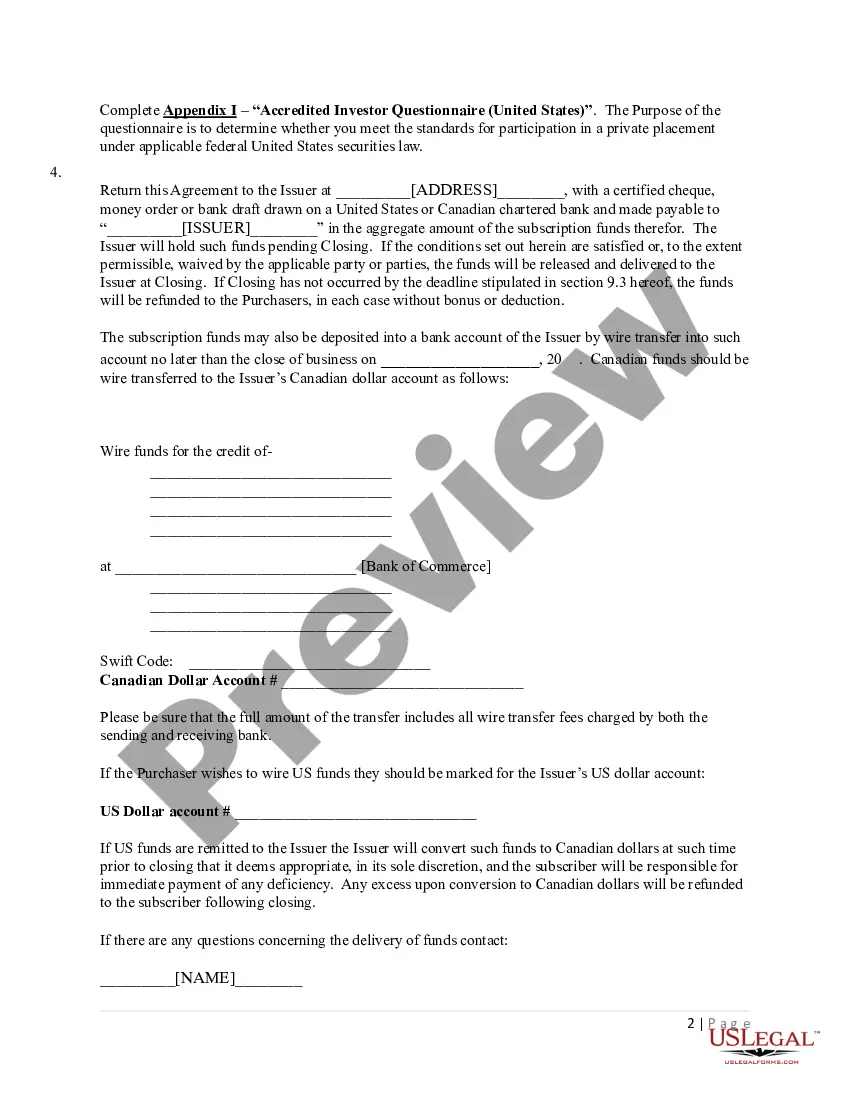

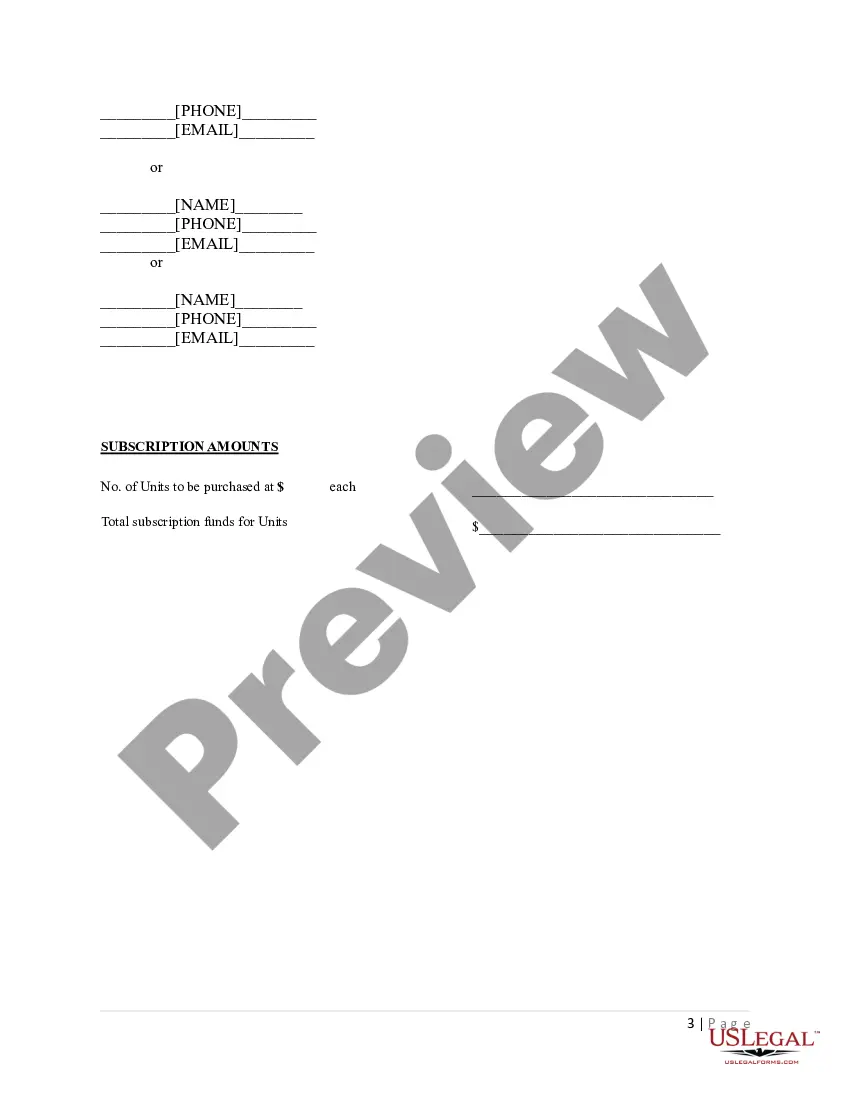

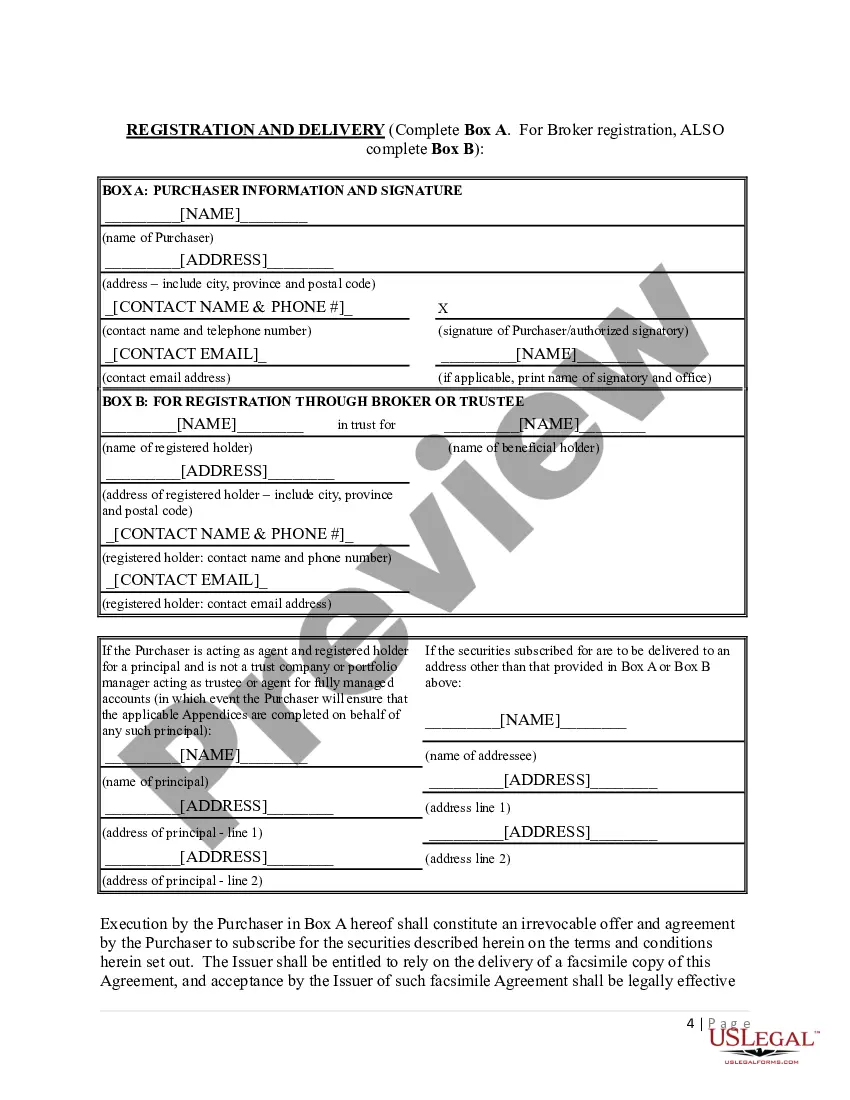

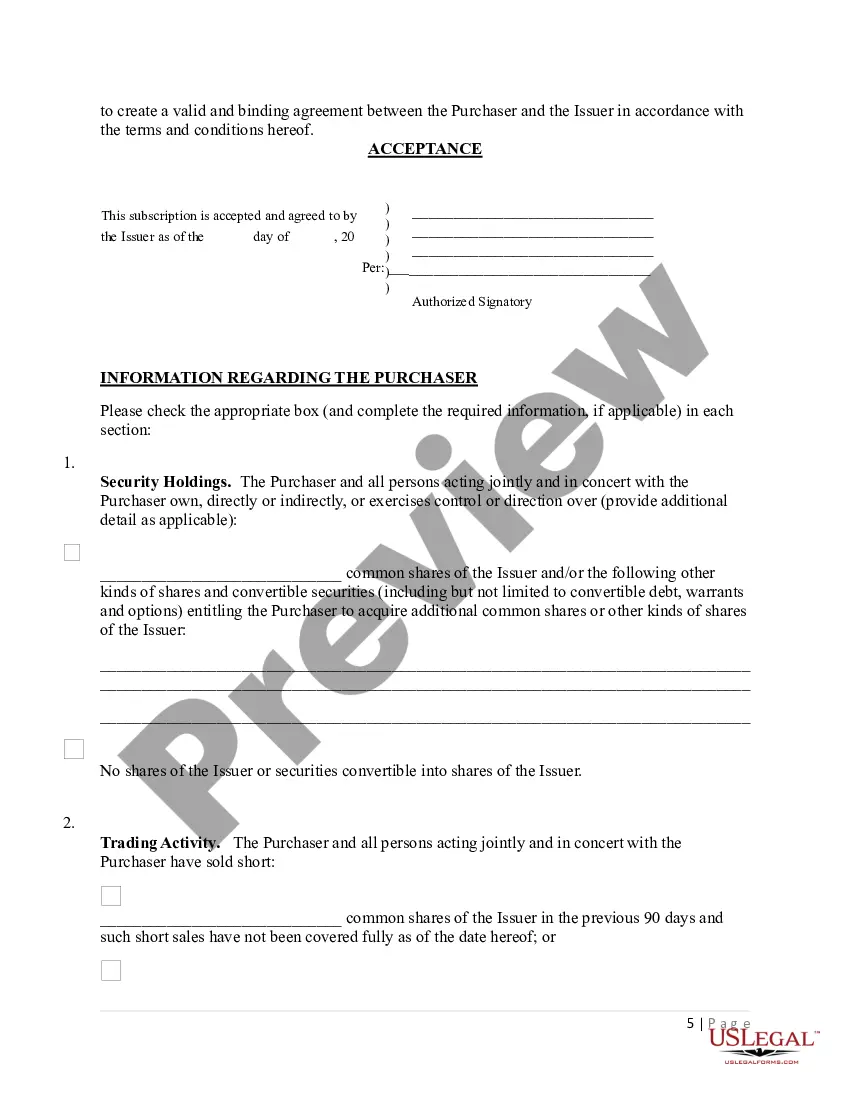

Title: Understanding the Chicago Illinois Subscription Agreement: A Comprehensive Review Introduction: Chicago, Illinois, serves as a vibrant hub for businesses seeking growth opportunities. To facilitate seamless operations, businesses often draft and execute subscription agreements with their stakeholders. In this article, we will delve into the intricacies of the Chicago Illinois Subscription Agreement, its key provisions, and various types that exist in the local business ecosystem. 1. What is a Chicago Illinois Subscription Agreement? A Chicago Illinois Subscription Agreement is a legally binding contract entered into between a company and its investors, shareholders, or members. It outlines the terms and conditions surrounding the purchase or acquisition of equity or debt securities, membership interests, or other forms of investment within the jurisdiction of Chicago, Illinois. 2. Key Components of a Chicago Illinois Subscription Agreement: a) Parties involved: Clearly identifies the company and the subscribing entity, including investor, shareholder, or member details. b) Subscription terms: Specifies