Maricopa Arizona Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms and conditions for a specific type of investment in a company. This financing option is commonly used by startup or early-stage companies to secure capital for growth and expansion. The Series A Preferred Stock Financing is one of several types of financing options available to companies seeking investment. Other types may include Series B or C Preferred Stock Financing, debt financing, or equity financing. The Maricopa Arizona Term Sheet for Series A Preferred Stock Financing typically includes the following key elements: 1. Valuation: It specifies the pre-money valuation of the company, which determines the per-share price and the number of shares to be issued to the investors. 2. Investment Amount: The term sheet outlines the total investment amount to be provided by the investor(s) in exchange for the preferred stock. 3. Liquidation Preference: This clause determines the hierarchy of payout in case of a liquidation event (such as a sale or bankruptcy). Preferred stockholders typically have a higher priority for receiving their investment back before common stockholders. 4. Dividend Terms: The term sheet may mention the dividend payment terms for the preferred stock, which can be cumulative or non-cumulative. 5. Anti-Dilution Protection: It covers provisions to protect investors from dilution in the event of future equity financings at a lower valuation. 6. Board Representation: The term sheet may specify the right of the preferred stock investors to have representation on the company's board of directors. 7. Conversion Rights: It outlines the terms under which the preferred stock can be converted into common stock, typically triggered by a qualified initial public offering (IPO) or a sale of the company. 8. Voting Rights: The term sheet may define the voting rights of preferred stockholders on certain specified matters, such as changes to the company's bylaws or major asset transactions. 9. Founder Vesting: It may include provisions that require founders and key executives to vest their equity over time to align their incentives with the company's long-term success. Maricopa Arizona Term Sheet — Series A Preferred Stock Financing provides a framework for negotiations between the company and potential investors. It acts as a guide for drafting the final investment agreement, ensuring both parties are aligned on the key terms and conditions of the investment. Overall, this type of financing provides an avenue for companies to secure the necessary capital to fuel their growth while providing investors with potential financial upside through the ownership of preferred stock.

Maricopa Arizona Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Maricopa Arizona Term Sheet - Series A Preferred Stock Financing Of A Company?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Maricopa Term Sheet - Series A Preferred Stock Financing of a Company, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Term Sheet - Series A Preferred Stock Financing of a Company from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Term Sheet - Series A Preferred Stock Financing of a Company:

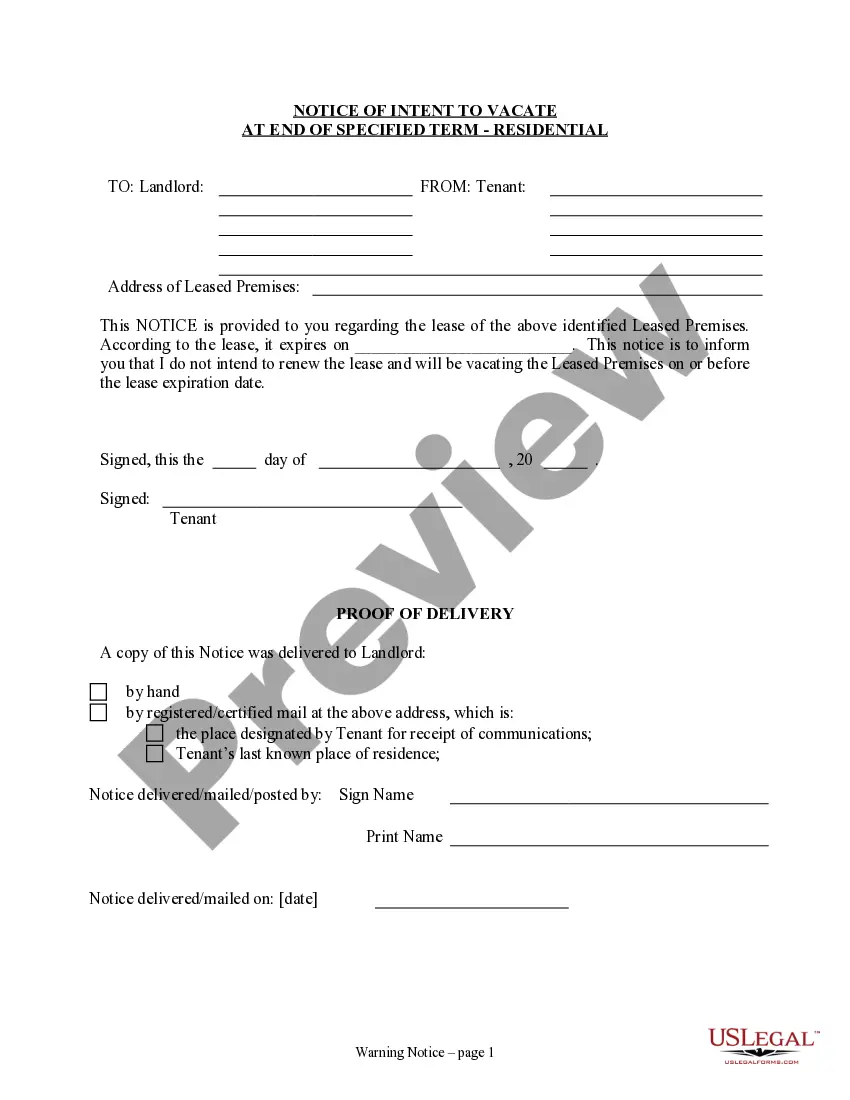

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!