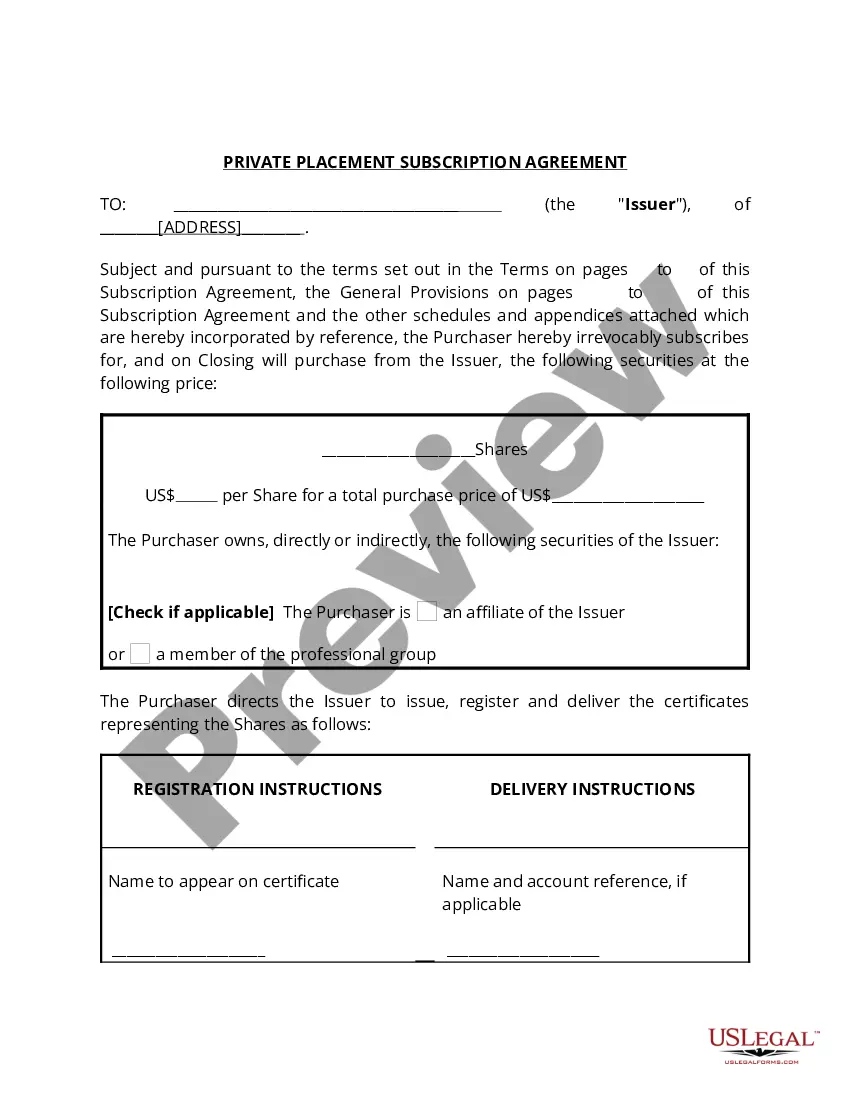

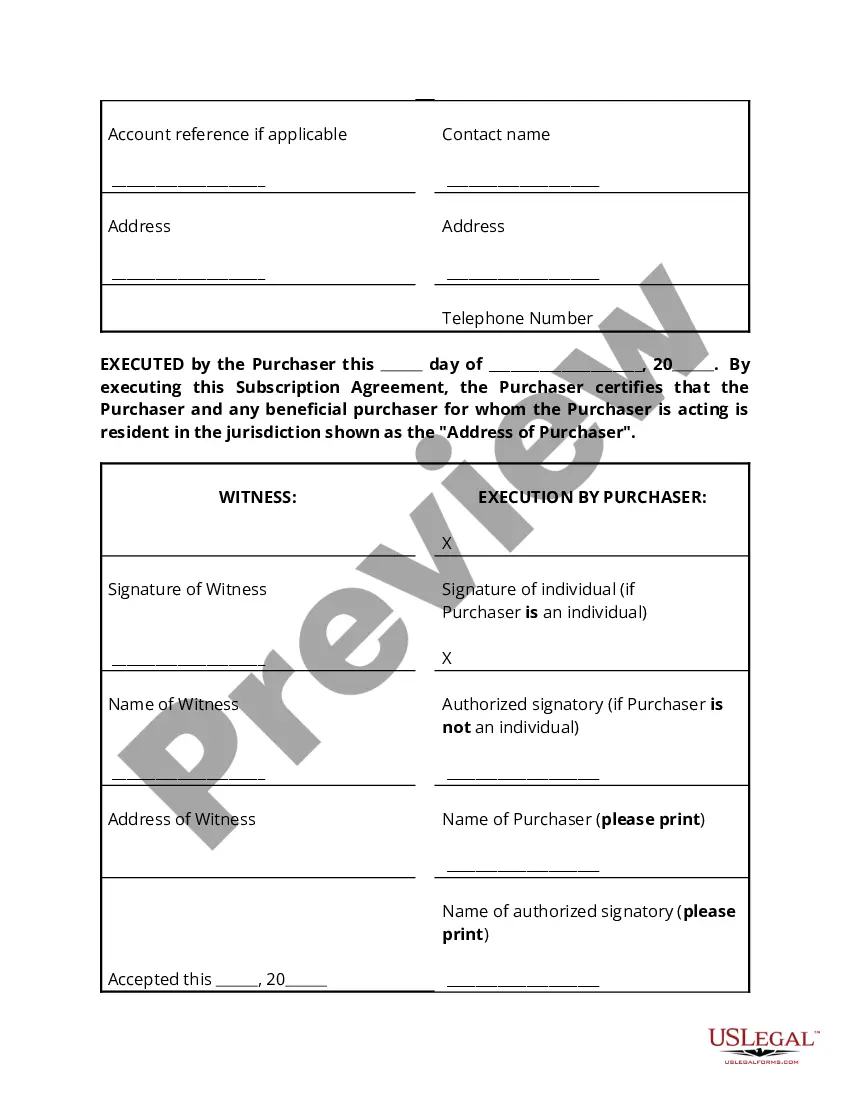

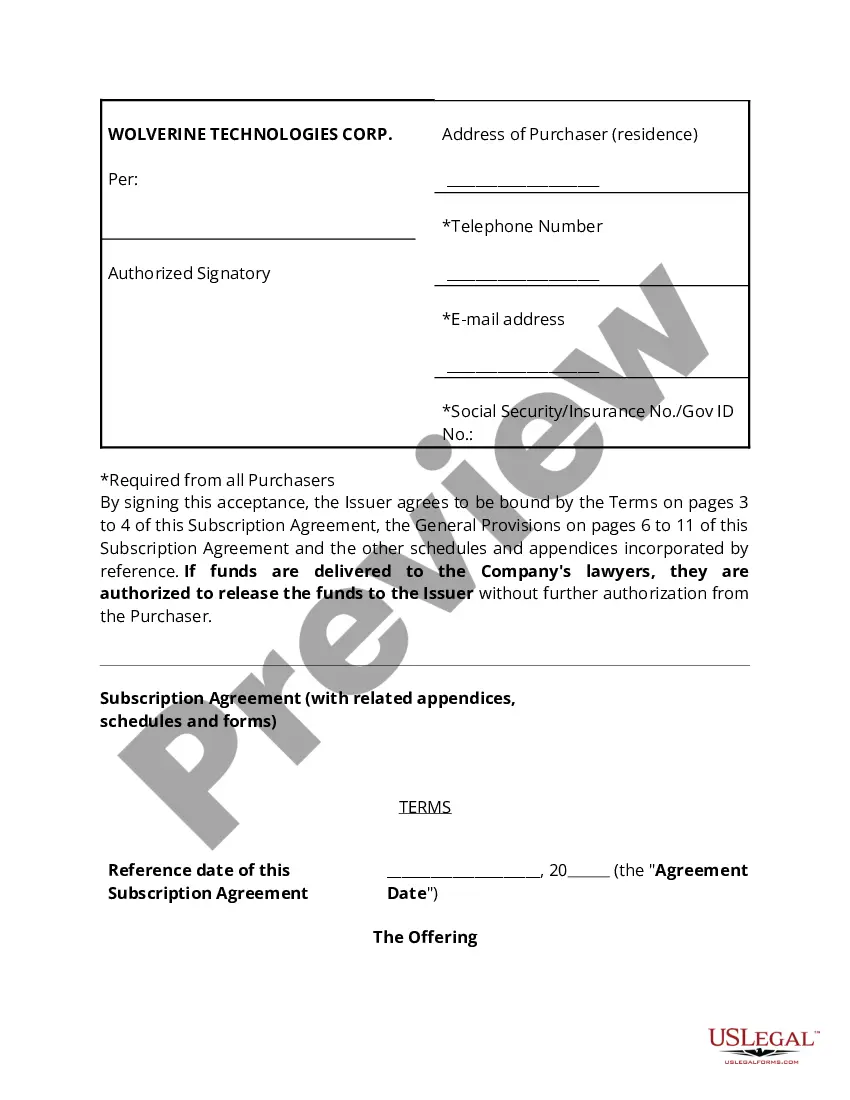

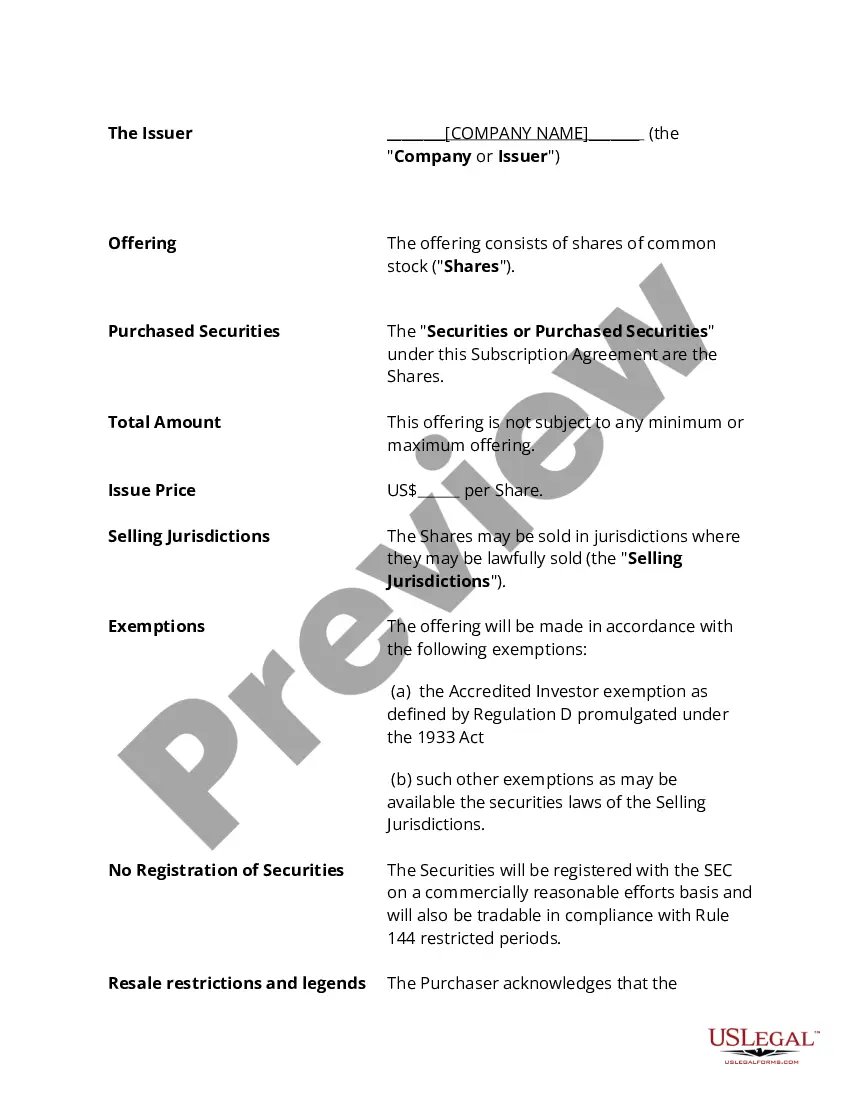

A Nassau New York Private Placement Subscription Agreement is a legal document that outlines the terms and conditions for an individual or entity to invest in a private placement offering, which is a sale of securities that are not registered with the Securities and Exchange Commission (SEC). This agreement is specifically designed for transactions related to investments within Nassau County, New York. The agreement serves as a contract between the issuer, typically a private company seeking funding, and the investor. It defines the rights, obligations, and responsibilities of each party involved. The primary purpose of this agreement is to protect the interests of both the issuer and the investor, establishing a clear understanding of the terms of the investment. Key provisions within a Nassau New York Private Placement Subscription Agreement may include: 1. Parties: Identifies the parties involved, including the issuer and the investor. 2. Subscription Details: Specifies the number of securities being offered, the price per security, and the total investment amount. 3. Representations and Warranties: Requires the investor to represent and warrant that they have legal capacity, financial capability, and relevant investment knowledge to participate in the private placement. 