The Broward Florida Term Sheet — Series A Preferred Stock Financing is a legally binding document that outlines the terms and conditions associated with a company's financing through the issuance of Series A Preferred Stock in Broward County, Florida. This financing vehicle is commonly used by startup companies to raise capital and attract investments from venture capitalists or angel investors. The term sheet serves as a preliminary agreement between the company and the investors, highlighting key terms, rights, and responsibilities for both parties involved. The Broward Florida Term Sheet — Series A Preferred Stock Financing typically includes various sections and clauses, addressing crucial aspects of the investment agreement. These may include: 1. Investment Amount: The term sheet states the amount of capital that the investors are willing to provide in exchange for the issuance of Series A Preferred Stock. This amount is usually agreed upon after evaluating the company's financial projections and potential. 2. Valuation: The valuation section determines the pre-money valuation of the company. This is crucial in establishing the ownership percentage that the investors will acquire through their investment. The valuation may be negotiated based on the company's current and potential value. 3. Liquidation Preference: This section outlines the order of priority in distributing proceeds in the event of a liquidation or sale of the company. Preferred stockholders, including Series A investors, typically have a higher claim on the company's assets compared to common shareholders. 4. Dividend Rights: The term sheet may include provisions regarding the payment of dividends to the preferred stockholders. Series A Preferred shareholders often have the right to receive dividends before common shareholders, if the company's financial performance allows for distributions. 5. Conversion Rights: This section details the circumstances under which the Series A Preferred Stock can be converted into common stock. Conversion may occur upon certain triggering events, such as an initial public offering or acquisition of the company. 6. Anti-Dilution Protection: The term sheet may include anti-dilution provisions that protect the investors' ownership percentage in case of subsequent equity offerings at a lower price. This provision ensures that the investors' stake is not significantly diluted by future financing rounds. 7. Board Representation: Investors participating in Series A Preferred Stock Financing often negotiate the right to appoint one or more representatives to the company's board of directors. This allows them to actively participate in the company's strategic decision-making process. It is important to note that while the aforementioned sections are commonly found in a Broward Florida Term Sheet — Series A Preferred Stock Financing, the specific terms and conditions can vary based on individual negotiations and the unique circumstances of the involved parties. Different types of preferred stock financing can also exist, such as Series B, Series C, and so on, each denoting subsequent rounds of financing with potentially different terms.

Broward Florida Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Broward Florida Term Sheet - Series A Preferred Stock Financing Of A Company?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, finding a Broward Term Sheet - Series A Preferred Stock Financing of a Company suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Broward Term Sheet - Series A Preferred Stock Financing of a Company, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Broward Term Sheet - Series A Preferred Stock Financing of a Company:

- Examine the content of the page you’re on.

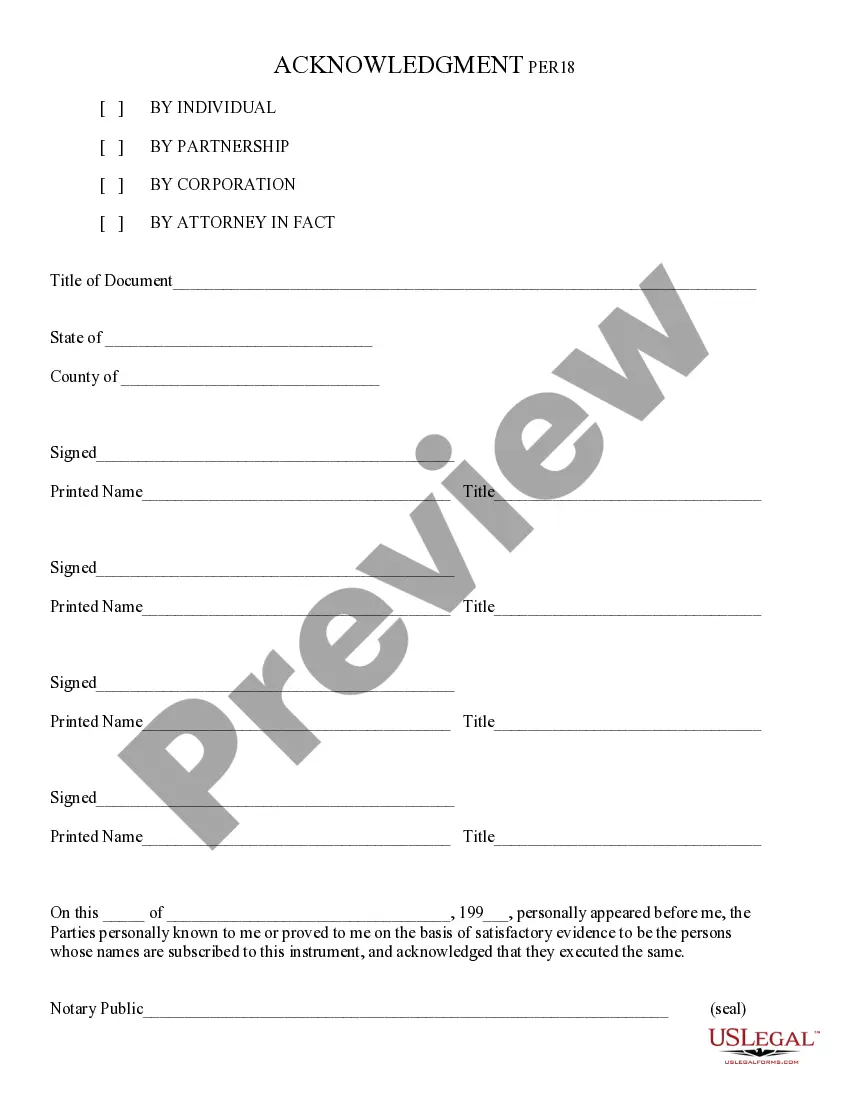

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Broward Term Sheet - Series A Preferred Stock Financing of a Company.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!