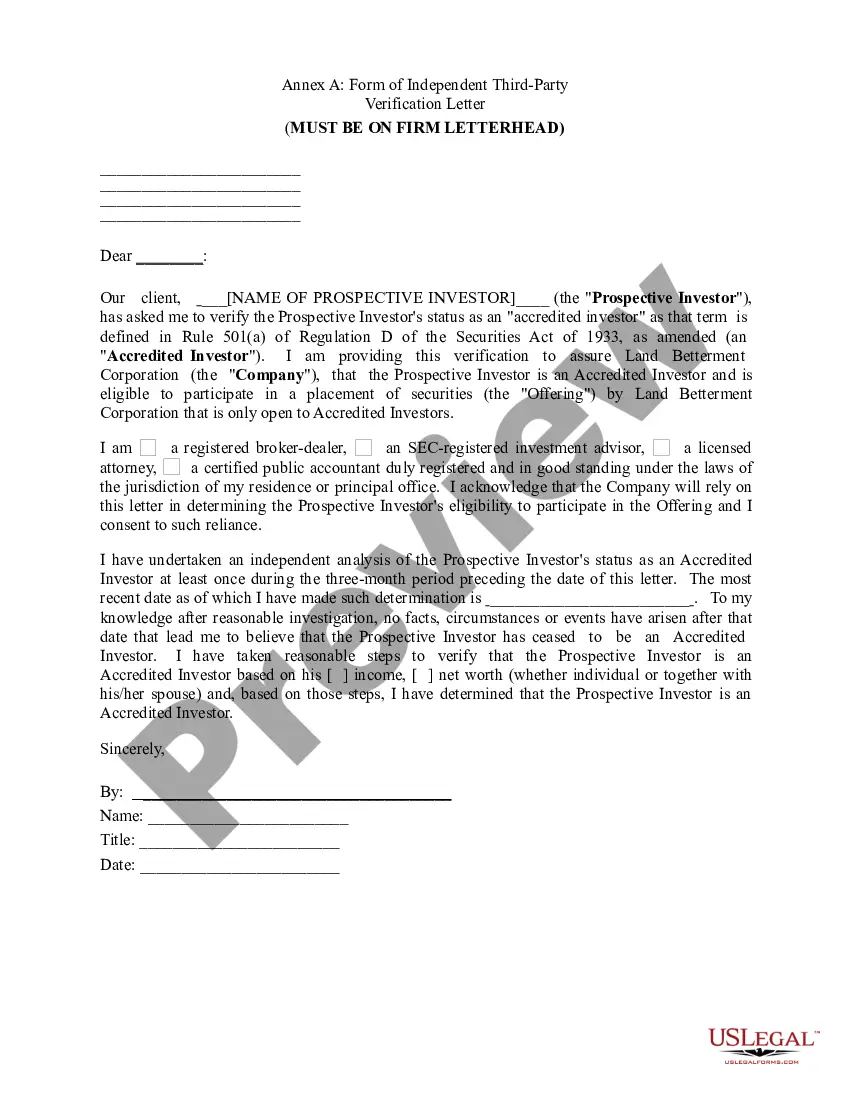

Collin Texas Accredited Investor Certification Letter is a document that verifies an individual or entity's status as an accredited investor in compliance with federal securities regulations. As an accredited investor, individuals and organizations are deemed to have met the financial criteria necessary to participate in certain investment opportunities that are generally limited to accredited investors. The accreditation process is crucial as it ensures that investors have the financial sophistication and ability to evaluate and bear the risks associated with specific investment types, such as private placements or venture capital investments. The Collin Texas Accredited Investor Certification Letter serves as proof of this accreditation and allows investors to access a broader range of investment options and opportunities. The certification letter typically includes essential information about the investor, such as their full name, contact details, and any relevant personal or business identification numbers. It also outlines the specific regulations and definitions that govern accredited investor status, including the criteria set forth by the U.S. Securities and Exchange Commission (SEC) under Rule 501 of Regulation D. It is important to note that there may be variations in the types of Collin Texas Accredited Investor Certification Letters based on the specific investment opportunities or regulations within the state. Different types of certification letters may exist for individuals, entities, or even specialized categories of investors, such as financial institutions or trusts. For example, some variations of Collin Texas Accredited Investor Certification Letters may include: 1. Individual Accredited Investor Certification Letter: This type of letter is issued to an individual who meets the specific financial thresholds laid out by the SEC. It serves as an acknowledgment of their accreditation status, allowing them to engage in investments restricted to accredited investors. 2. Entity Accredited Investor Certification Letter: This letter is issued to entities such as corporations, limited liability companies (LCS), partnerships, or trusts that qualify as accredited investors based on their financial standing. Entities must meet specific requirements, such as having assets exceeding a certain threshold or being wholly owned by accredited investors. 3. Specialized Investor Certification Letter: In some cases, specialized investor categories may require distinct accreditation certifications. This could include financial institutions, insurance companies, employee benefit plans, or trusts being managed by accredited investment professionals. Overall, the Collin Texas Accredited Investor Certification Letter plays a crucial role in facilitating the participation of qualified investors in private investment opportunities. It enables investors to explore a wider range of investments and access potentially lucrative ventures that may not be available to non-accredited investors, emphasizing the importance of proper documentation and compliance within the realm of securities regulations.

