Harris Texas Investment Agreement, also known as Harris Texas Stock Purchase Agreement, is a legal contract that outlines the terms and conditions for the purchase and sale of shares of common stock in a company. This agreement is commonly used in the investment and finance sectors for securing investments and equity ownership. The Harris Texas Investment Agreement specifies the details of the transaction, including the number of shares being purchased, the purchase price per share, and the total value of the investment. It also outlines the rights and obligations of both the buyer (investor) and the seller (company issuing the shares). The agreement typically discusses important aspects such as the purchase method, closing conditions, representations and warranties, and post-closing obligations. Investors engaging in the Harris Texas Investment Agreement can have different motivations, such as seeking investment opportunities, capital appreciation, and potential dividends. It is crucial to thoroughly review the agreement, as it can include specific provisions related to voting rights, restrictions on transfer of shares, anti-dilution clauses, and tag-along or drag-along rights. Moreover, variations of the Harris Texas Investment Agreement can exist depending on the specific circumstances and requirements of the parties involved. Some examples include: 1. Harris Texas Preferred Stock Purchase Agreement: This agreement is used when investors specifically purchase preferred shares to common shares. Preferred shares often come with additional benefits, such as priority in dividends or liquidation proceeds. 2. Harris Texas Stock Subscription Agreement: This agreement is utilized when an investor agrees to subscribe for newly issued shares in a company, rather than purchasing existing shares. 3. Harris Texas Stock Option Agreement: In situations where a company wants to grant options to purchase common stock to its employees or other individuals, the Harris Texas Stock Option Agreement is employed. This document outlines the terms and conditions for the exercise of these stock options. In conclusion, the Harris Texas Investment Agreement plays a vital role in facilitating the purchase of shares of common stock. Its purpose is to protect the rights and interests of both the investor and the company, ensuring clarity and transparency throughout the transaction process.

Harris Texas Investment Agreement regarding the purchase of shares of common stock

Description

How to fill out Harris Texas Investment Agreement Regarding The Purchase Of Shares Of Common Stock?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Harris Investment Agreement regarding the purchase of shares of common stock, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Harris Investment Agreement regarding the purchase of shares of common stock from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Investment Agreement regarding the purchase of shares of common stock:

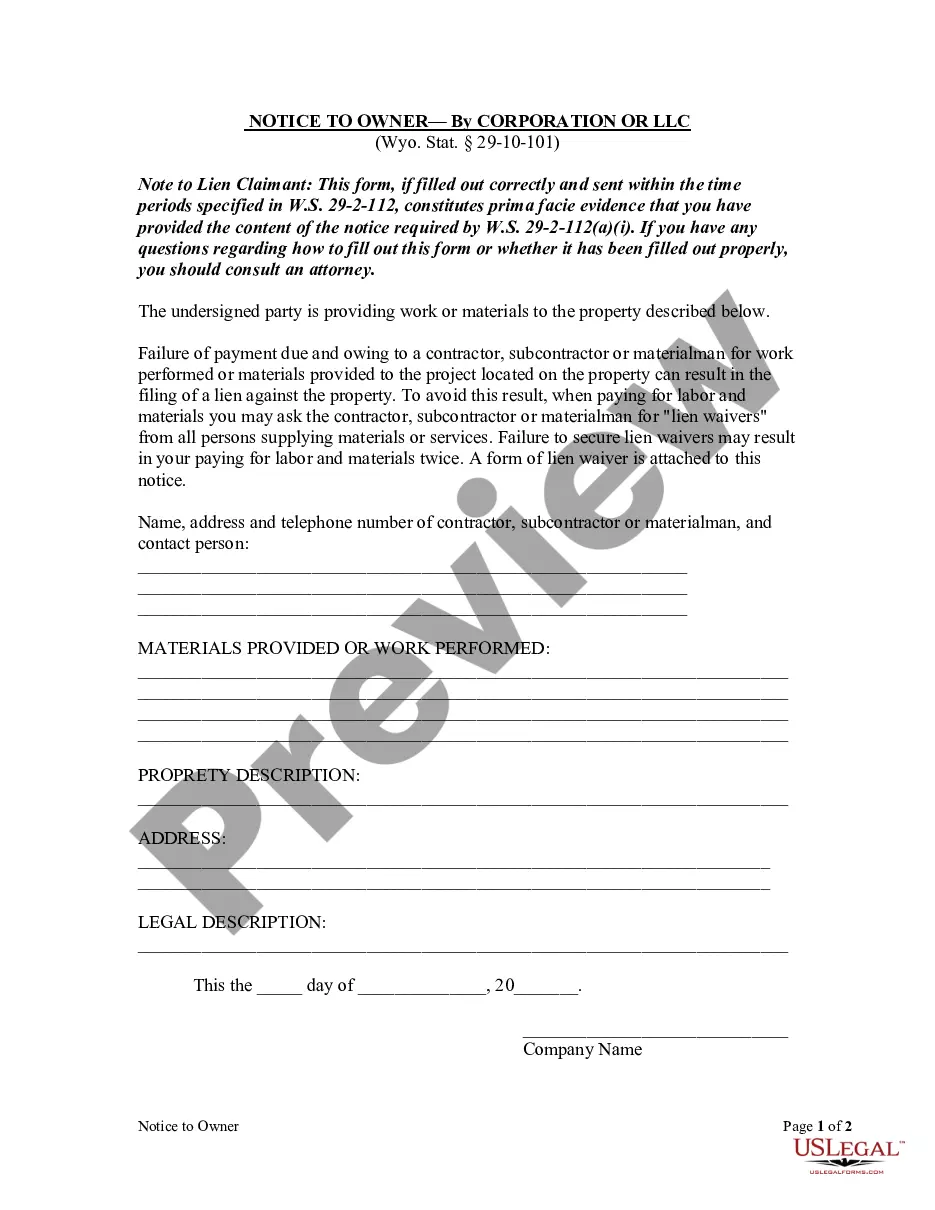

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!