Phoenix Arizona Acceptance of Investor Relations Agreement plays a critical role in attracting new investors to invest in company stocks. This agreement establishes a formal and transparent relationship between the company and its current and potential investors, facilitating effective communication and trust-building. By leveraging relevant keywords and providing detailed descriptions, potential investors can gain a better understanding of the different types of Phoenix Arizona Acceptance of Investor Relations Agreement available to assist in obtaining new investors in company stock. 1. "Phoenix Arizona Acceptance of Investor Relations Agreement with Reporting Requirements": This type of agreement outlines specific reporting requirements between the company and its investors. It ensures timely and accurate dissemination of financial information, business updates, and other essential data to maintain transparency and promote investor confidence. By meeting these requirements, companies can attract new investors who prioritize well-informed investment decisions. 2. "Phoenix Arizona Acceptance of Investor Relations Agreement with Proxy Voting Rights": This agreement grants investors the right to vote on important matters, such as corporate decisions, director appointments, mergers and acquisitions, and other significant events. By including proxy voting rights in the agreement, companies extend a sense of control and involvement to their investors, making it more appealing for potential investors to engage in the stock market. 3. "Phoenix Arizona Acceptance of Investor Relations Agreement with Insider Trading Policies": In this type of agreement, companies establish stringent policies and guidelines to prevent insider trading by company employees and board members. By committing to transparency and ethical conduct, companies can safeguard the interests of their investors. This agreement assures potential investors that their investments are protected against any illegal or unfair practices, making it easier to attract new investors. 4. "Phoenix Arizona Acceptance of Investor Relations Agreement with Non-Disclosure Agreement (NDA)": For companies with proprietary information or plans that are not yet disclosed to the public, this type of agreement helps protect sensitive data. By signing an NDA, investors commit to keeping any confidential information confidential, providing companies with the reassurance that their trade secrets won't be compromised. This agreement facilitates trust-building, as potential investors understand that their investments are based on exclusive insights not available elsewhere. 5. "Phoenix Arizona Acceptance of Investor Relations Agreement with Exclusivity Clause": In certain cases, companies may grant exclusive rights or privileges to specific investors as part of their investor relations strategy. This agreement restricts the company from engaging with other potential investors for a specified period, allowing the designated investors to enjoy unique benefits or opportunities. The exclusivity clause adds an element of exclusivity and increased investment value, attracting potential investors seeking differentiated advantages. Overall, a well-crafted Phoenix Arizona Acceptance of Investor Relations Agreement can significantly assist companies in obtaining new investors in their company stock. By providing clear terms, commitments, and safeguards, these agreements enhance investor trust, maximize transparency, and demonstrate the company's dedication to ethical practices.

Phoenix Arizona Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock

Description

How to fill out Phoenix Arizona Acceptance Of Investor Relations Agreement Assisting In Obtaining New Investors In Company Stock?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Phoenix Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Phoenix Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

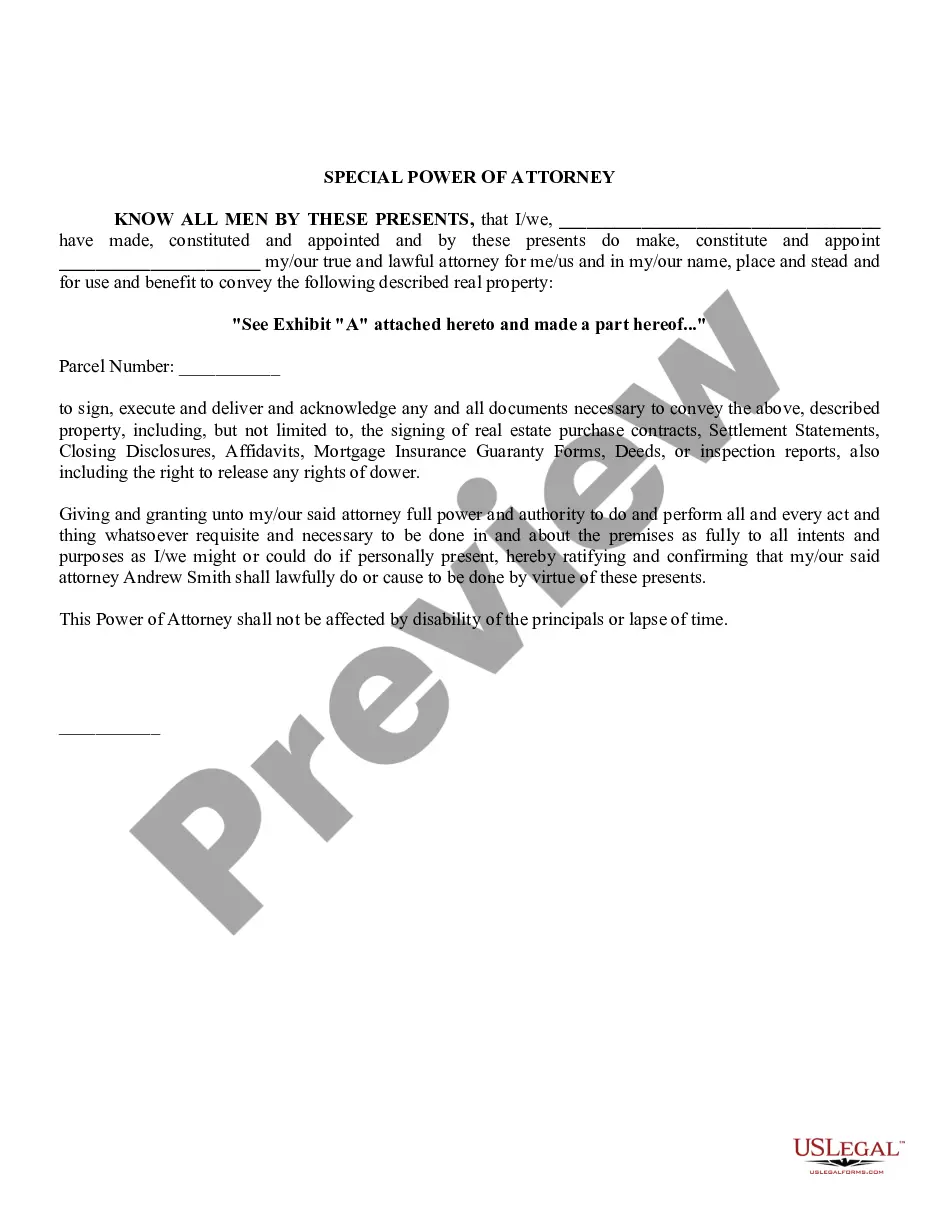

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Acceptance of Investor Relations Agreement assisting in obtaining new investors in company stock in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!