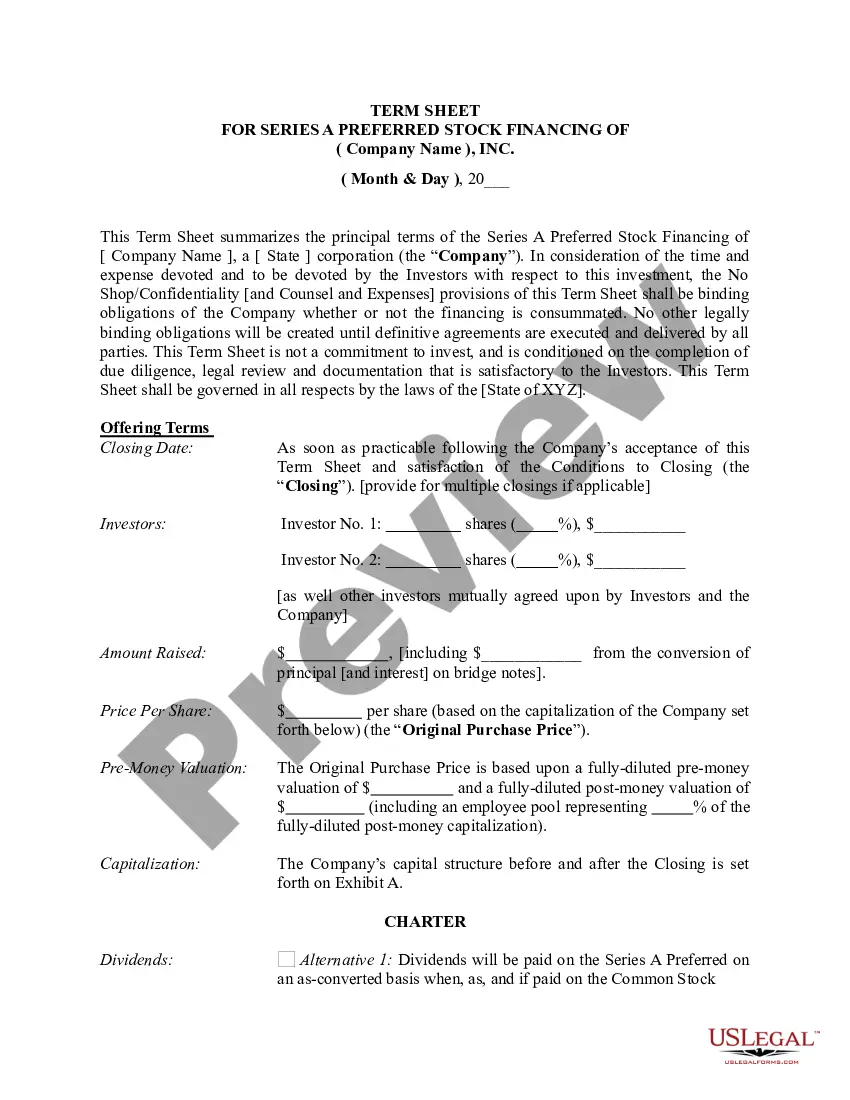

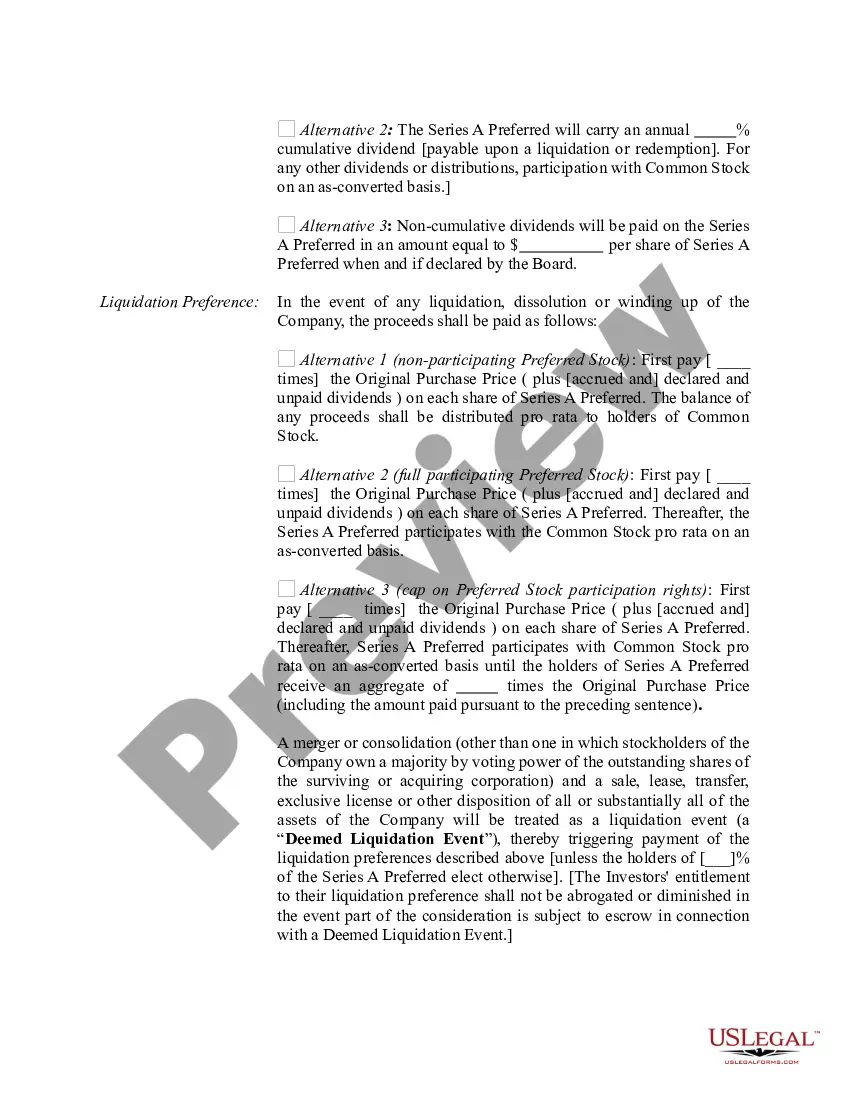

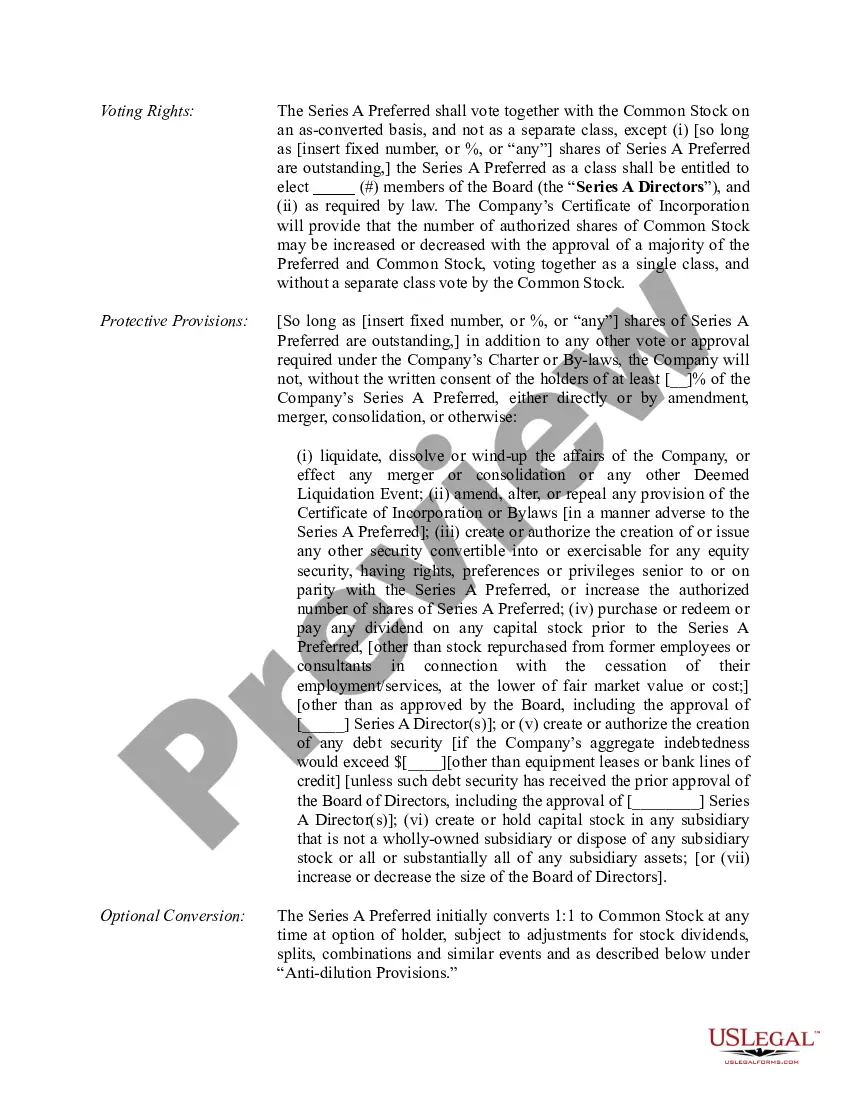

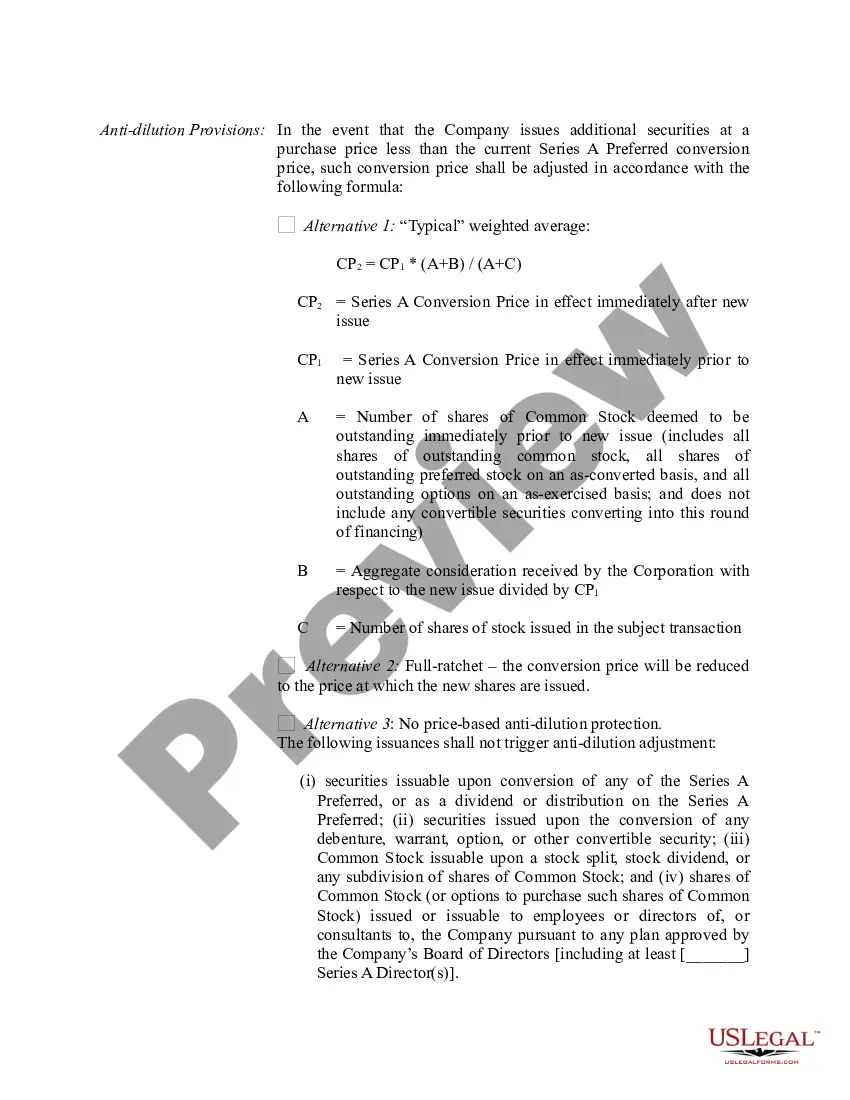

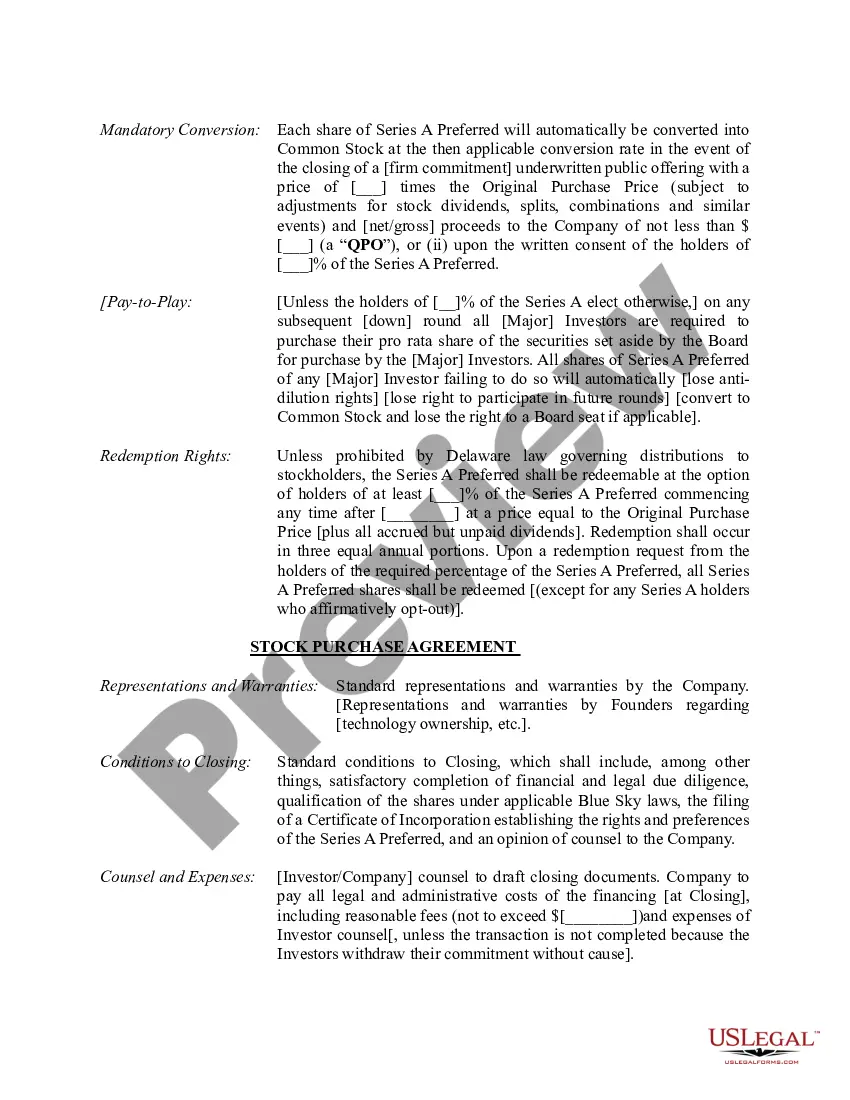

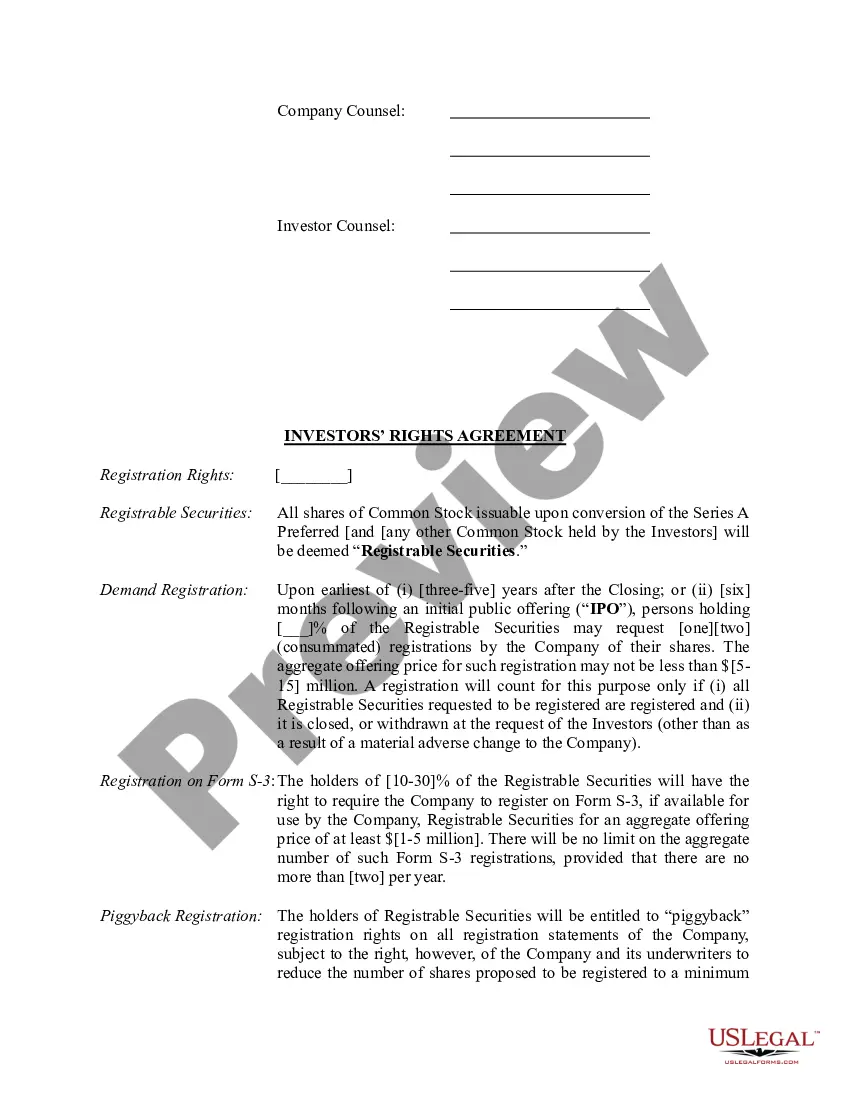

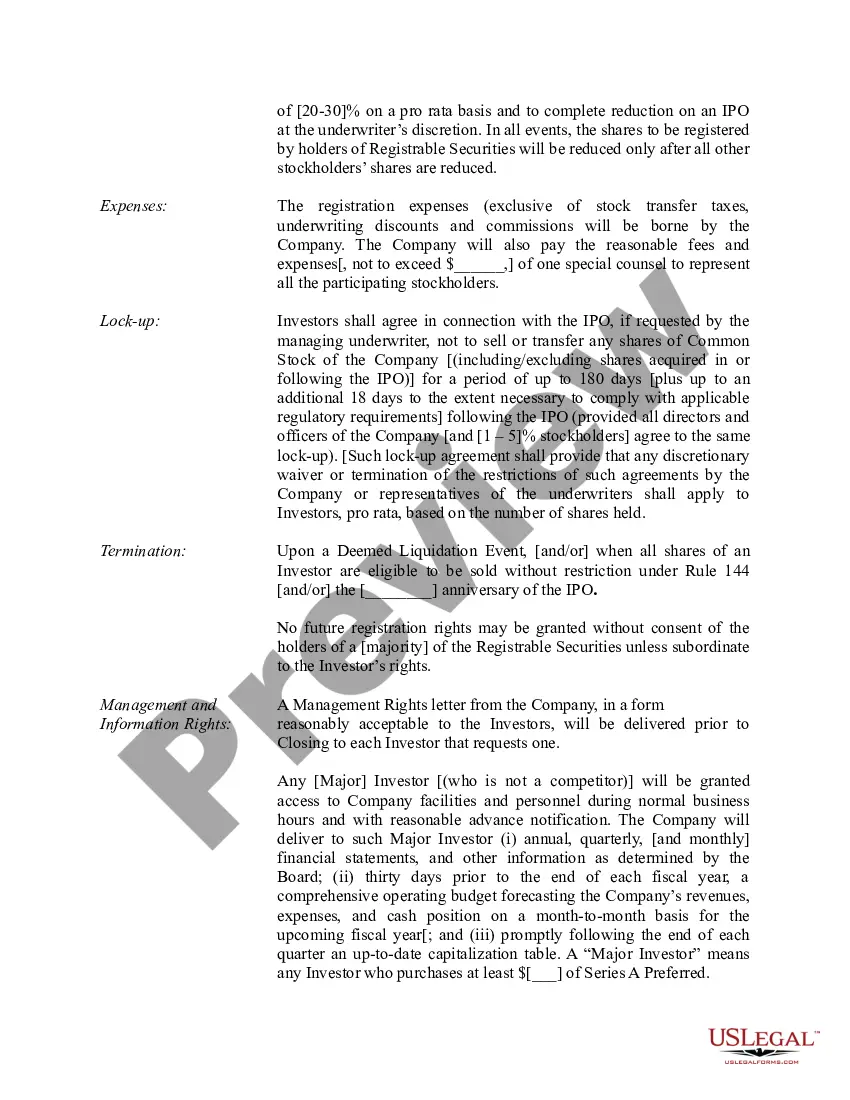

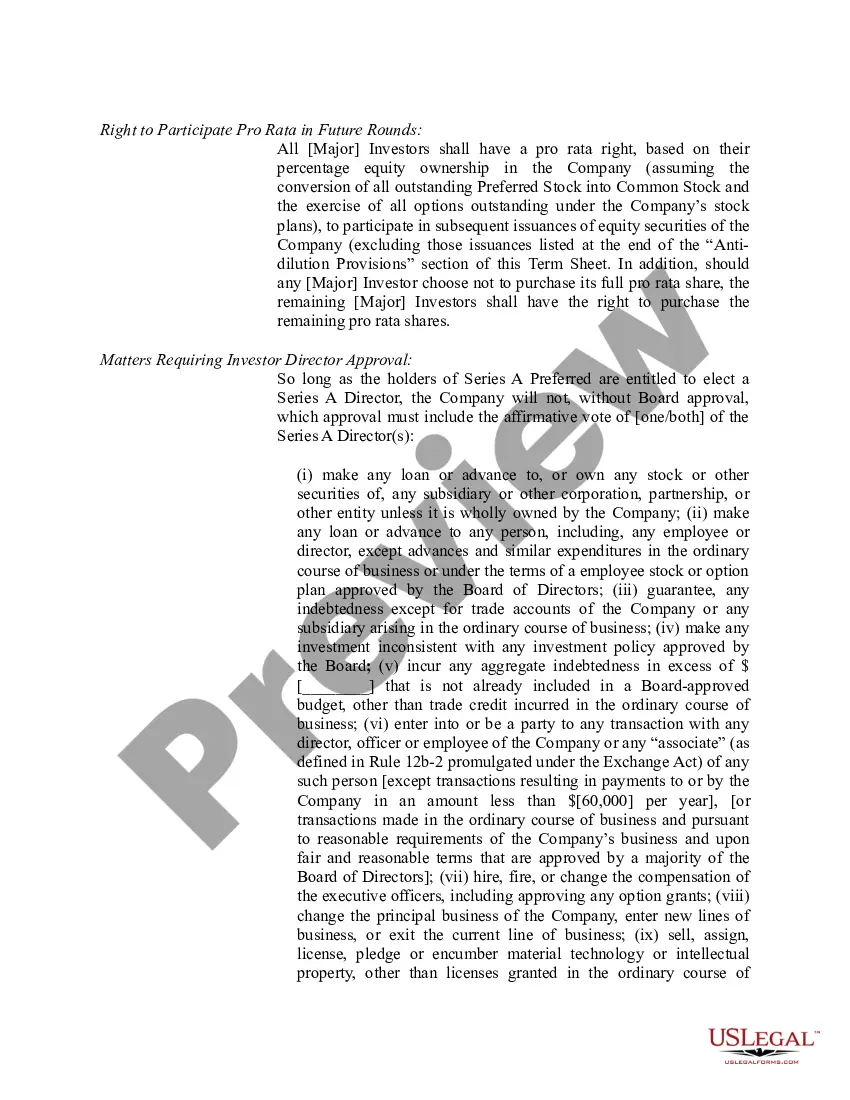

A Phoenix Arizona Term Sheet — Series A Preferred Stock Financing is a legal document that outlines the terms and conditions of an investment round in a company based in Phoenix, Arizona. This financing method is specifically focused on issuing preferred stock to raise capital for early-stage or growth-stage companies. The term sheet serves as a preliminary agreement between the company seeking funding and the prospective