Bronx New York Accredited Investor Certification Letter is a document that serves as proof of an individual or entity's accreditation status in accordance with the U.S. Securities and Exchange Commission's (SEC) regulations. The certification letter is necessary for individuals or entities seeking to engage in certain types of investment activities, such as participating in private placements, hedge funds, venture capital funds, or other securities offerings that are limited to accredited investors. Keywords: Bronx New York, Accredited Investor Certification Letter, accreditation status, SEC regulations, investment activities, private placements, hedge funds, venture capital funds, securities offerings Various types of Bronx New York Accredited Investor Certification Letters may include: 1. Individual Accredited Investor Certification Letter: This type of certification letter is issued to individuals who meet the specific requirements set by the SEC to qualify as an accredited investor. Individual investors must have a minimum annual income of $200,000 (or $300,000 jointly with a spouse) for the past two years or have a net worth exceeding $1 million (excluding the value of their primary residence). 2. Entity Accredited Investor Certification Letter: This type of certification letter is issued to entities such as corporations, partnerships, limited liability companies (LCS), or trusts that meet the criteria to be considered accredited investors. Entities can qualify if they have total assets exceeding $5 million or if all of their equity owners or beneficiaries meet the individual accredited investor criteria. 3. Accredited Investor Certification Letter for Foreign Investors: This type of certification letter is specific to foreign investors who meet the qualifications of an accredited investor. Foreign investors must demonstrate that they meet the SEC's criteria for accreditation based on their income, net worth, or professional experience. 4. Accredited Investor Certification Letter for Financial Institutions: This type of certification letter is issued to certain financial institutions that meet the SEC's requirements to be considered accredited investors. The criteria for financial institutions often involve being regulated by the SEC, state securities regulators, or other appropriate government authorities. In summary, a Bronx New York Accredited Investor Certification Letter is a crucial document that confirms an individual or entity's accreditation status, allowing them to engage in various investment opportunities restricted to accredited investors. Different types of certification letters cater to individuals, entities, foreign investors, and financial institutions, based on their compliance with the SEC's accreditation criteria.

Bronx New York Accredited Investor Certification Letter

Description

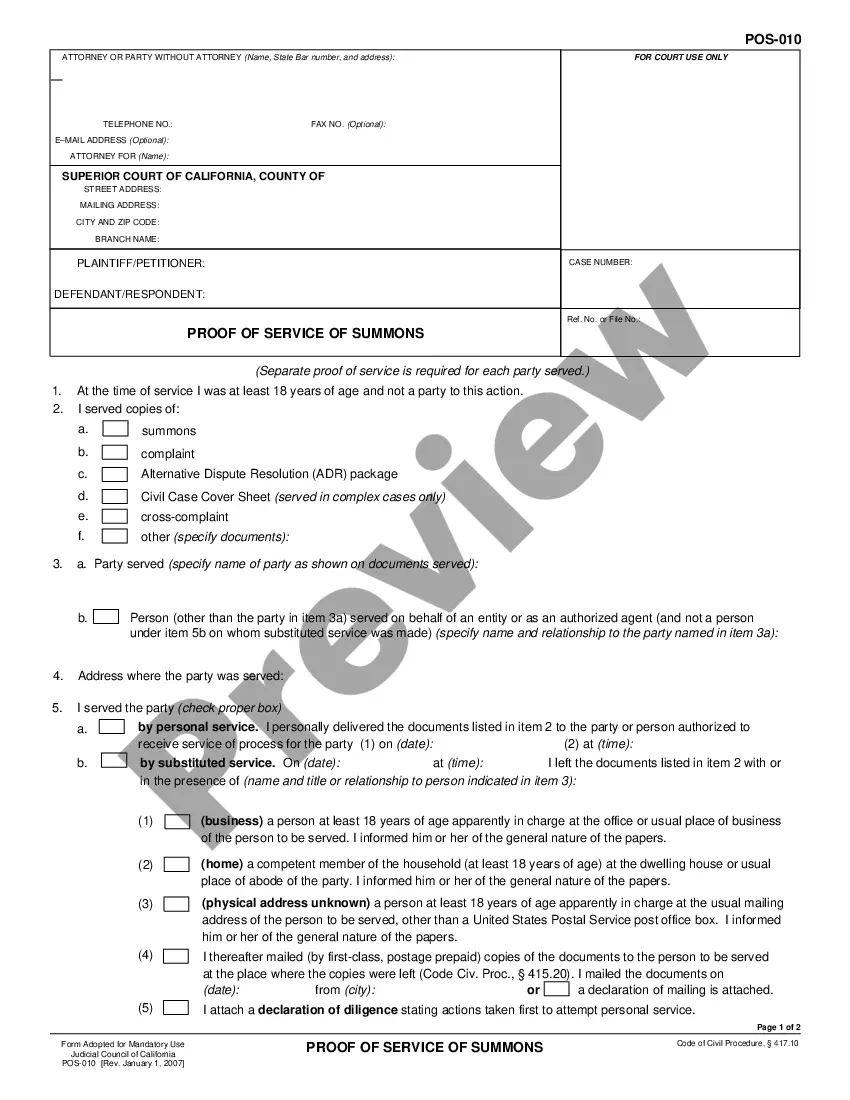

How to fill out Bronx New York Accredited Investor Certification Letter?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Bronx Accredited Investor Certification Letter suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Bronx Accredited Investor Certification Letter, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Bronx Accredited Investor Certification Letter:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Bronx Accredited Investor Certification Letter.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!