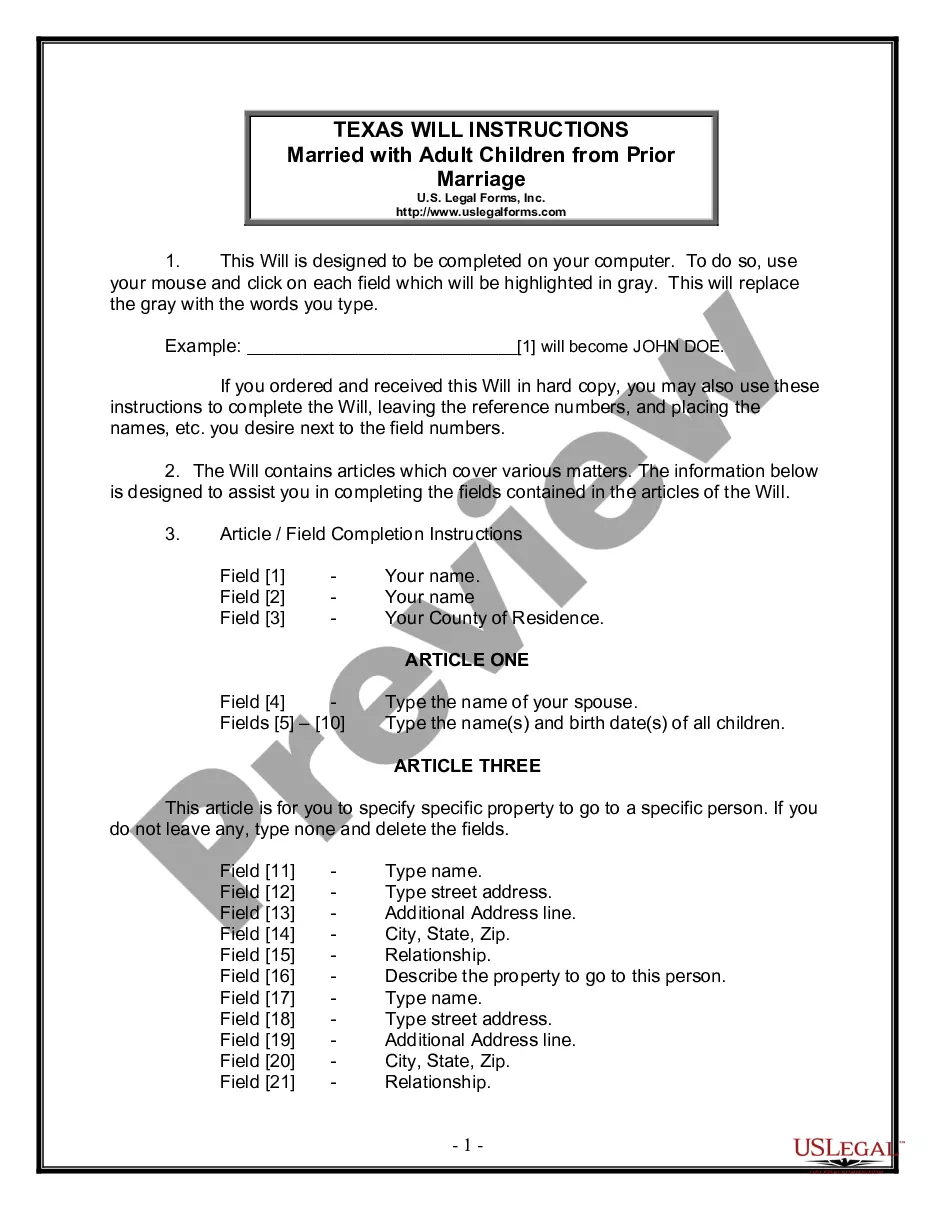

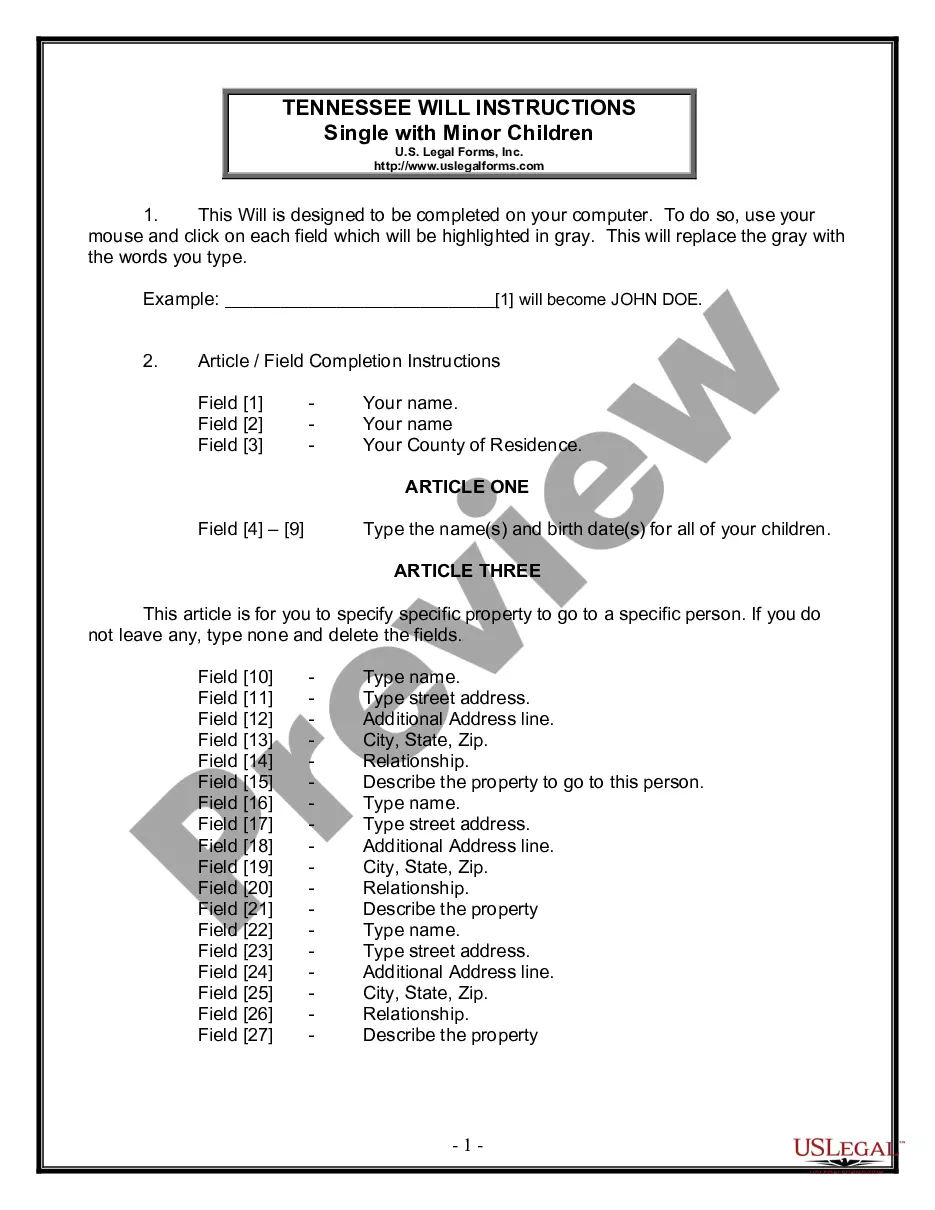

