Riverside California Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms, conditions, and provisions agreed upon by a company and its investors regarding the issuance and purchase of Series A Preferred Stock. This financing round is typically undertaken by startups or early-stage companies seeking capital infusion to fuel growth and expansion. The Series A Preferred Stock is a class of shares that provides certain rights and privileges to investors, giving them priority over common stockholders in terms of liquidation preference, voting rights, dividends, and potential returns upon exit. The term sheet serves as a preliminary agreement, setting the groundwork for the finalization of the preferred stock financing deal. In the Riverside, California region, several types of Series A Preferred Stock Financing term sheets may exist, each tailored to meet specific objectives and requirements. These variations are influenced by factors such as company size, industry, growth stage, and investor preferences. Here are some common types: 1. Traditional Series A Term Sheet: This type of term sheet encompasses standard provisions and terms typically seen in preferred stock financings. It includes provisions related to liquidation preferences, anti-dilution protection, voting rights, dividends, conversion rights, and board representation. 2. Participating Preferred Stock Term Sheet: This variant of Series A Preferred Stock Financing grants investors the right to participate in the company's proceeds upon a sale or liquidation, even after receiving their initial investment payouts. It allows them to receive both their liquidation preferences and a pro rata share of the remaining proceeds, ensuring potential higher returns. 3. Convertible Preferred Stock Term Sheet: This form of term sheet provides investors with the option to convert their preferred shares into common shares at a predetermined conversion ratio. Conversion is typically triggered by specific events such as an initial public offering (IPO) or a future funding round, providing potential upside to investors if the company achieves significant milestones. 4. Fixed Dividend Preferred Stock Term Sheet: In this type of term sheet, preferred shareholders are entitled to a fixed dividend rate, regardless of the company's profitability. This offers investors a predictable income stream while reducing the risk associated with solely relying on the company's performance for returns. 5. Pay-to-Play Preferred Stock Term Sheet: Pay-to-Play provisions are included in certain term sheets to incentivize ongoing investor participation and commitment. This provision mandates that if existing investors choose not to participate in future funding rounds, they would lose certain rights or face additional dilution. It encourages investors to continue supporting the company's growth and aligns their interests with the success of the business. In conclusion, a Riverside California Term Sheet — Series A Preferred Stock Financing of a Company is a crucial document that outlines the terms and conditions by which investors provide capital to a company in exchange for preferred stock. The specific type of term sheet employed will vary based on the company's needs and the preferences of the investors involved.

Riverside California Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Riverside California Term Sheet - Series A Preferred Stock Financing Of A Company?

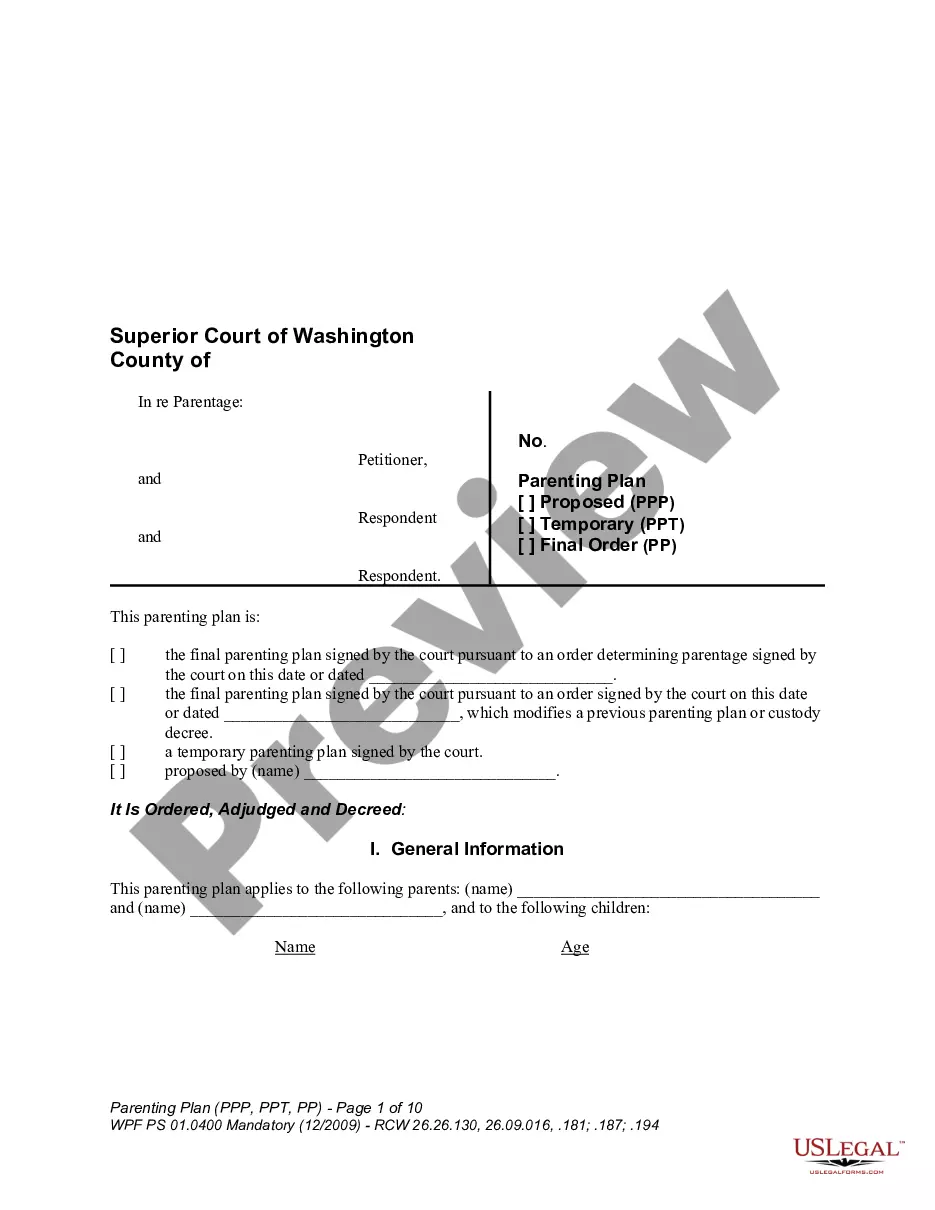

If you need to get a trustworthy legal form supplier to obtain the Riverside Term Sheet - Series A Preferred Stock Financing of a Company, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to get and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Riverside Term Sheet - Series A Preferred Stock Financing of a Company, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Riverside Term Sheet - Series A Preferred Stock Financing of a Company template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Riverside Term Sheet - Series A Preferred Stock Financing of a Company - all from the convenience of your sofa.

Sign up for US Legal Forms now!