A Travis Texas Conversion Agreement is a legal document that outlines the terms and conditions of converting a business entity from one form to another in Travis County, Texas. This agreement ensures that the conversion process adheres to the specific laws and regulations applicable in Travis County. Keywords: Travis Texas Conversion Agreement, legal document, terms and conditions, business entity, converting, form, Travis County, Texas, laws and regulations. There are different types of Travis Texas Conversion Agreements, including: 1. Conversion from a Sole Proprietorship to a Corporation: This agreement documents the process of converting a sole proprietorship business into a corporation in Travis County, Texas. It includes details about the transfer of assets, liabilities, and ownership structure. 2. Conversion from a Partnership to a Limited Liability Company (LLC): This agreement outlines the conversion process for a partnership business to become an LLC in Travis County, Texas. It covers the transfer of partnership interests, assets, and liabilities to the newly formed LLC. 3. Conversion from a Corporation to an S Corporation: This agreement focuses on converting an existing corporation into an S Corporation in Travis County, Texas. It outlines the steps for electing S Corporation status, including shareholder consent and meeting the requirements set by the Internal Revenue Service (IRS). 4. Conversion from an LLC to a Corporation: This agreement governs the conversion process when an LLC decides to transform into a corporation in Travis County, Texas. It includes provisions for transferring membership interests, assets, liabilities, and changing the business structure. 5. Conversion from an S Corporation to a C Corporation: This agreement addresses the conversion process of an S Corporation into a C Corporation in Travis County, Texas. It covers the necessary steps to revoke the S Corporation election, including shareholder consent and IRS compliance. In summary, a Travis Texas Conversion Agreement is a vital legal document that ensures a smooth and lawful transition of a business entity from one form to another in Travis County, Texas. Different types of conversion agreements exist to accommodate various business transformations, such as from a sole proprietorship to a corporation, partnership to an LLC, corporation to an S Corporation, LLC to a corporation, and S Corporation to a C Corporation.

Travis Texas Conversion Agreement

Description

How to fill out Travis Texas Conversion Agreement?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Travis Conversion Agreement.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Travis Conversion Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Travis Conversion Agreement:

- Ensure you have opened the correct page with your local form.

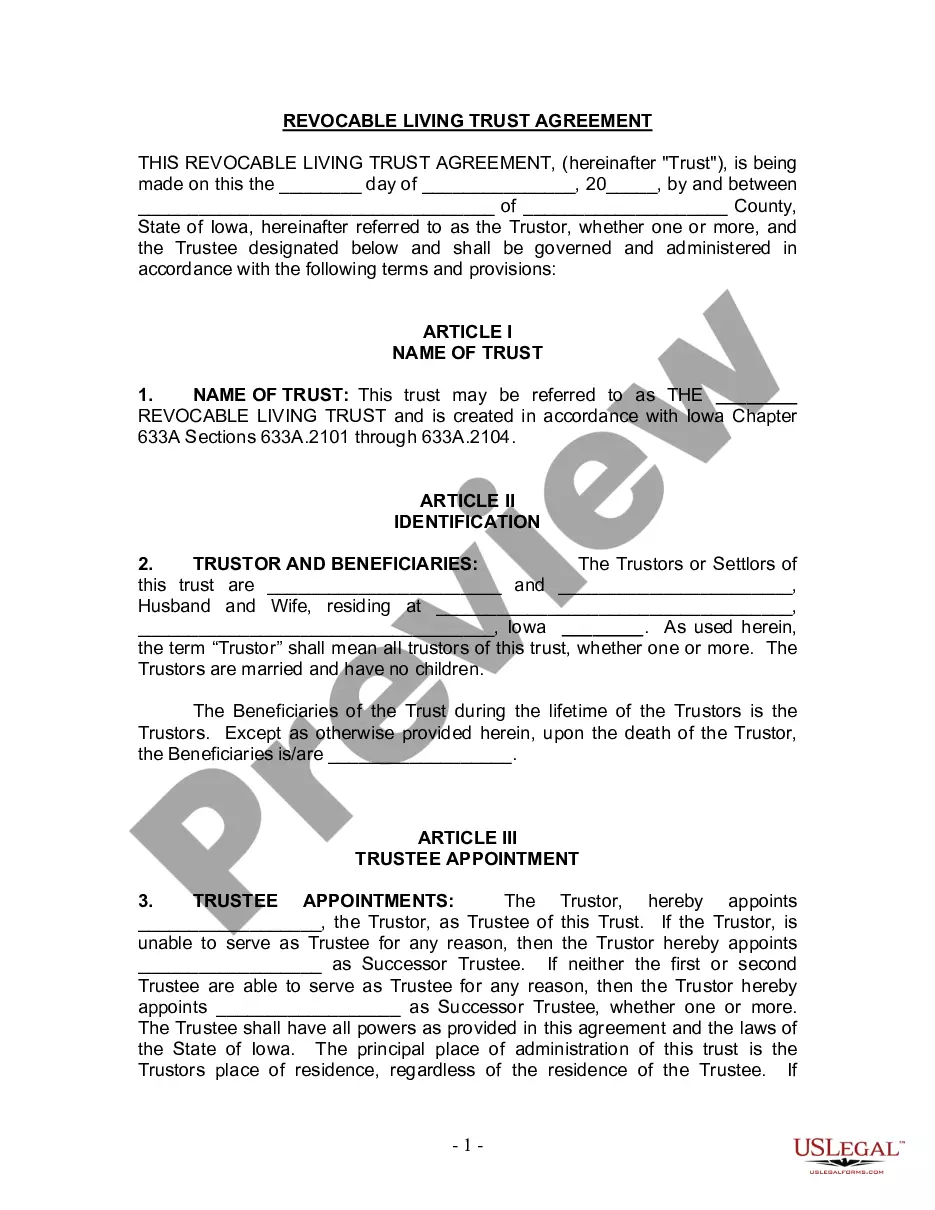

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Travis Conversion Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!