Queens, New York is a borough located within New York City, known for its diverse and vibrant communities. In the world of finance, a Term Sheet — Series A Preferred Stock Financing of a Company refers to a legally binding document outlining the terms and conditions of an investment agreement between a company and its investors. There are various types of Queens New York Term Sheet — Series A Preferred Stock Financing of a Company, each with their own specific characteristics. These types may include: 1. Traditional Series A Preferred Stock Financing: This type of financing involves issuing preferred stock to investors, which grants them certain privileges over common stockholders. Investors typically receive preferential treatment in terms of dividends, liquidation preference, and voting rights. These provisions are designed to protect investors' interests and incentivize their participation. 2. Participating Preferred Stock Financing: In this type of financing, preferred stockholders not only enjoy the privileges mentioned above but also participate in the division of any remaining profits after the traditional preference is satisfied. This can potentially result in higher returns for investors if the company performs well. 3. Convertible Preferred Stock Financing: With this type of financing, investors have the option to convert their preferred stock into common stock at a predetermined conversion ratio. This provides investors with the opportunity to benefit from future growth and increased valuation of the company. 4. Cumulative Preferred Stock Financing: In this scenario, if any dividends are unpaid in one period, they accumulate and must be paid before dividends to common shareholders can be distributed. This feature ensures that preferred stockholders are not left with unpaid dividends and provides them with a degree of certainty in terms of income. 5. Redeemable Preferred Stock Financing: Redeemable preferred stock allows the company to repurchase the stock from investors at a predetermined price and date in the future. These gives company the flexibility to retire the stock once certain conditions are met or when they want to reduce their financial liabilities. A Queens New York Term Sheet — Series A Preferred Stock Financing of a Company outlines the specific details of the investment agreement, including the valuation of the company, the amount of funding to be raised, the rights and privileges of the preferred stockholders, and any other provisions or conditions agreed upon by both parties. It serves as a blueprint for the financing round and provides a clear understanding of the expectations and obligations of both the company and its investors.

Queens New York Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Queens New York Term Sheet - Series A Preferred Stock Financing Of A Company?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Queens Term Sheet - Series A Preferred Stock Financing of a Company suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Queens Term Sheet - Series A Preferred Stock Financing of a Company, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Queens Term Sheet - Series A Preferred Stock Financing of a Company:

- Check the content of the page you’re on.

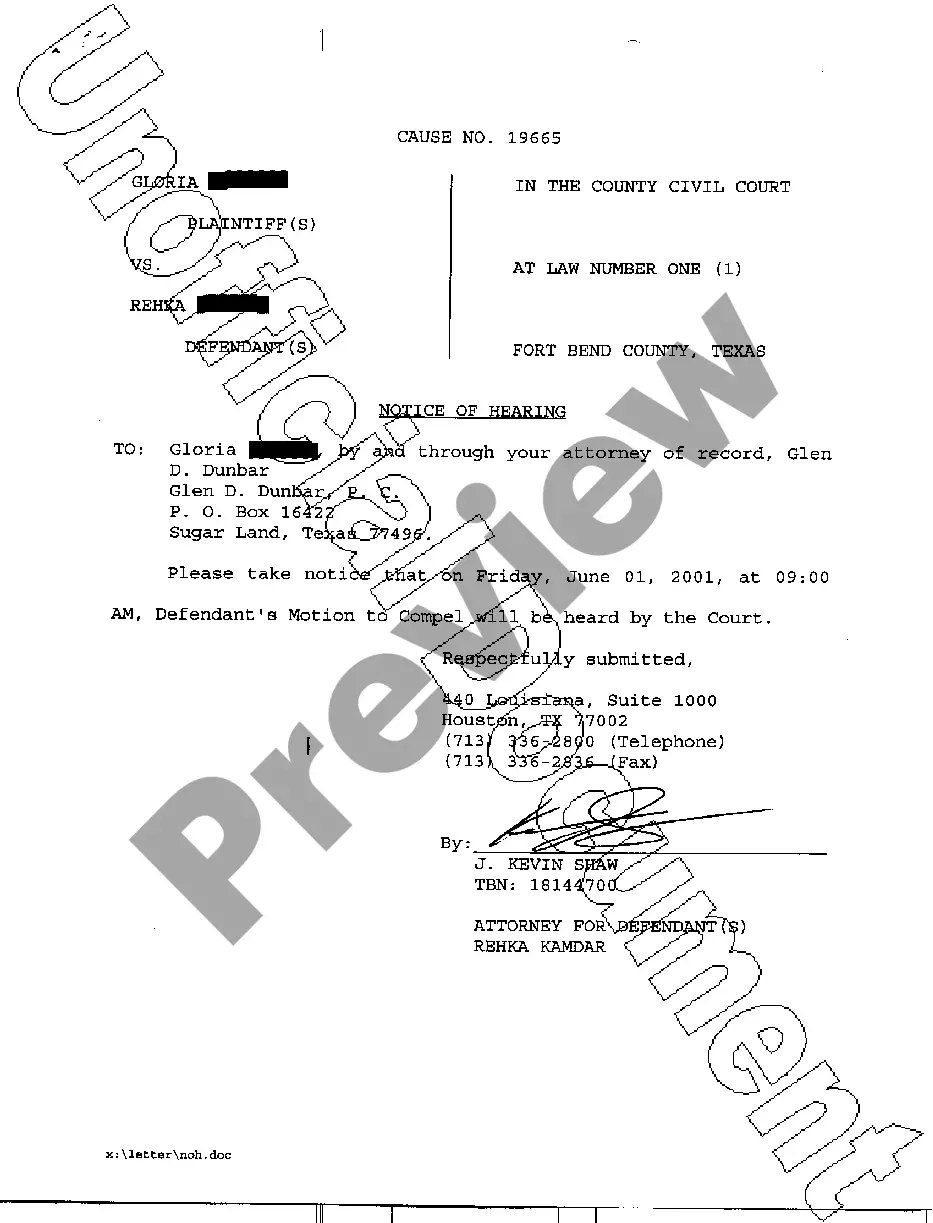

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Queens Term Sheet - Series A Preferred Stock Financing of a Company.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!