San Diego California Investment Agreement is a legal contract that outlines the terms and conditions between an investor and a company for the purchase of shares of common stock. This agreement plays a crucial role in protecting both parties' interests and ensuring a fair and transparent investment process. The agreement typically starts with an introductory section that provides the names of the investor and the company, the date of the agreement, and any necessary background information. It also defines the purpose and objectives of the investment, which may include goals for growth, profit potential, and strategic partnership. The agreement then proceeds to detail the financial terms, including the number of shares being purchased, the purchase price per share, and the total investment amount. It may also mention any additional costs, such as legal fees or transaction fees, which are incurred during the investment process. To protect investors' rights and ensure their involvement in decision-making processes, a San Diego California Investment Agreement may include provisions regarding corporate governance. This can include voting rights, board representation, and access to financial statements and reports. Another important aspect of the agreement is the terms and conditions surrounding the issuance and transferability of shares. It may outline any restrictions on selling or transferring the shares, the right of first refusal, or the need for board approval for any transfers. Such provisions ensure that the investor's shares are securely held and prevent any unauthorized transfers. In some cases, there may be different types or variations of San Diego California Investment Agreements. These could be differentiated based on factors such as the investor's level of involvement in the company, the investment timeframe, or the nature of the business. Some common types include: 1. Series A Investment Agreement: This agreement is specific to the initial round of funding received by a startup company. It often includes more comprehensive terms and conditions to protect early investors' interests. 2. Convertible Note Agreement: This type of agreement is often used when an investor provides short-term financing to a company in the form of a loan, which can be converted into shares at a later stage. It outlines the repayment terms, interest rates, and conversion details. 3. Equity Purchase Agreement: This agreement is employed when an investor acquires shares of common stock directly from an existing shareholder rather than the company. It may involve negotiations on the price and terms with the selling shareholder. Overall, a San Diego California Investment Agreement lays the foundation for a mutually beneficial relationship between the investor and the company. It ensures transparency, protection of rights, and clear guidelines for the purchase and ownership of shares of common stock.

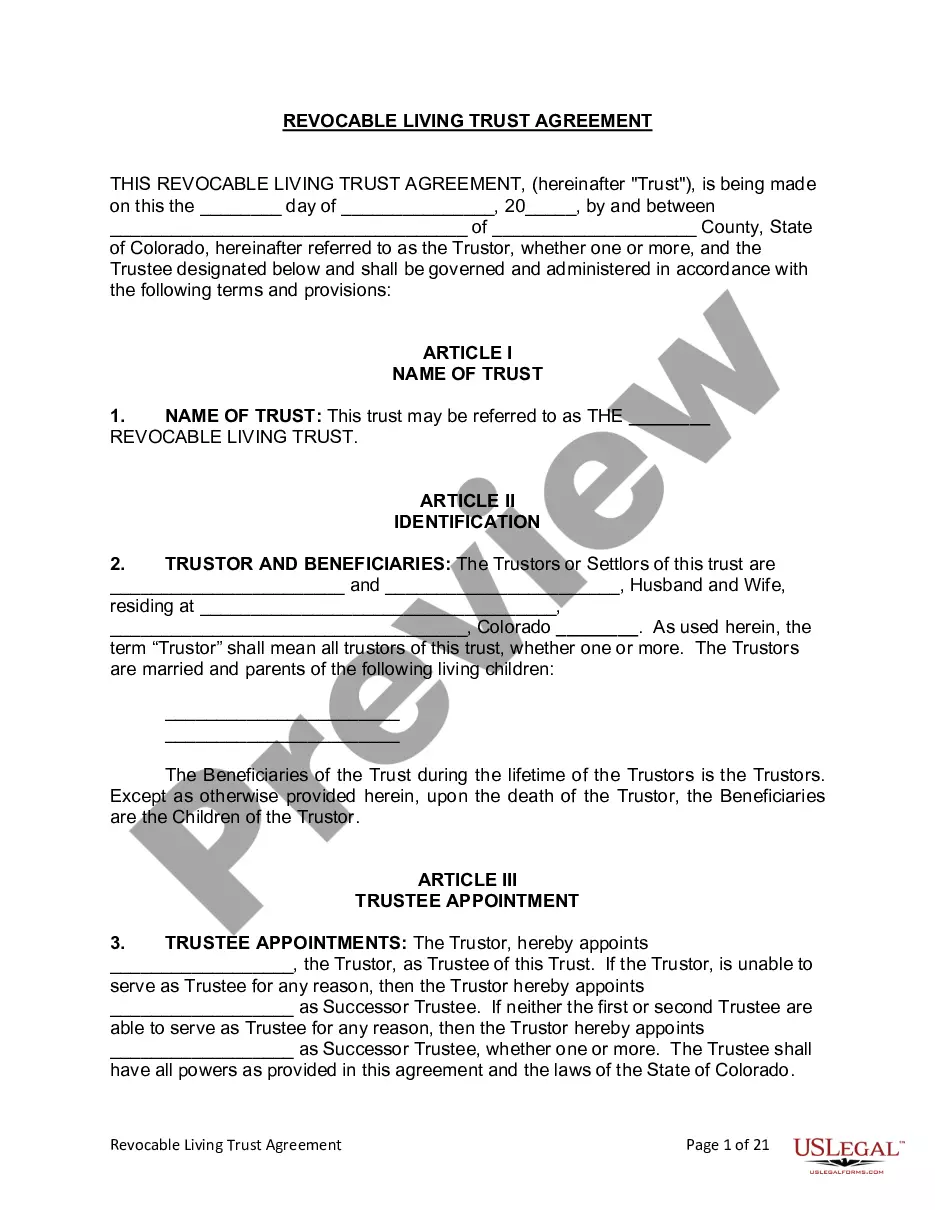

San Diego California Investment Agreement regarding the purchase of shares of common stock

Description

How to fill out San Diego California Investment Agreement Regarding The Purchase Of Shares Of Common Stock?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Diego Investment Agreement regarding the purchase of shares of common stock, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Diego Investment Agreement regarding the purchase of shares of common stock from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Diego Investment Agreement regarding the purchase of shares of common stock:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

What to Include in an Investor Agreement The names and addresses of the parties. The purpose of the investment. The date of the investment. The structure of the investment. The signatures of the parties.

A rights issue is one way for a cash-strapped company to raise capital often to pay down debt. Shareholders can buy new shares at a discount for a certain period. With a rights issue, because more shares are issued to the market, the stock price is diluted and will likely go down.

The investor rights agreement specifies the investor's right of first refusal, whether they have any restrictions on the sale or transfer of shares, and allocated voting rights or board responsibilities. Investor rights agreements offer protection for both the investor and the company.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

Common Stock Agreement means an agreement executed by a Common Stockholder and the Company as contemplated by Section 5, below, which imposes on the shares of Common Stock held by the Common Stockholder such restrictions as the Board or Committee deem appropriate.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract.

Equity Investment Agreement means an agreement or contract to provide a loan or accept a mortgage or to purchase qualified securities or other means whereby financial aid is made available to or on behalf of a young, high risk, technology based small business.

A stock and asset purchase agreement is a contract between the buyer and seller of a business. It outlines the terms, conditions, and details regarding the sale of shares or ownership interest in an existing company.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.