A Maricopa Arizona General Security Agreement granting secured party secured interest is a legal document that establishes a contractual relationship between a borrower and a lender in Maricopa, Arizona. This agreement is designed to protect the rights of the lender, referred to as the secured party, in case the borrower defaults on their loan obligations. Keywords: Maricopa Arizona, General Security Agreement, secured party, secured interest, contractual relationship, borrower, lender, loan obligations, defaults. Different types of Maricopa Arizona General Security Agreement granting secured party secured interest may include: 1. Real Property Security Agreement: This type of agreement grants the secured party a secured interest in the borrower's real estate property located in Maricopa, Arizona. It ensures that if the borrower defaults, the secured party has the right to recover their investment by seizing or selling the property. 2. Chattel Mortgage Agreement: This agreement pertains to movable personal property, such as vehicles, equipment, or inventory. It grants the secured party a secured interest in the borrower's chattels, allowing them to repossess or sell the assets in case of default. 3. Accounts Receivable Financing Agreement: This type of agreement involves the borrower granting a secured interest in their accounts receivable to the secured party. It ensures that any payments owed to the borrower by their customers will be redirected to the secured party if the borrower fails to repay the loan. 4. Intellectual Property Security Agreement: In cases where the borrower owns valuable intellectual property, such as patents, copyrights, or trademarks, this agreement grants a secured interest to the lender. Consequently, if the borrower defaults, the secured party can seize or license the intellectual property to recoup their investment. 5. General Security Agreement with Floating Charge: This agreement is comprehensive and provides the secured party a secured interest in all present and future assets of the borrower. By using a floating charge, the secured party has the flexibility to extend their secured interest to assets acquired after the agreement is made. Maricopa Arizona General Security Agreements granting secured party secured interest are crucial to ensure that lenders are protected in the event of borrower defaults, providing a legal framework for the recovery of their investment.

Maricopa Arizona General Security Agreement granting secured party secured interest

Description

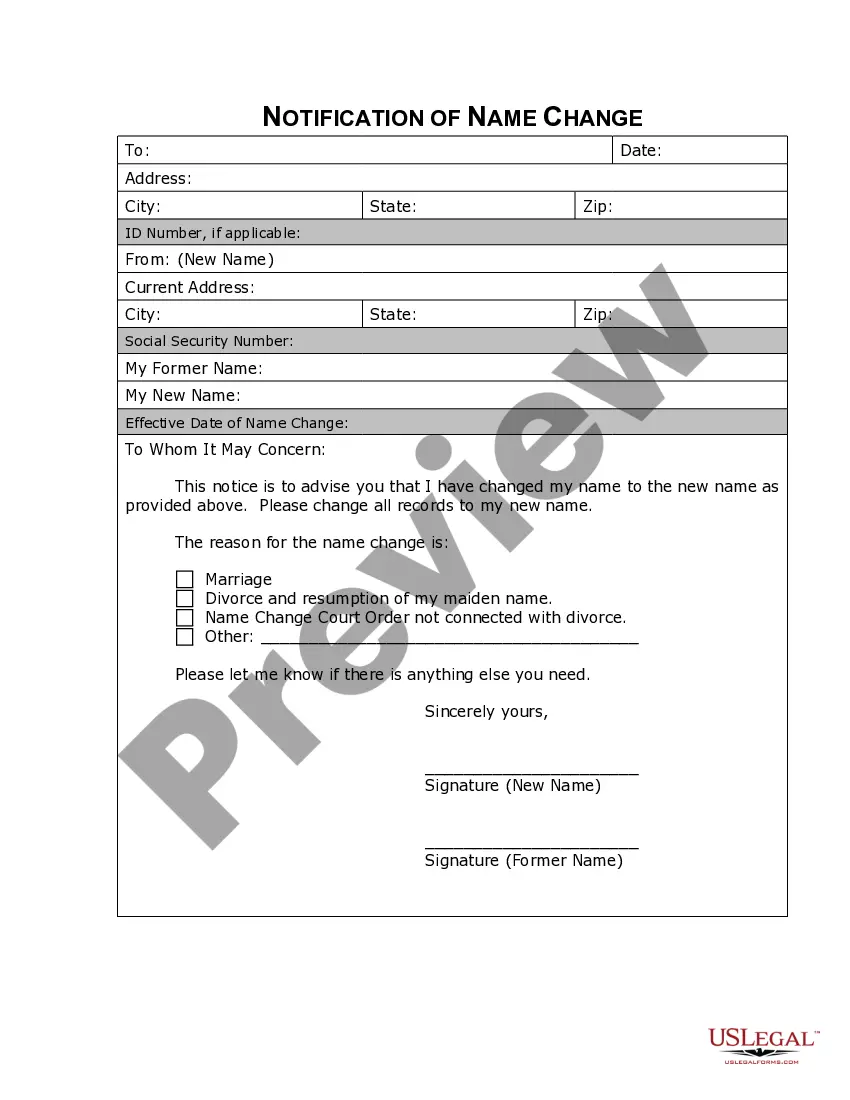

How to fill out Maricopa Arizona General Security Agreement Granting Secured Party Secured Interest?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Maricopa General Security Agreement granting secured party secured interest is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Maricopa General Security Agreement granting secured party secured interest. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa General Security Agreement granting secured party secured interest in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other person to secure payment and performance of an Account, such Grantor shall promptly assign such security interest to the Collateral Agent.

To perfect a security interest in goods, where must a creditor file a financing statement? With the office of the secretary of state of the state where the debtor is located.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically upon attachment of the security interest.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

A secured party has an interest in proceeds if the secured party takes the proceeds into the possession of the secured party or if the secured party files a financing statement on the proceeds.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically upon attachment of the security interest.

A secured party can perfect a security interest by filing a financing statement with the appropriate state or local office. (3) a description of the collateral by item or type.

Defined in the UCC as: A person in whose favor a security interest is created or provided for under a security agreement, whether or not any obligation to be secured is outstanding.

A security interest is created by an agreement (security agreement) authorizing the lender to take specific collateral property owned by the borrower in the event the borrower defaults on the loan.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.