the number of shares, units, or debt instruments to be subscribed, as well as the purchase price per share or unit. c) Representations and warranties: Outlines statements made by the subscribing entity regarding their eligibility, financial stability, and compliance with laws. d) Subscription process: Describes how the subscription process will be carried out, including the submission of subscription funds and other documentation. e) Conditions precedent: Enumerates the conditions that must be fulfilled before the subscription becomes valid. f) Governing law and jurisdiction: Specifies that the agreement shall be governed by and construed in accordance with the laws of Illinois. g) Dispute resolution: Clarifies the dispute resolution mechanism, such as arbitration or litigation, in case of disagreements between the parties. 3. Types of Chicago Illinois Subscription Agreements: a) Share Subscription Agreement: This type of agreement governs the purchase of shares in a company, entitling the shareholder to ownership and rights associated with those shares. b) Unit Subscription Agreement: Typically used in limited liability companies (LCS), this agreement allows members to invest in units, granting them ownership, voting rights, and a share in profits. c) Debt Subscription Agreement: Pertains to agreements where investors lend funds to the company in exchange for a fixed return, often applicable in the form of debentures, bonds, or other debt instruments. d) Convertible Subscription Agreement: In certain cases, investors may have the option to convert their investments into equity or other financial instruments at a predefined conversion ratio. Conclusion: A Chicago Illinois Subscription Agreement plays a pivotal role in facilitating investment activities within the city. Understanding the key provisions and different types of agreements empowers businesses and investors to engage in secure and transparent transactions. By carefully drafting and executing these agreements, Chicago-based businesses can establish stronger investor relations, boost growth, and achieve financial objectives with confidence.

Chicago Illinois Subscription Agreement

Description

How to fill out Chicago Illinois Subscription Agreement?

Drafting documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Chicago Subscription Agreement without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Chicago Subscription Agreement on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Chicago Subscription Agreement:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!