The Harris Texas Security Agreement is a legal document that outlines the terms and conditions surrounding the borrowing of funds and granting of a security interest in assets between a debtor and a creditor. This agreement provides a framework for securing loans and protecting the lender's interests in case of default or non-payment. One type of Harris Texas Security Agreement is the Real Estate Security Agreement. This agreement is specifically used when the borrowed funds are secured by the debtor's real estate property. It establishes a lien on the property, allowing the lender to claim the property if the debtor fails to repay the loan. Another type is the Personal Property Security Agreement (PSA). This agreement pertains to the borrowing of funds where the security interest granted is on the debtor's personal property, including assets such as inventory, equipment, and accounts receivable. By granting a security interest, the debtor provides assurance to the lender that there is collateral available to satisfy the loan in case of default. The specifics of the Harris Texas Security Agreement may vary depending on the parties involved and the nature of the transaction, but it typically includes the following key elements: 1. Parties: The agreement will identify the debtor (borrower) and the creditor, also known as the secured party. 2. Description of Collateral: The agreement will provide a detailed description of the assets or property being used as security or collateral for the loan. This may include both real property (in case of Real Estate Security Agreement) and personal property (in case of PSA). 3. Granting Security Interest: The debtor agrees to grant a security interest in the specified assets to the creditor as collateral for the loan. 4. Borrowing Terms: The agreement will outline the terms and conditions of the loan, including the principal amount, interest rate, repayment terms, and any penalties or fees associated with default. 5. Default and Remedies: The agreement will clarify the actions that the creditor can take in case of default by the debtor. This may include repossession or foreclosure of the collateral, the right to sell the collateral, or pursuing legal action for recovery. 6. Governing Law: The agreement will specify that it is governed by the laws of Harris County, Texas, ensuring that the agreement follows the relevant legal requirements and procedures of the jurisdiction. It is important to consult with legal professionals or experts in Harris Texas to ensure compliance with local laws and regulations when drafting and executing a Harris Texas Security Agreement. Each agreement should be customized to fit the specific needs and circumstances of the parties involved.

Harris Texas Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

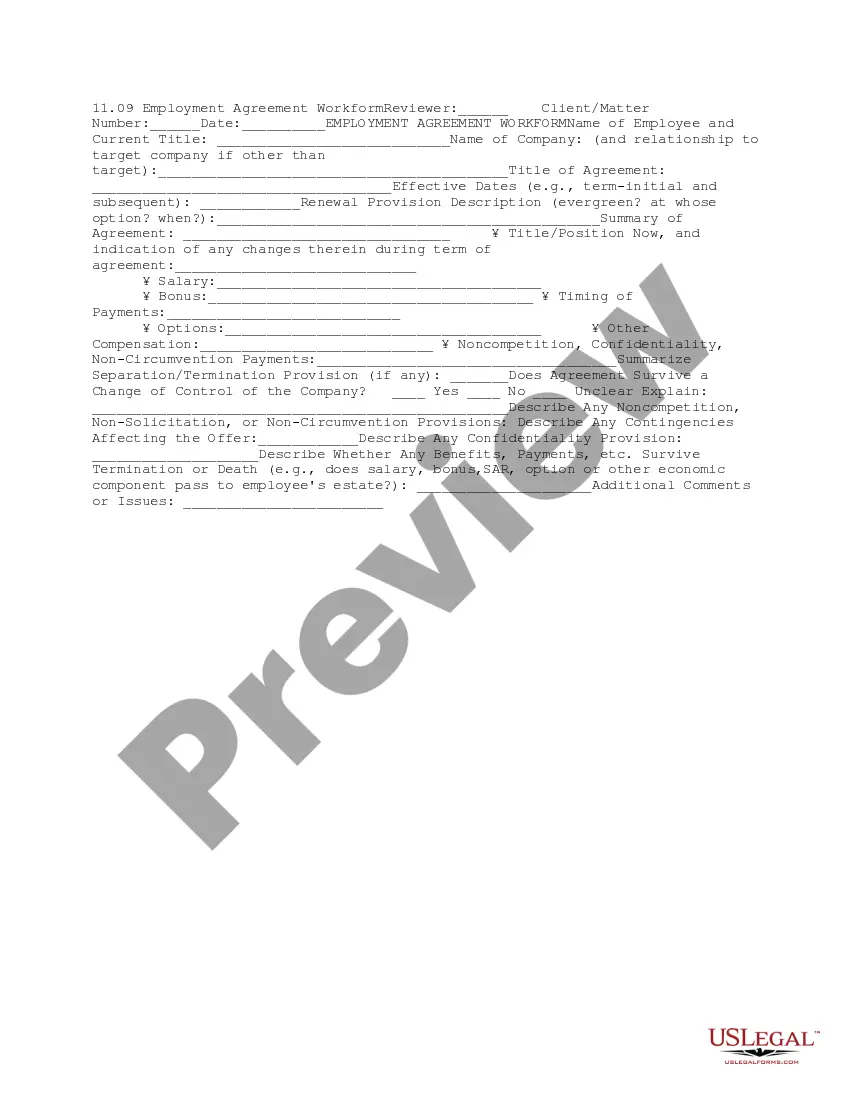

How to fill out Harris Texas Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Harris Security Agreement regarding borrowing of funds and granting of security interest in assets without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Security Agreement regarding borrowing of funds and granting of security interest in assets by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Harris Security Agreement regarding borrowing of funds and granting of security interest in assets:

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!