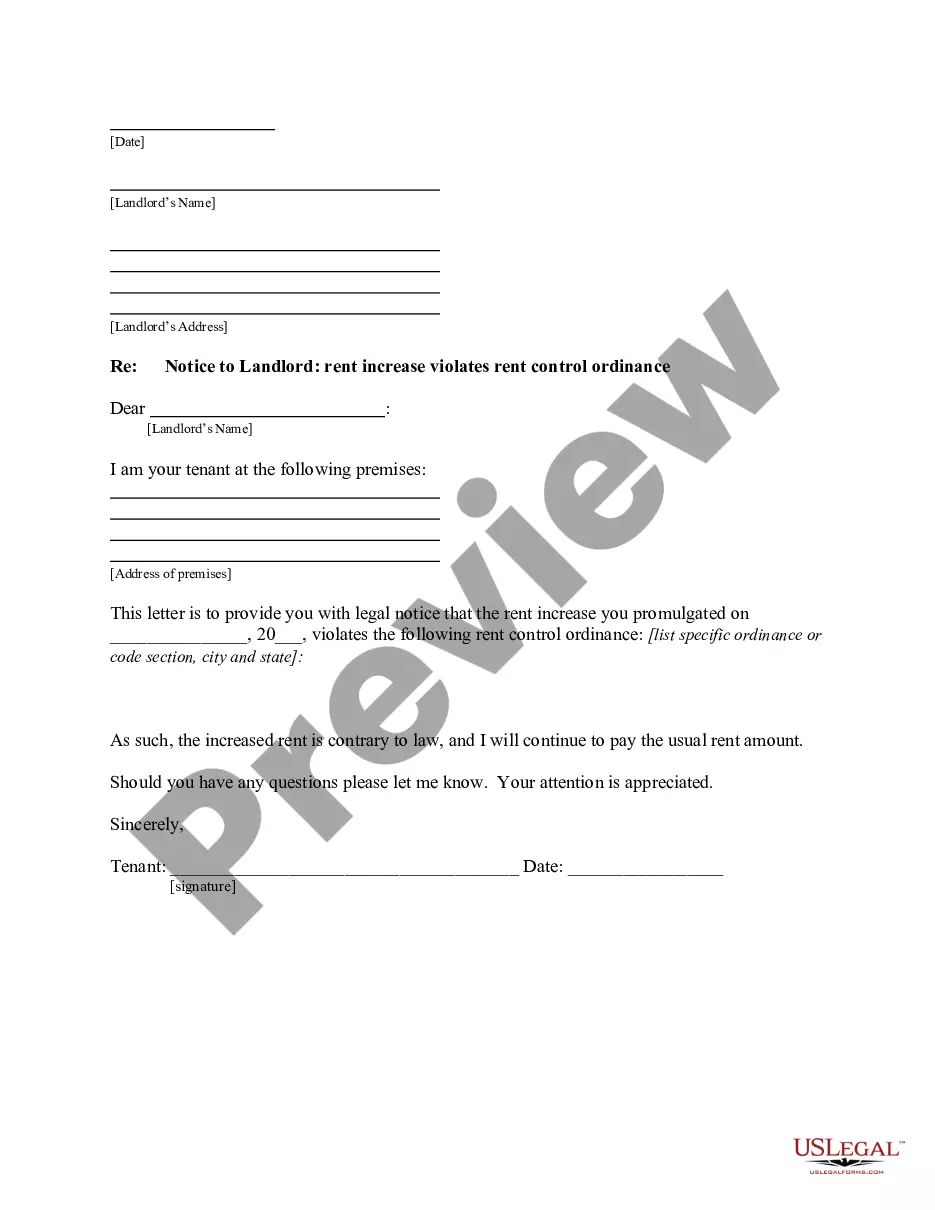

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!