Mecklenburg North Carolina Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms and conditions for investment in a company through the issuance of Series A Preferred Stock. This financing arrangement is a common method for early-stage or startup companies to raise capital from investors. The term sheet contains vital information regarding the investment, including: 1. Preferred Stock: The Series A Preferred Stock is a specific class of shares that carry certain rights and privileges not available to common stockholders. These may include a preferred liquidation preference, anti-dilution protection, voting rights, and rights to dividends. 2. Valuation: The term sheet highlights the pre-money valuation of the company, which determines how much the investor’s investment is worth in terms of ownership stake. This valuation is crucial as it directly affects the number of shares the investor will receive. 3. Investment Amount: The term sheet specifies the total investment amount committed by the investor, which can be a fixed number or a range. This amount is generally contingent upon reaching certain milestones or achieving specific performance targets. 4. Board Representation: In Series A Preferred Stock financing, investors often seek board representation to actively participate in the decision-making processes of the company. The term sheet will outline the number of board seats the investor will be entitled to, usually with proportional representation to their ownership stake. 5. Liquidation Preferences: This section outlines the order of priority for distributing proceeds in the event of a company's liquidation or sale. Preferred stockholders typically have a higher preference compared to common stockholders, guaranteeing them a certain level of return on their investment before others. 6. Anti-Dilution Protection: The term sheet may include provisions to protect the investor's ownership stake in case of future equity issuance sat a lower valuation. Anti-dilution clauses can be either full-ratchet or weighted-average, providing restrictions or adjustments to maintain the investor's percentage of ownership. 7. Dividends: Investors may be entitled to receive dividends on their Series A Preferred Stock, typically paid out before any dividends are distributed to common stockholders. The term sheet indicates the dividend rate and any conditions or limitations on dividend payments. 8. Rights and Restrictions: Additional rights and restrictions, such as veto rights, protective provisions, redemption rights, or drag-along rights, may be outlined in the term sheet. Some variations or alternative term sheets for Series A Preferred Stock Financing in Mecklenburg North Carolina might include: 1. Series Seed Preferred Stock Term Sheet: This term sheet is tailored for companies at an even earlier stage of development, typically prior to their Series A round. It may have simplified terms and a lower investment amount. 2. Mezzanine Preferred Stock Term Sheet: Mezzanine financing usually occurs between a company's Series A and Series B funding rounds when it requires additional capital to bridge the gap. The term sheet in this case may have specific provisions related to this unique financing stage. Each term sheet will vary depending on the specific needs and conditions of the company and investor involved. It is crucial for both parties to carefully review and negotiate the terms outlined in the Mecklenburg North Carolina Term Sheet — Series A Preferred Stock Financing to ensure a mutually beneficial agreement.

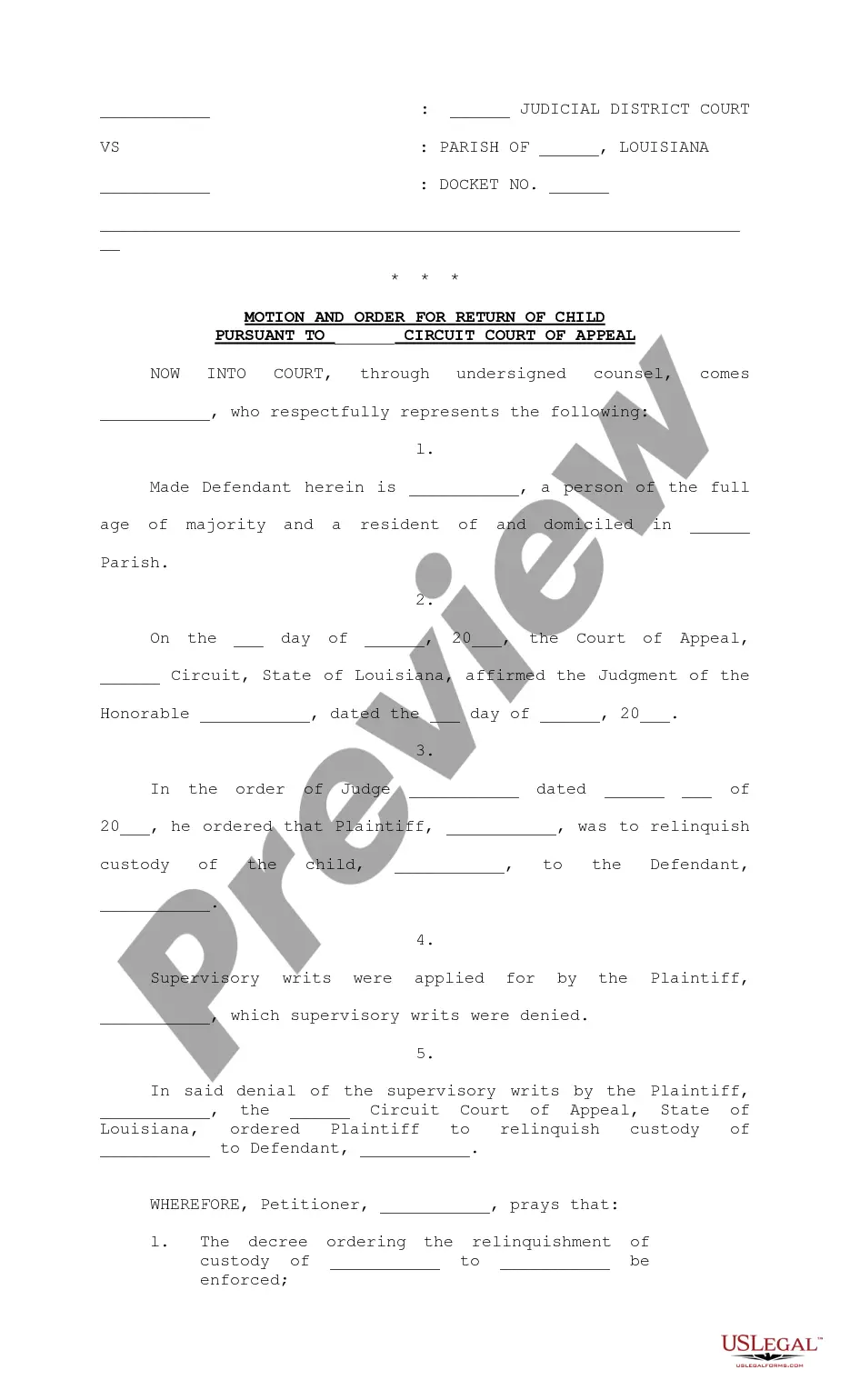

Mecklenburg North Carolina Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Mecklenburg North Carolina Term Sheet - Series A Preferred Stock Financing Of A Company?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Mecklenburg Term Sheet - Series A Preferred Stock Financing of a Company meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Mecklenburg Term Sheet - Series A Preferred Stock Financing of a Company, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Mecklenburg Term Sheet - Series A Preferred Stock Financing of a Company:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Mecklenburg Term Sheet - Series A Preferred Stock Financing of a Company.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!