San Jose, California Accredited Investor Certification Letter is an official document that verifies an individual or entity's status as an accredited investor in accordance with the rules set forth by the U.S. Securities and Exchange Commission (SEC). San Jose, California, being a hub for technological advancements and innovation, attracts numerous investors who want to participate in various investment opportunities and ventures. The Accredited Investor Certification Letter serves as proof of an investor's eligibility to partake in certain private investment opportunities that are typically restricted to accredited investors. Accredited investors are individuals or entities that meet specific wealth or income requirements, allowing them to invest in higher-risk investment options such as private equity, hedge funds, venture capital, and certain private placements. To obtain a San Jose, California Accredited Investor Certification Letter, individuals or entities must undergo a thorough review process to ensure they meet the SEC's accredited investor criteria. Generally, there are three main types of San Jose, California Accredited Investor Certification Letters: 1. Individual Accredited Investor Certification Letter: This letter is issued to individuals who fulfill specific income or net worth thresholds. According to the SEC's definition (Rule 501 of Regulation D), an individual accredited investor must have an annual income exceeding $200,000 ($300,000 jointly with a spouse) in each of the past two years, with a reasonable expectation of the same income level in the current year, or possess a net worth surpassing $1 million (excluding the value of the primary residence). 2. Entity Accredited Investor Certification Letter: This letter is provided to certain entities, such as corporations, limited liability companies, partnerships, and trusts, that meet specific criteria set by the SEC. Eligible entities must have total assets exceeding $5 million or be composed of equity owners, all of whom are accredited investors individually. 3. Institutional Accredited Investor Certification Letter: This letter applies to specific institutions, including banks, registered investment companies, insurance companies, and governmental organizations. These institutions are granted accredited investor status regardless of their total asset value or income level. The San Jose, California Accredited Investor Certification Letter is a crucial document for investors looking to engage in private investment opportunities. It demonstrates an investor's eligibility and compliance with SEC regulations, allowing them access to a wider range of investment options. It is important to note that the requirements and specifications for obtaining this letter may vary slightly between different jurisdictions, but they generally align with the SEC's guidelines.

San Jose California Accredited Investor Certification Letter

Description

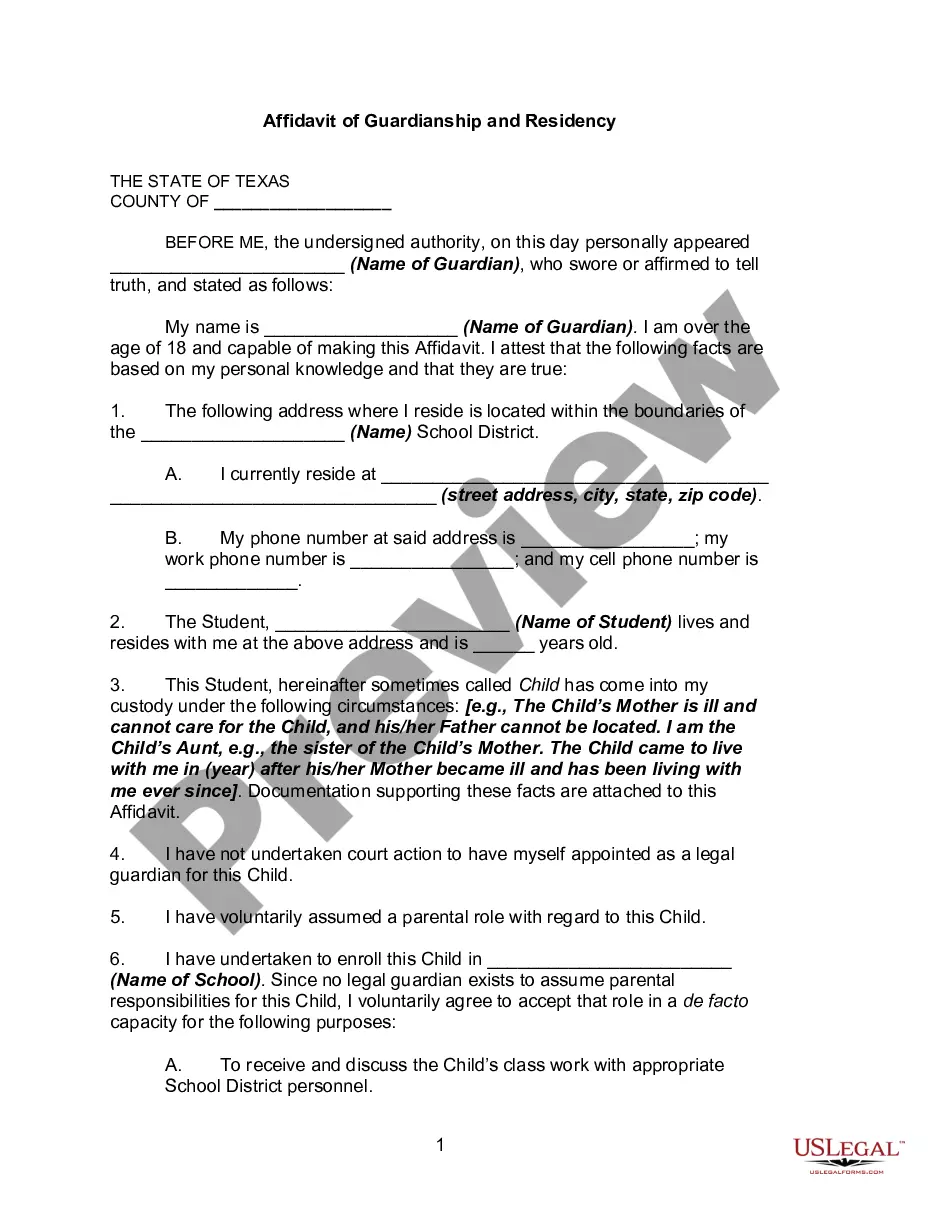

How to fill out San Jose California Accredited Investor Certification Letter?

Creating documents, like San Jose Accredited Investor Certification Letter, to manage your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for a variety of cases and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the San Jose Accredited Investor Certification Letter form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading San Jose Accredited Investor Certification Letter:

- Ensure that your template is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the San Jose Accredited Investor Certification Letter isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our service and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!