4. Risk Disclosures: Provides disclosures about the inherent risks associated with the investment, including the illiquid nature of the securities and the potential for loss of investment. 5. Transfer Restrictions: Outlines any limitations on the transferability of the securities, often including a lock-up period during which the investor cannot sell or transfer their investment. 6. Governing Law and Dispute Resolution: Specifies the jurisdiction whose laws will govern the agreement and outlines the process for resolving any disputes that may arise. 7. Confidentiality: Establishes confidentiality obligations, preventing the investor from disclosing sensitive information about the offering. Different types of Nassau New York Private Placement Subscription Agreements may vary based on the specific terms and conditions negotiated between the issuer and the investor. Some variations may include: — Equity Private Placement Subscription Agreement: Pertains to investments in shares or ownership interests of a private company. — Debt Private Placement Subscription Agreement: Relates to investments in debt instruments of a private entity, such as bonds or promissory notes. — Convertible Securities Private Placement Subscription Agreement: Deals with investments in securities that can be converted into a different class of securities or equity shares in the future. These variations depend on the nature of the private placement offering and the type of securities being offered by the issuer. It is crucial for both the issuer and the investor to carefully review and understand the specific terms of the subscription agreement before proceeding with the investment.

Nassau New York Private Placement Subscription Agreement

Description

How to fill out Nassau New York Private Placement Subscription Agreement?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Nassau Private Placement Subscription Agreement meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Nassau Private Placement Subscription Agreement, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Nassau Private Placement Subscription Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Nassau Private Placement Subscription Agreement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Just as the PPM provides disclosure to the client regarding the company's financial status,the Subscription Agreement provides full disclosure to the company regarding the investor's financial status.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Regulation D lets companies doing specific types of private placements raise capital without needing to register the securities with the SEC.

In practice, issuers often provide a document called a private placement memorandum or offering memorandum that introduces the investment and discloses information about the securities offering and the issuer.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.

Issuing in the private placement market offers companies a variety of advantages, including maintaining confidentiality, accessing long-term, fixed-rate capital, diversifying financing sources and creating additional financing capacity.

An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Private placement bonds are unregistered debt securities that are sold to accredited investors via investment banks. Typical use of proceeds is similar to those of public bonds: refinancing debt, expansion, acquisitions, dividends, and stock buyback and recapitalization programs.

The PPM is a self-contained disclosure document consisting of everything that an investor will need to fund your business. The PPM also operates as legal protection that allows you to raise capital from investors while closing the loop on legal exposure and regulatory issues.

Also known as an Offering Memorandum or PPM. A document that outlines the terms of securities to be offered in a private placement. Resembles a business plan in content and structure.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.