investors. It provides an overview of the investment structure, rights, and obligations of both parties involved. Here are some important keywords to highlight in a detailed description of Phoenix Arizona Term Sheet — Series A Preferred Stock Financing: 1. Preferred Stock: This refers to a class of ownership shares in a corporation that typically carries additional rights and privileges compared to common stock. Preferred stockholders enjoy priority in terms of dividends and liquidation preferences. 2. Series A: Series A refers to the specific round of financing secured by a startup or growth-stage company. Typically, Series A financing is obtained after seed funding and is focused on scaling operations, hiring key personnel, and expanding marketing efforts. 3. Financing: Financing refers to the process of raising capital or funds to support a company's operations, growth, or expansion plans. In the context of a Phoenix Arizona Term Sheet — Series A Preferred Stock Financing, it involves the issuance of preferred stock to attract investment. 4. Term Sheet: A term sheet is a non-binding document that outlines the key terms and conditions of an investment. It typically covers investment amount, valuation, liquidation preferences, board seats, anti-dilution provisions, and the rights and preferences of preferred stock. 5. Valuation: Valuation is the process of determining the worth or estimated value of a company. In the context of Series A Preferred Stock Financing, investors and the company establish the valuation of the company, which impacts the price per share of the preferred stock. 6. Liquidation Preferences: Liquidation preferences establish the order in which investors are repaid in the event of a company's liquidation or sale. Series A Preferred Stockholders usually have a higher priority over common stockholders, ensuring they are paid back their initial investment first. 7. Board Seats: Board seats refer to the number of positions on a company's board of directors that investors are entitled to occupy. In a Series A Preferred Stock Financing, investors often negotiate for board seats to have a say in the company's strategic decisions and protect their investment. Different types of Phoenix Arizona Term Sheet — Series A Preferred