The Nassau New York Security Agreement is a legally binding contract that governs the borrowing and lending of funds, as well as the granting of a security interest in assets within Nassau County, New York. This agreement is essential for businesses or individuals seeking financial assistance or loans while using their assets as collateral. Key elements of the Nassau New York Security Agreement include: 1. Borrowing of Funds: The agreement outlines the terms and conditions under which funds are borrowed, including the repayment schedule, interest rates, and any additional fees associated with the loan. 2. Granting of Security Interest: In exchange for the loan, the borrower grants a security interest in their assets, providing the lender with a legal claim over the assets as collateral. This serves as a protection for the lender in case the borrower defaults on the loan. 3. Asset Description: The agreement provides a detailed description of the assets that are being used as collateral, ensuring clarity and understanding of the assets involved. This can include tangible assets like real estate, vehicles, or equipment, as well as intangible assets such as intellectual property or financial accounts. 4. Perfection of Security Interest: To ensure that the lender's claim is superior to others, the agreement may require the borrower to take necessary steps to perfect the security interest. This may involve filing documents with relevant authorities to establish the lender's priority in case of multiple claims or insolvency. 5. Default and Remedies: The agreement outlines the specific events that may constitute a default and the remedies available to the lender in such situations. This may include the right to seize and sell the assets, initiate legal proceedings, or appoint a receiver. Different types of Nassau New York Security Agreements regarding borrowing of funds and granting of security interest in assets may include: 1. Real Estate Security Agreement: Specifically applicable when real estate is used as collateral, this agreement focuses on the details of the property, including any liens, encumbrances, or prior mortgages. 2. Chattel Mortgage Agreement: When movable personal property, such as vehicles or equipment, are pledged as collateral, this agreement outlines the specific items, their condition, and supporting documentation like vehicle identification numbers or serial numbers. 3. Intellectual Property Security Agreement: This agreement is relevant when intangible assets like patents, trademarks, or copyrights are used as collateral. It details the nature of the intellectual property and the steps taken to perfect the security interest. In summary, the Nassau New York Security Agreement is a crucial contract for borrowers and lenders, establishing the terms and conditions of borrowing funds while granting a security interest in assets. The agreement ensures transparency, protects the rights of both parties, and provides remedies in case of default. Different types of security agreements vary depending on the nature of the assets used as collateral.

Nassau New York Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Nassau New York Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Draftwing forms, like Nassau Security Agreement regarding borrowing of funds and granting of security interest in assets, to take care of your legal matters is a difficult and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms intended for different scenarios and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Nassau Security Agreement regarding borrowing of funds and granting of security interest in assets form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Nassau Security Agreement regarding borrowing of funds and granting of security interest in assets:

- Ensure that your template is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Nassau Security Agreement regarding borrowing of funds and granting of security interest in assets isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.

Protection; assurance; indemnification.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

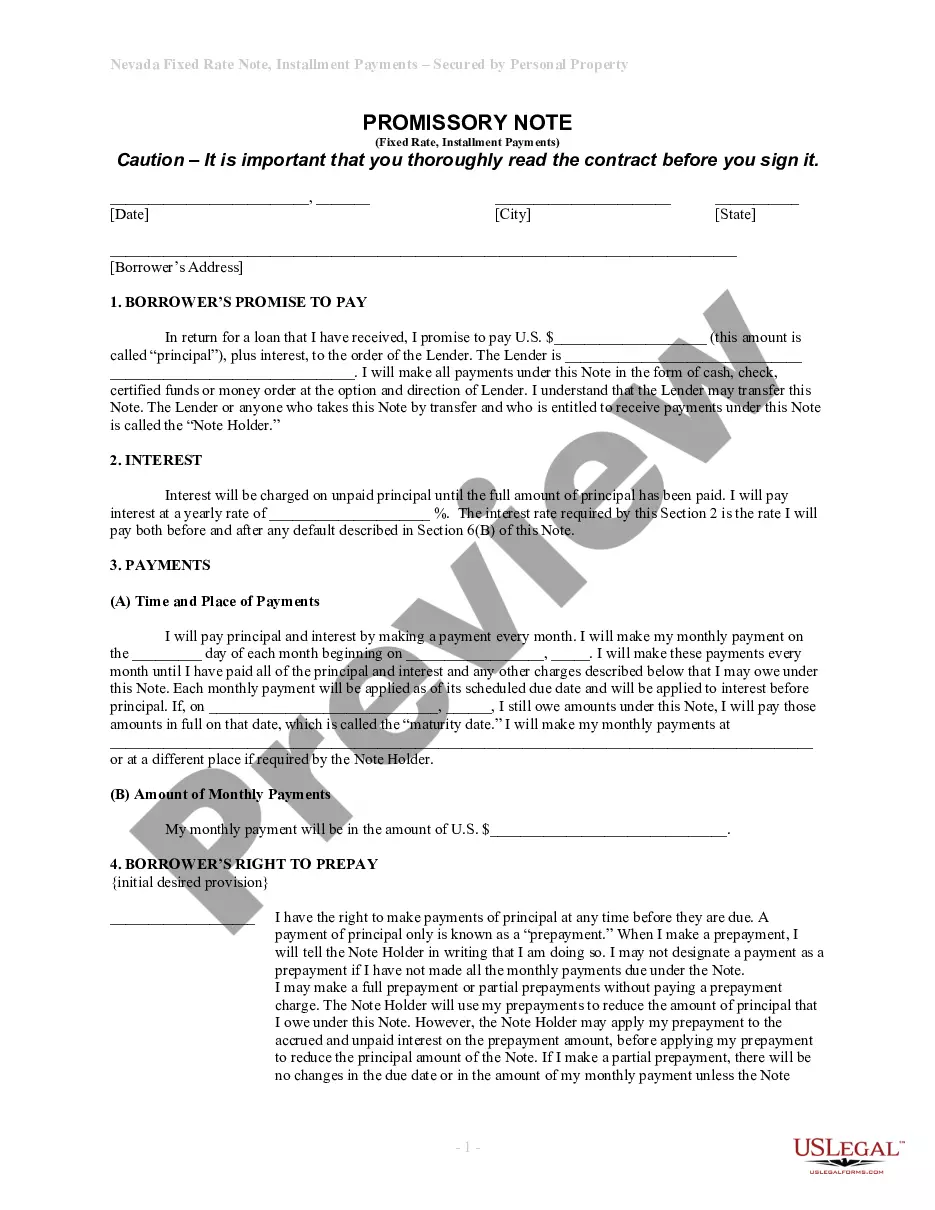

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.