Hennepin Minnesota Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Hennepin Minnesota Term Sheet - Series A Preferred Stock Financing Of A Company?

Do you need to quickly create a legally-binding Hennepin Term Sheet - Series A Preferred Stock Financing of a Company or probably any other document to manage your own or corporate affairs? You can select one of the two options: contact a legal advisor to write a legal document for you or create it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Hennepin Term Sheet - Series A Preferred Stock Financing of a Company and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, carefully verify if the Hennepin Term Sheet - Series A Preferred Stock Financing of a Company is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were looking for by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Hennepin Term Sheet - Series A Preferred Stock Financing of a Company template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Moreover, the documents we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

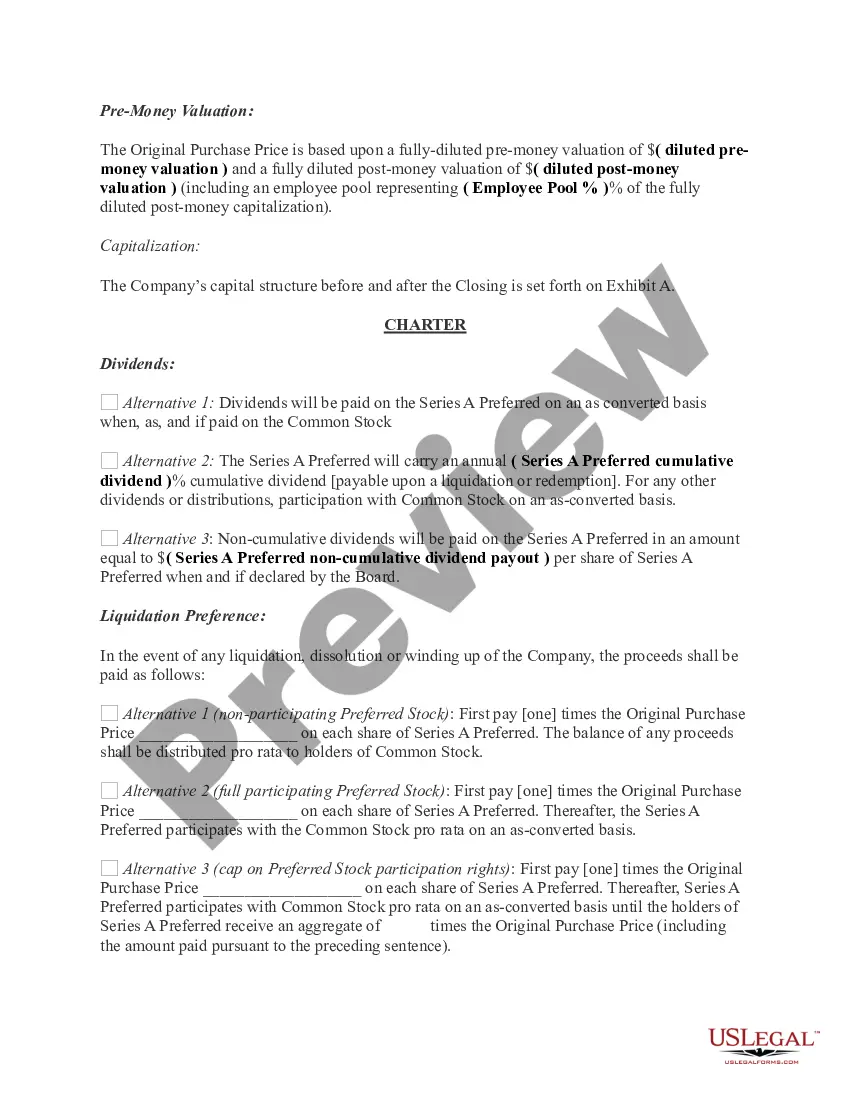

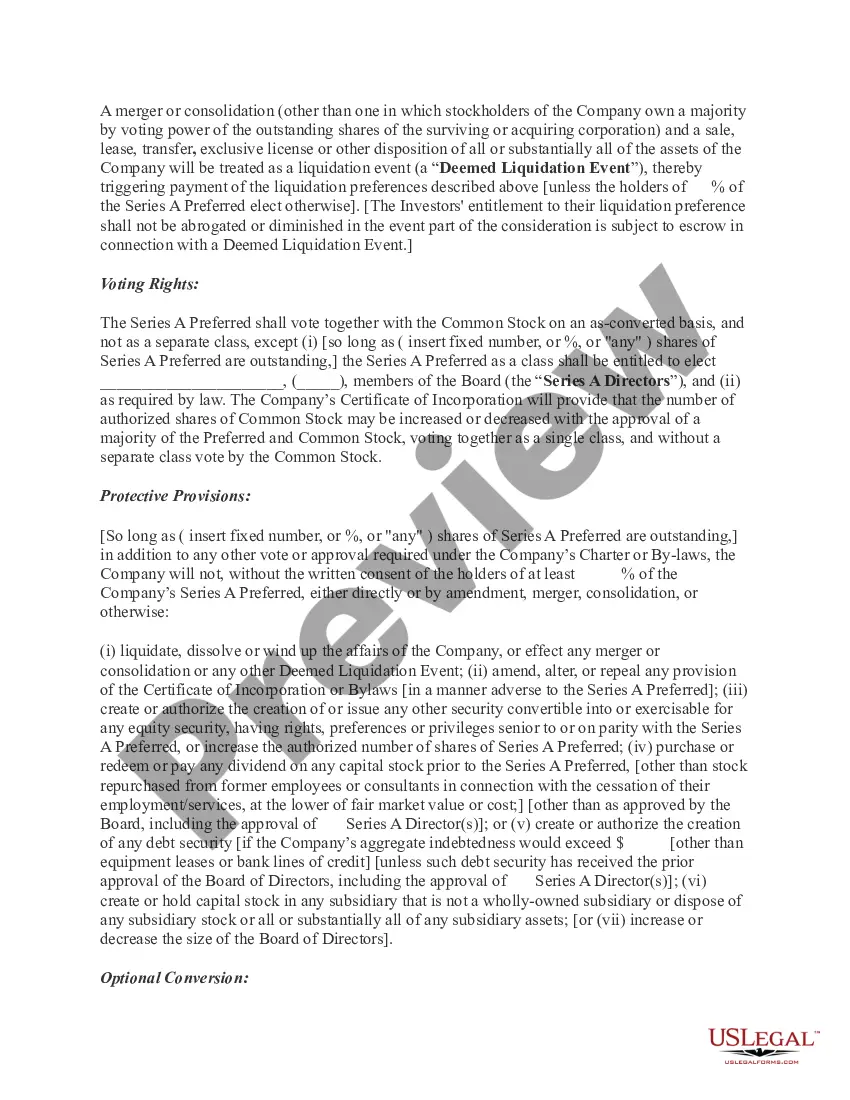

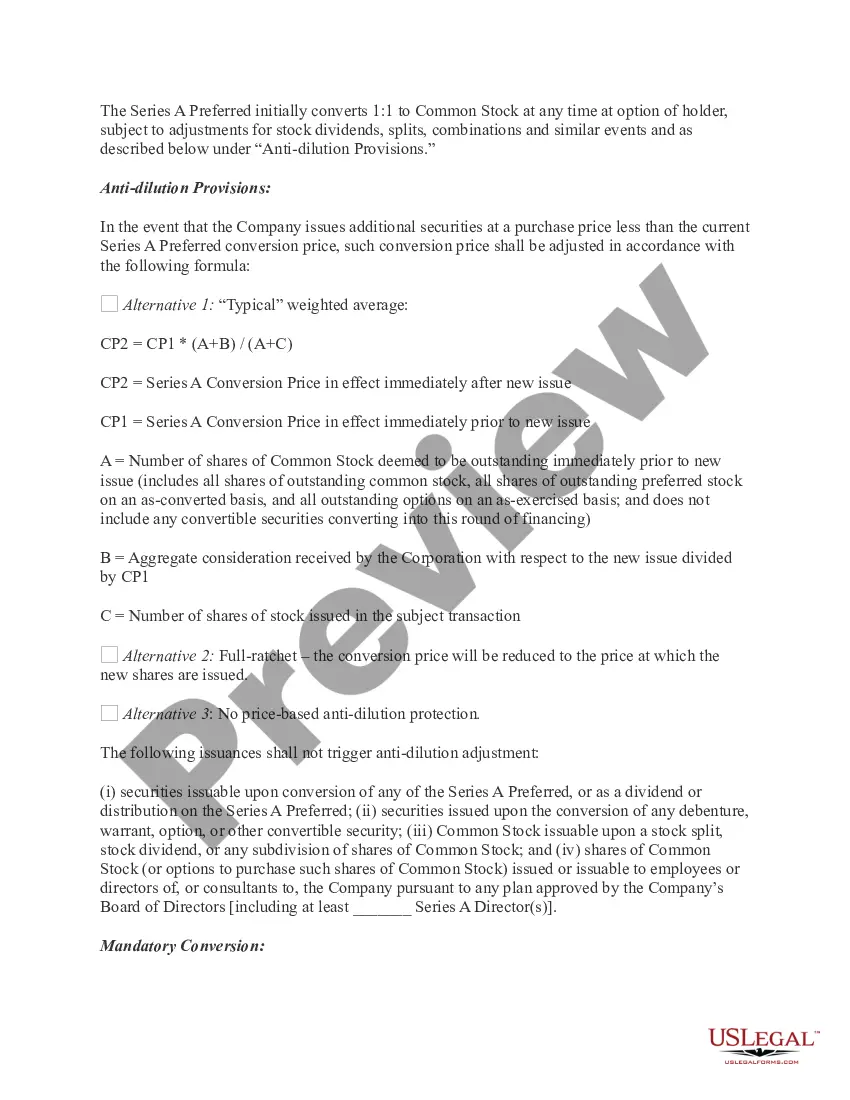

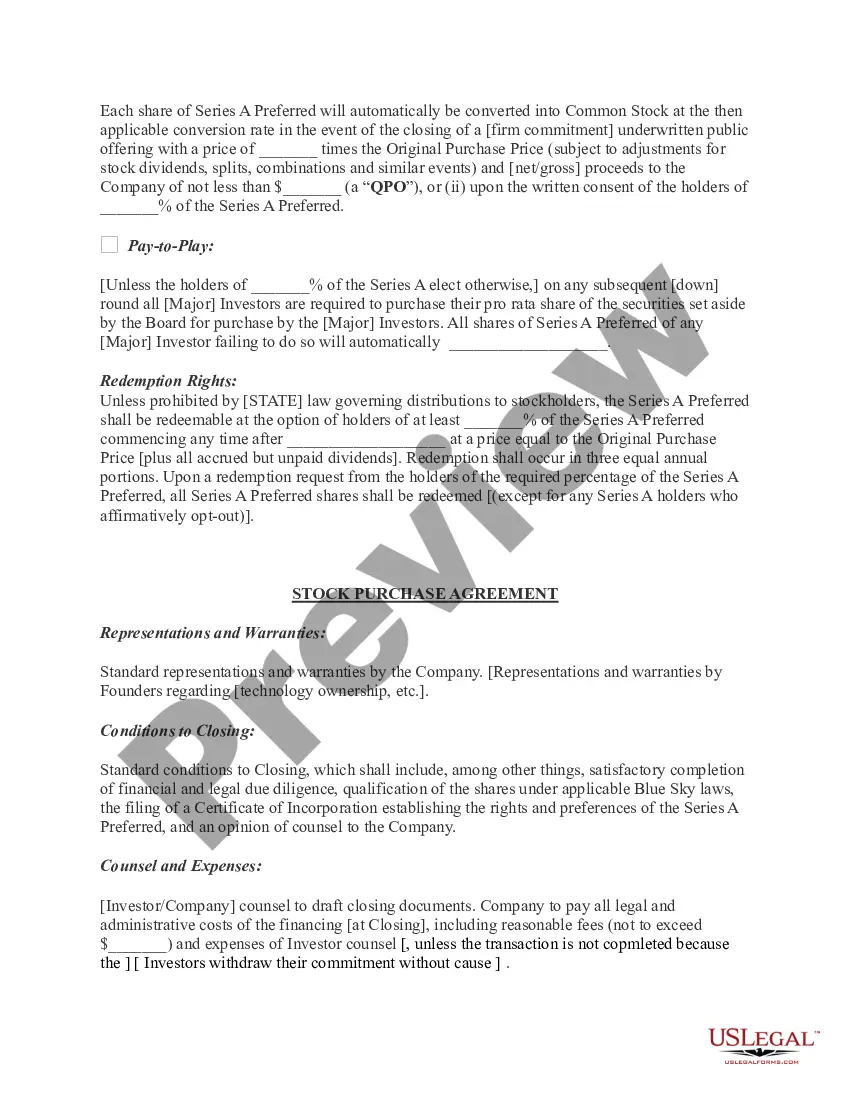

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with startups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

In a seed round, the investor will typically be the one providing the term sheet. This may change, especially when there are multiple investors in later and larger rounds. Common items in a term sheet include: Who is issuing the note or stock.

Last year, the average Series B round for a U.S. company clocked in at $45 millionup nearly 50 percent from 2020. And so far in 2022, round size has ticked up even higher.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

A Series A term sheet is a basic agreement that outlines all the terms and conditions of the investment. Term sheets usually focus on two key areas; control of company shares and how financials will be divided if an exit occurs.

Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. Series B investors usually pay a higher share price for investing in the company than Series A investors. Series B investors typically prefer convertible preferred stock vs.