Stock Financing may include variations in terms or additional provisions, such as: — Option Pool: A provision that sets aside a certain percentage of equity for future employee stock options. — Anti-dilution Provisions: These provisions protect investors from dilution of their ownership stake in case the company issues additional shares in the future at a lower price. — Conversion Rights: This allows preferred stockholders to convert their shares into common stock under certain circumstances, such as an Initial Public Offering (IPO) or acquisition. — Drag-along Rights: Investors may assert drag-along rights to compel other shareholders to sell their shares in the event of a major transaction, ensuring a unified decision. — Protective Provisions: These provisions grant certain rights to preferred stockholders, such as veto power over key decisions or changes to the company's structure. In conclusion, a Phoenix Arizona Term Sheet — Series A Preferred Stock Financing is a legal agreement that outlines the terms and conditions of an investment round focused on issuing preferred stock to raise capital for a company based in Phoenix, Arizona. It lays out the rights and obligations of both the company and investors, covering aspects like valuation, liquidation preferences, and board representation. Different variations may include additional provisions like an option pool, anti-dilution provisions, conversion rights, drag-along rights, and protective provisions.

Phoenix Arizona Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Phoenix Arizona Term Sheet - Series A Preferred Stock Financing Of A Company?

Creating forms, like Phoenix Term Sheet - Series A Preferred Stock Financing of a Company, to manage your legal matters is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Phoenix Term Sheet - Series A Preferred Stock Financing of a Company template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Phoenix Term Sheet - Series A Preferred Stock Financing of a Company:

- Make sure that your form is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Phoenix Term Sheet - Series A Preferred Stock Financing of a Company isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our website and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!