The Allegheny Pennsylvania Security Agreement is a legal contract that outlines the terms and conditions associated with borrowing funds and granting a security interest in assets. This agreement is commonly used in financial transactions, where a borrower seeks to obtain funds from a lender and pledges specific assets as collateral to secure the loan. Key provisions within the Allegheny Pennsylvania Security Agreement typically include: 1. Identification of Parties: The agreement begins by clearly identifying the lender (secured party) and the borrower (debtor). It also includes details such as their legal names, addresses, and contact information. 2. Description of Assets: The agreement specifies the assets that will be offered as collateral to secure the loan. This may include tangible assets like real estate, vehicles, equipment, inventory, or intangible assets such as intellectual property rights or accounts receivable. 3. Grant of Security Interest: The borrower grants the lender a security interest in the identified assets. This means that if the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover the outstanding debt. 4. Collateral Perfection: To protect the lender's security interest, the agreement often requires the borrower to take certain actions, such as registering the security interest with relevant authorities or maintaining insurance on the collateral. 5. Payment Obligations: The agreement outlines the borrower's repayment obligations, including the principal amount borrowed, interest rates, repayment schedule, and any other fees or charges. 6. Default and Remedies: The agreement defines the events that would constitute a default, such as non-payment, violation of other contractual terms, or bankruptcy. It also outlines the remedies available to the lender in case of default, such as accelerating the loan, initiating legal proceedings, or selling the collateral. It's worth mentioning that while the above provisions generally apply to the Allegheny Pennsylvania Security Agreement, variations may exist depending on the specific circumstances or parties involved. This agreement is commonly used in different contexts, including commercial loans, personal loans, mortgages, and equipment financing, to name a few. Each type may have specific provisions tailored to the unique nature of the borrowing and the assets involved.

Allegheny Pennsylvania Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Allegheny Pennsylvania Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

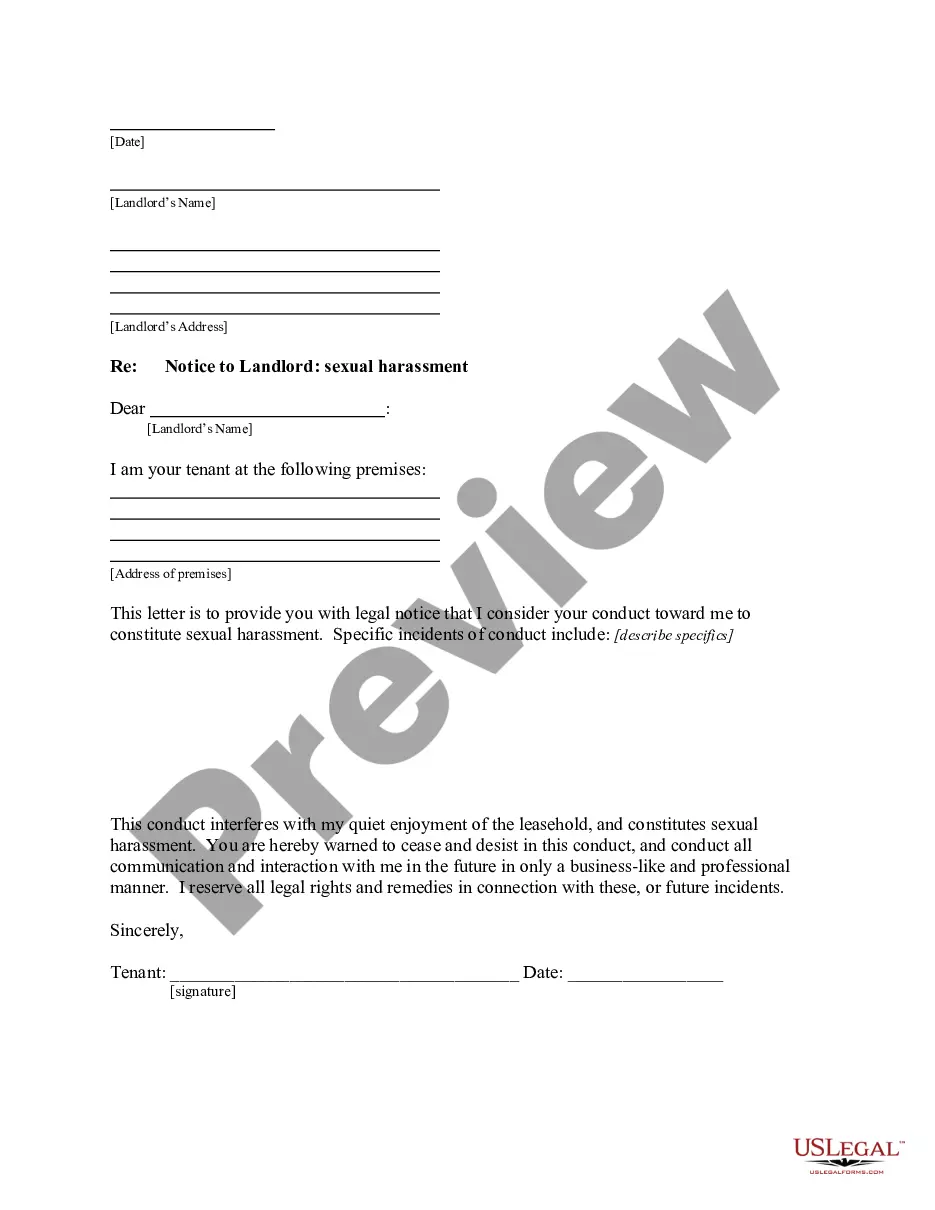

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Allegheny Security Agreement regarding borrowing of funds and granting of security interest in assets, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Allegheny Security Agreement regarding borrowing of funds and granting of security interest in assets, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Security Agreement regarding borrowing of funds and granting of security interest in assets:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Allegheny Security Agreement regarding borrowing of funds and granting of security interest in assets and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!