A Santa Clara California General Security Agreement is a legal document that grants a secured party a secured interest in certain assets or property to secure the repayment of a debt or obligation. This agreement is commonly used in various business transactions, such as loans, financing arrangements, or other credit arrangements. The purpose of the General Security Agreement is to provide protection for the secured party by creating a security interest in the specified collateral. This collateral may include tangible assets like equipment, inventory, or real estate, as well as intangible assets such as intellectual property rights, accounts receivable, or contractual rights. By granting a secured interest, the borrower or debtor pledges the specified collateral as security for the repayment of the debt or performance of the obligation. The secured party, typically a lender or creditor, gains priority rights over other unsecured creditors in the event of default or non-payment. The Santa Clara California General Security Agreement complies with the applicable laws and regulations in the state, including the Uniform Commercial Code (UCC) Article 9, which provides guidelines for securing interests in personal property. There are different types of General Security Agreements that may vary depending on the specific circumstances and parties involved. Some common variations include: 1. Real Estate Security Agreement: This type of agreement is used when the collateral offered by the debtor is real property, such as land or buildings. 2. Chattel Mortgage: In cases where the collateral consists of movable property, such as vehicles, machinery, or equipment, a chattel mortgage is often used. It gives the secured party a lien on the specific chattel or personal property. 3. Floating Charge: A floating charge creates a security interest over a class or group of assets that may change or fluctuate over time. It allows the debtor to continue dealing with the specified assets in the ordinary course of business until a trigger event occurs, such as default, insolvency, or bankruptcy. 4. Debenture: A debenture is a type of document that contains both indebtedness and security provisions. It grants the secured party both a right to repayment of the debt and a security interest in specified assets. In conclusion, the Santa Clara California General Security Agreement granting secured party secured interest serves as a crucial legal tool to protect the interests of lenders, creditors, and other secured parties. It establishes a clear framework for securing assets or property and plays a vital role in business transactions that involve the provision of credit or financing.

Santa Clara California General Security Agreement granting secured party secured interest

Description

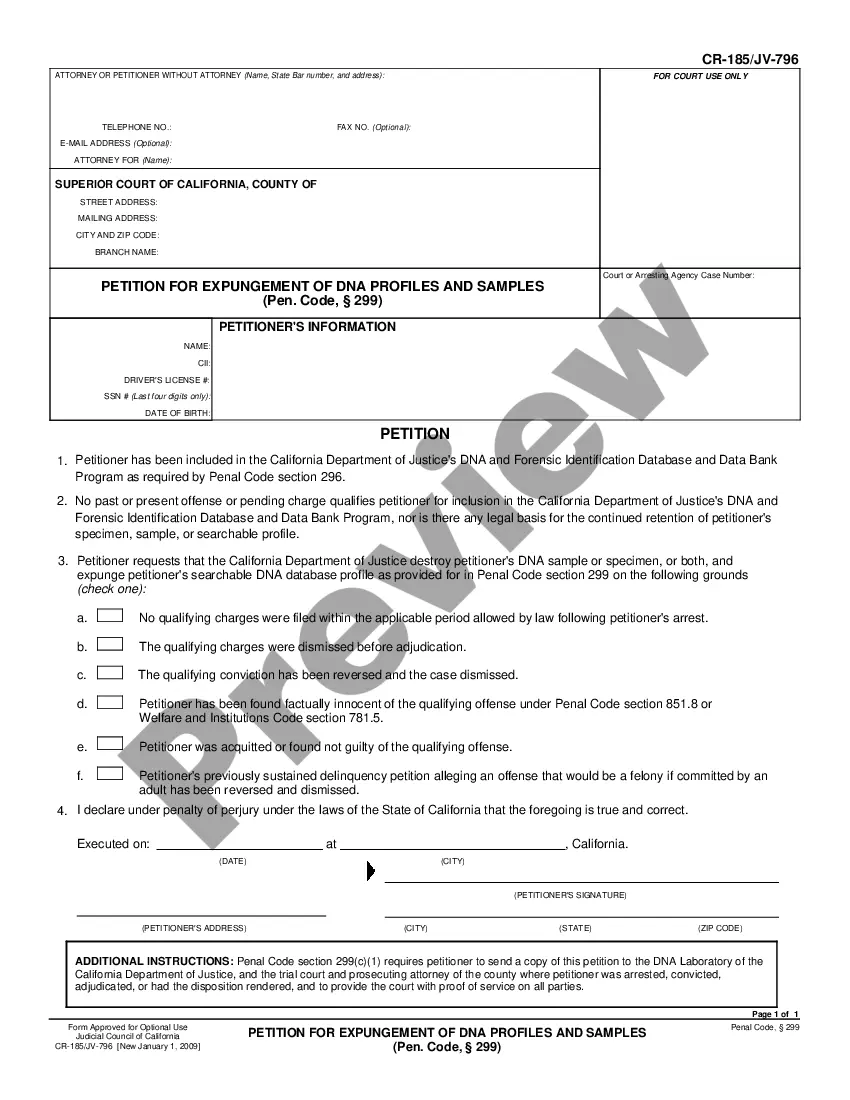

How to fill out Santa Clara California General Security Agreement Granting Secured Party Secured Interest?

Draftwing documents, like Santa Clara General Security Agreement granting secured party secured interest, to take care of your legal affairs is a challenging and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for different scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Santa Clara General Security Agreement granting secured party secured interest form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Santa Clara General Security Agreement granting secured party secured interest:

- Make sure that your form is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Santa Clara General Security Agreement granting secured party secured interest isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A general security agreement (GSA) is the most common form of personal property security used in the Atlantic Provinces to secure commercial loans and other business obligations owed to a financial institution or other creditor (Secured Party).

Secured party is defined as the person in whose favor the security interest is granted (§9-102(a)(72)(A)).

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

A security interest arises when, in exchange for a loan, a borrower agrees in a security agreement that the lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

Defined in the UCC as: A person in whose favor a security interest is created or provided for under a security agreement, whether or not any obligation to be secured is outstanding.

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.