Cuyahoga Ohio Term Sheet — Series A Preferred Stock Financing is a legal agreement that outlines the terms and conditions of a company's financial arrangement for raising capital through the issuance of preferred stock. This type of financing is typically utilized by early-stage startups or companies looking to expand their operations or launch new products. The Series A Preferred Stock refers to a specific class of stock with preferential rights and privileges compared to common stock. It is often the first round of financing that a company receives from external investors, such as venture capital firms or angel investors. The terms and conditions outlined in the term sheet are crucial for both the company and the investors to ensure a fair and mutually beneficial investment. The Cuyahoga Ohio Term Sheet — Series A Preferred Stock Financing covers various essential aspects of the investment, including: 1. Valuation: The term sheet specifies the pre-money valuation of the company, which determines the investor's ownership percentage in exchange for their investment. This valuation is crucial for determining the price per share of the preferred stock. 2. Investment Amount: The term sheet outlines the total amount the investors are committing to invest in the company. It may also specify the minimum and maximum investment amounts for individual investors. 3. Liquidation Preferences: This clause determines the order in which investors are repaid in the event of a liquidation event or sale of the company. Series A Preferred Stockholders typically have priority over common stockholders. 4. Dividends: The term sheet may specify whether the preferred stock carries cumulative or non-cumulative dividends. Cumulative dividends accumulate if not paid and are typically paid before common stockholders. 5. Anti-dilution Protection: This provision protects investors from dilution of their ownership stake in case the company raises additional funding at a lower valuation in the future. It may include price-based or weighted-average anti-dilution provisions. 6. Board of Directors: The term sheet may stipulate the number of board seats the investors are entitled to and any other board-related rights they may have. 7. Voting Rights: The preferred stockholders may have specific voting rights on certain matters, such as the appointment of key executives, major corporate transactions, or changes in the company's capital structure. 8. Redemption and Conversion Rights: The term sheet may outline the circumstances under which the preferred stock can be redeemed by the company or converted into common shares. It is important to note that the content and terms of a Cuyahoga Ohio Term Sheet — Series A Preferred Stock Financing can vary from company to company and investor to investor. Each term sheet is tailored to the specific needs and requirements of the parties involved. Other types of financing term sheets may include Series B, Series C, and subsequent rounds of preferred stock financing as a company progresses through different stages of growth.

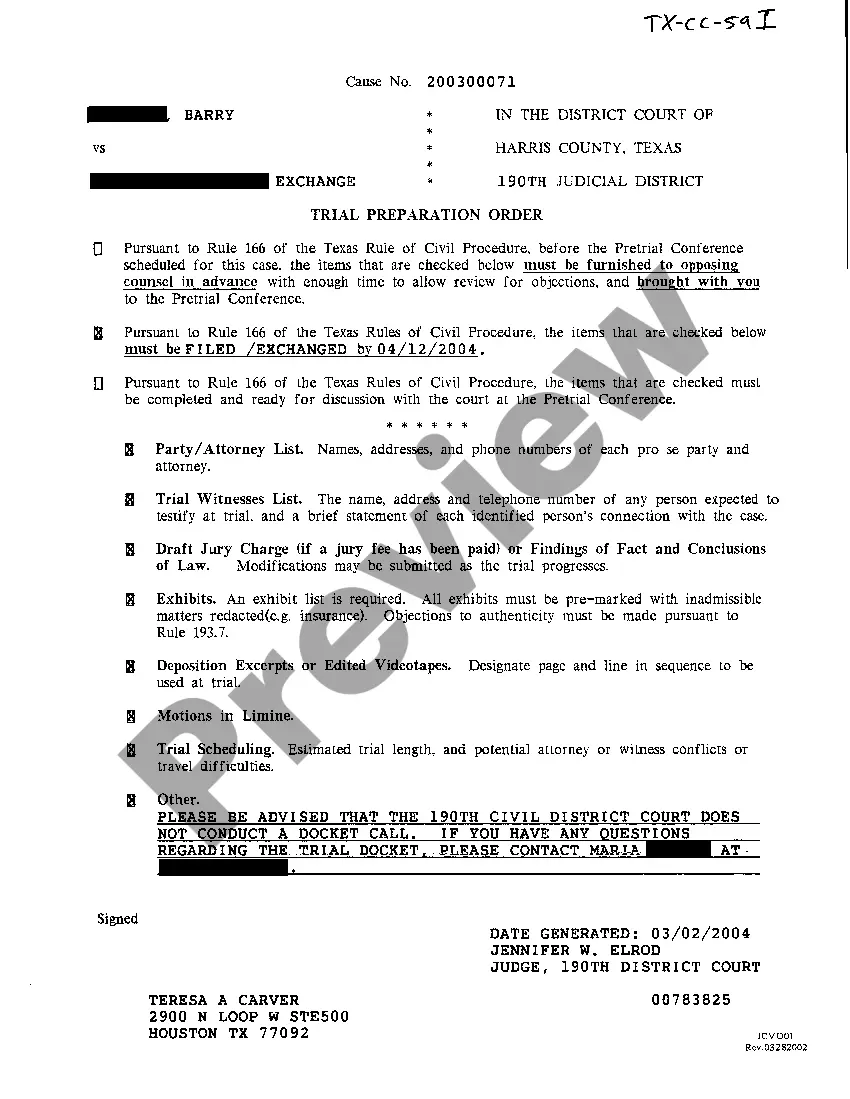

Cuyahoga Ohio Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Cuyahoga Ohio Term Sheet - Series A Preferred Stock Financing Of A Company?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Cuyahoga Term Sheet - Series A Preferred Stock Financing of a Company, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Term Sheet - Series A Preferred Stock Financing of a Company from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Cuyahoga Term Sheet - Series A Preferred Stock Financing of a Company:

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!