The Fulton Georgia Security Agreement is a legally binding document that outlines the terms and conditions for borrowing funds and granting a security interest in assets. This agreement is crucial for protecting the rights of lenders and providing a framework for loan transactions in Fulton, Georgia. It ensures that lenders have collateral to secure funds borrowed and provides a legal mechanism in case of default. The main purpose of the Fulton Georgia Security Agreement is to identify the assets that will serve as security for the loan and establish a priority right for the lender over those assets. By granting a security interest in assets, the borrower allows the lender to seize and sell the assets in case of default, thus minimizing the lender's risk. The agreement entails a detailed description of the assets offered as security, including but not limited to real estate, equipment, inventory, accounts receivable, and intellectual property. It specifies the conditions under which the security interest will be enforced, such as missed payment deadlines or breaches of the loan agreement. Various types of Security Agreements can be identified in Fulton, Georgia, depending on the nature of the transaction and the specific assets involved. Some examples include: 1. Real Estate Security Agreement: This type of agreement is used when the borrower offers real estate property as collateral for the borrowed funds. It includes a detailed description of the property, such as its location, boundaries, and any encumbrances. 2. Chattel Security Agreement: When movable property, such as equipment, vehicles, or inventory, is pledged as collateral, a chattel security agreement is utilized. It defines the assets in detail and outlines procedures for the lender to take possession of and sell the collateral in case of default. 3. Accounts Receivable Financing Agreement: In situations where accounts receivable serve as collateral, an accounts receivable financing agreement may be employed. This agreement establishes the borrower's obligation to assign the right to receive payment from its customers to the lender. 4. Intellectual Property Security Agreement: If the borrower's intellectual property, such as patents, copyrights, or trademarks, is pledged as security, an intellectual property security agreement is utilized. It outlines the specific IP assets, their assignment to the lender, and the consequences in the event of default. It is important to note that the above-mentioned security agreements can be customized and combined based on the specific needs and requirements of the lender and borrower in Fulton, Georgia. Each agreement is unique and aims to protect both parties while facilitating the borrowing of funds and granting a security interest in assets.

Fulton Georgia Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Fulton Georgia Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Security Agreement regarding borrowing of funds and granting of security interest in assets, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the recent version of the Fulton Security Agreement regarding borrowing of funds and granting of security interest in assets, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fulton Security Agreement regarding borrowing of funds and granting of security interest in assets:

- Glance through the page and verify there is a sample for your region.

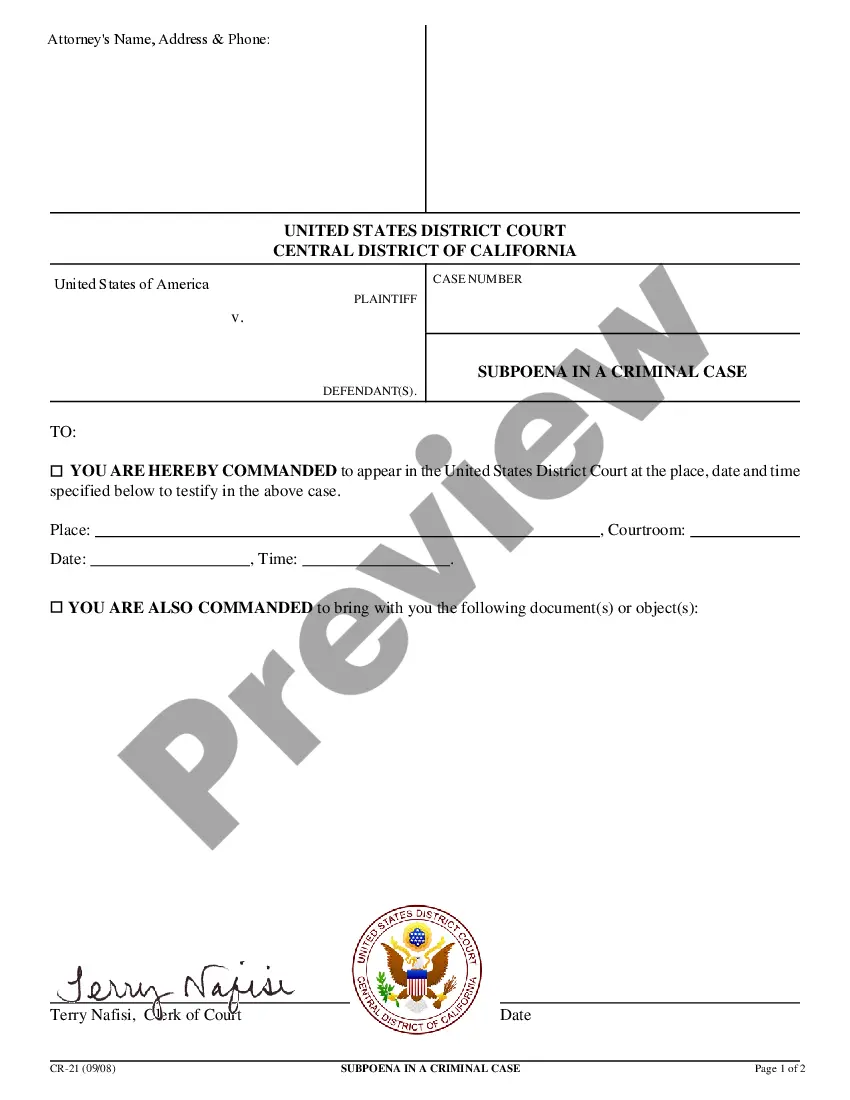

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Fulton Security Agreement regarding borrowing of funds and granting of security interest in assets and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!