Fulton Georgia Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms and conditions under which a company plans to raise funds through the issuance of Series A Preferred Stock. This type of financing is commonly used by startups and high-growth businesses to secure additional capital for expansion, research and development, or other strategic initiatives. The Fulton Georgia Term Sheet — Series A Preferred Stock Financing lays out various provisions that govern the rights and obligations of both the company seeking funding and the investors interested in purchasing preferred shares. It acts as a preliminary agreement, serving as a basis for negotiation before formalizing the transaction through definitive legal documents. Key elements often included in the term sheet include: 1. Capitalization: The term sheet outlines the company's current and anticipated capital structure, including the number of authorized and outstanding shares of preferred stock, common stock, and any potential securities. 2. Investment Amount and Valuation: It specifies the amount of funding the company intends to raise, as well as the valuation at which the preferred shares are offered. This valuation determines the price per share and affects the ownership percentages of both existing shareholders and the new investors. 3. Liquidation Preference: This provision defines how proceeds will be distributed in the event of a liquidation, such as through a sale or merger. Series A Preferred Stockholders often enjoy a higher rank in the distribution waterfall, ensuring that they receive their investment back before any other shareholders. 4. Dividend and Conversion Rights: The term sheet describes the dividend rates payable to the holders of preferred shares and outlines the terms for converting preferred shares into common shares. Conversion rights allow investors to participate in any potential upside of the company if it later goes public or is acquired. 5. Board Representation and Protective Provisions: Investors purchasing Series A Preferred Stock often negotiate the right to appoint a representative to the company's board of directors to protect their interests. The term sheet may include the number of board seats and outline any specific protective provisions they require to ensure their investment is adequately safeguarded. 6. Anti-dilution Protection: This provision protects investors from substantial dilution if the company subsequently issues new shares at a lower price. It ensures their ownership percentages are not significantly reduced and can be structured in various ways, such as full ratchet or weighted average. 7. Preemptive Rights: Preemptive rights grant the investors the opportunity to maintain their ownership percentage in the company by participating in future fundraising rounds. This provision can be critical in enabling investors to prevent dilution and protect their initial investment. Different types of Series A Preferred Stock Financing term sheets may vary depending on the specifics of the deal, the industry, and the negotiating power of the parties involved. However, these key elements often remain consistent, enabling both the company and investors to understand the contours of the financing arrangement before proceeding with formal legal documentation.

Fulton Georgia Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Fulton Georgia Term Sheet - Series A Preferred Stock Financing Of A Company?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Fulton Term Sheet - Series A Preferred Stock Financing of a Company, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fulton Term Sheet - Series A Preferred Stock Financing of a Company from the My Forms tab.

For new users, it's necessary to make several more steps to get the Fulton Term Sheet - Series A Preferred Stock Financing of a Company:

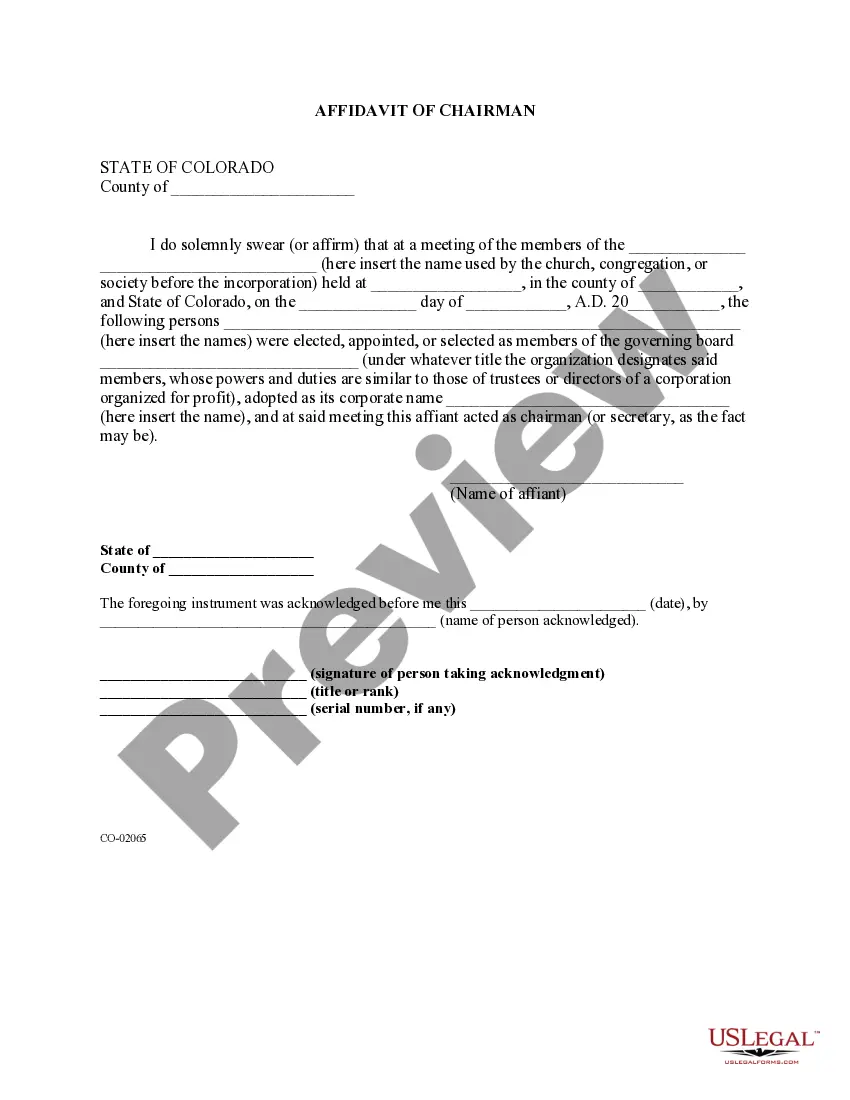

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!