Collin Texas Accredited Investor Certification Letter

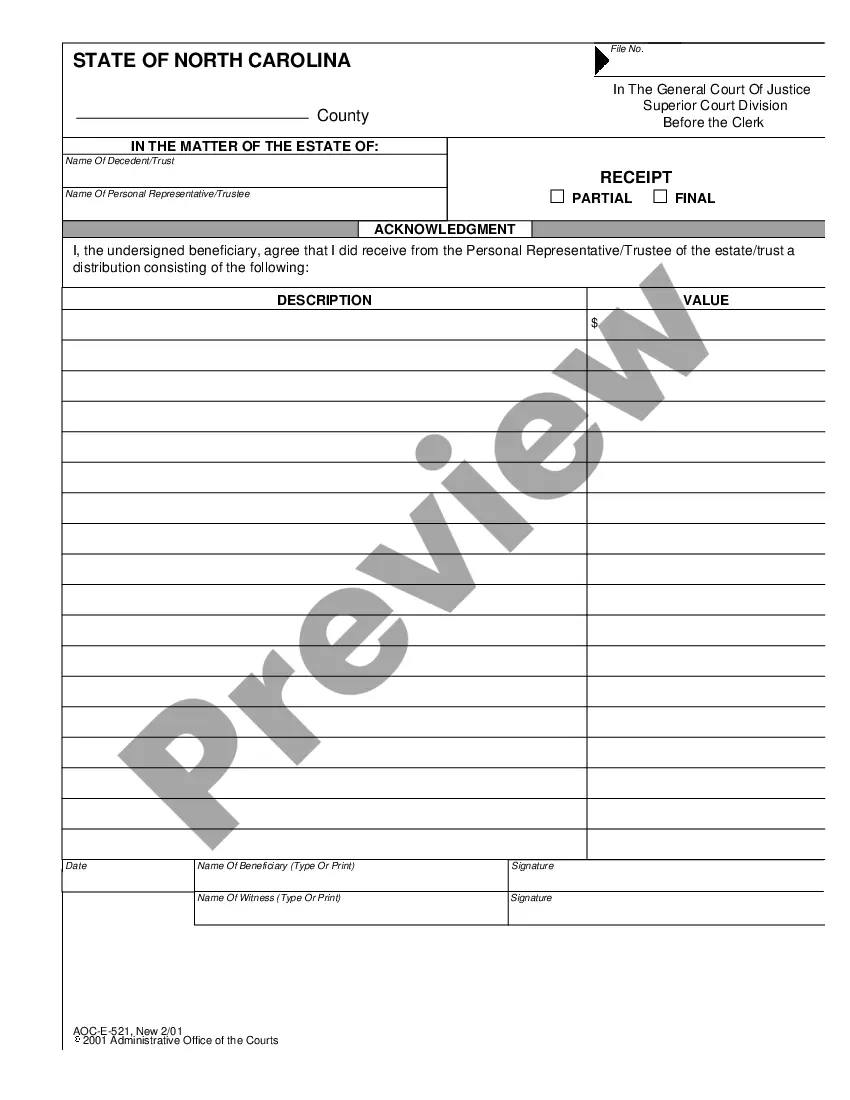

Description

How to fill out Collin Texas Accredited Investor Certification Letter?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Collin Accredited Investor Certification Letter is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Collin Accredited Investor Certification Letter. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Collin Accredited Investor Certification Letter in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!