The Fulton Georgia Certificate of Accredited Investor Status is a document that verifies an individual's eligibility to invest in certain private securities offerings under the federal securities laws. This certification is specific to individuals residing in Fulton, Georgia, and is issued by the appropriate regulatory authority in the region. To obtain a Fulton Georgia Certificate of Accredited Investor Status, individuals must meet certain criteria and provide supporting documentation to prove their accredited investor status. This certification is essential for participating in private placements, venture capital funds, hedge funds, and other investment opportunities that are only available to accredited investors. Accredited investors are individuals or institutions that meet specific financial thresholds and professional knowledge requirements, allowing them to invest in higher-risk securities. These thresholds are established by the U.S. Securities and Exchange Commission (SEC) under Regulation D, Rule 501, of the Securities Act of 1933. By possessing a Fulton Georgia Certificate of Accredited Investor Status, individuals gain access to investment opportunities that are generally not available to the public. These opportunities often include early-stage startups, real estate syndication, private equity funds, and other high-potential investment vehicles. Some key factors that determine accredited investor status and may be applicable to various types of Fulton Georgia Certificate of Accredited Investor Status include: 1. Income Requirement: Individuals must have an annual income exceeding a specific threshold, such as $200,000 for individuals or $300,000 for married couples. This threshold may vary depending on the certificate type. 2. Net Worth Requirement: An individual can qualify if their net worth exceeds a specified threshold, such as $1 million (excluding their primary residence). For certain types of accredited investors, this threshold may differ. 3. Professional Credentials: Individuals holding specific professional licenses, such as lawyers, doctors, or accountants, may automatically qualify as accredited investors. The certificate may mention such credentials if applicable. 4. Entity Accreditation: Certain entities, such as corporations, partnerships, and trusts, can qualify as accredited investors based on their total assets, executive officers, or general partners. It is important to note that there may be different types of Fulton Georgia Certificate of Accredited Investor Status based on the various criteria mentioned above. These types could be categorized as income-based certificates, net worth-based certificates, professional credentials-based certificates, or entity-based certificates. Obtaining a Fulton Georgia Certificate of Accredited Investor Status offers individuals the opportunity to access private markets and potentially generate higher returns on their investments. However, it is crucial to consult with a financial advisor or attorney to ensure compliance with applicable regulations and make informed investment decisions.

Fulton Georgia Certificate of Accredited Investor Status

Description

How to fill out Fulton Georgia Certificate Of Accredited Investor Status?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Fulton Certificate of Accredited Investor Status, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fulton Certificate of Accredited Investor Status from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Fulton Certificate of Accredited Investor Status:

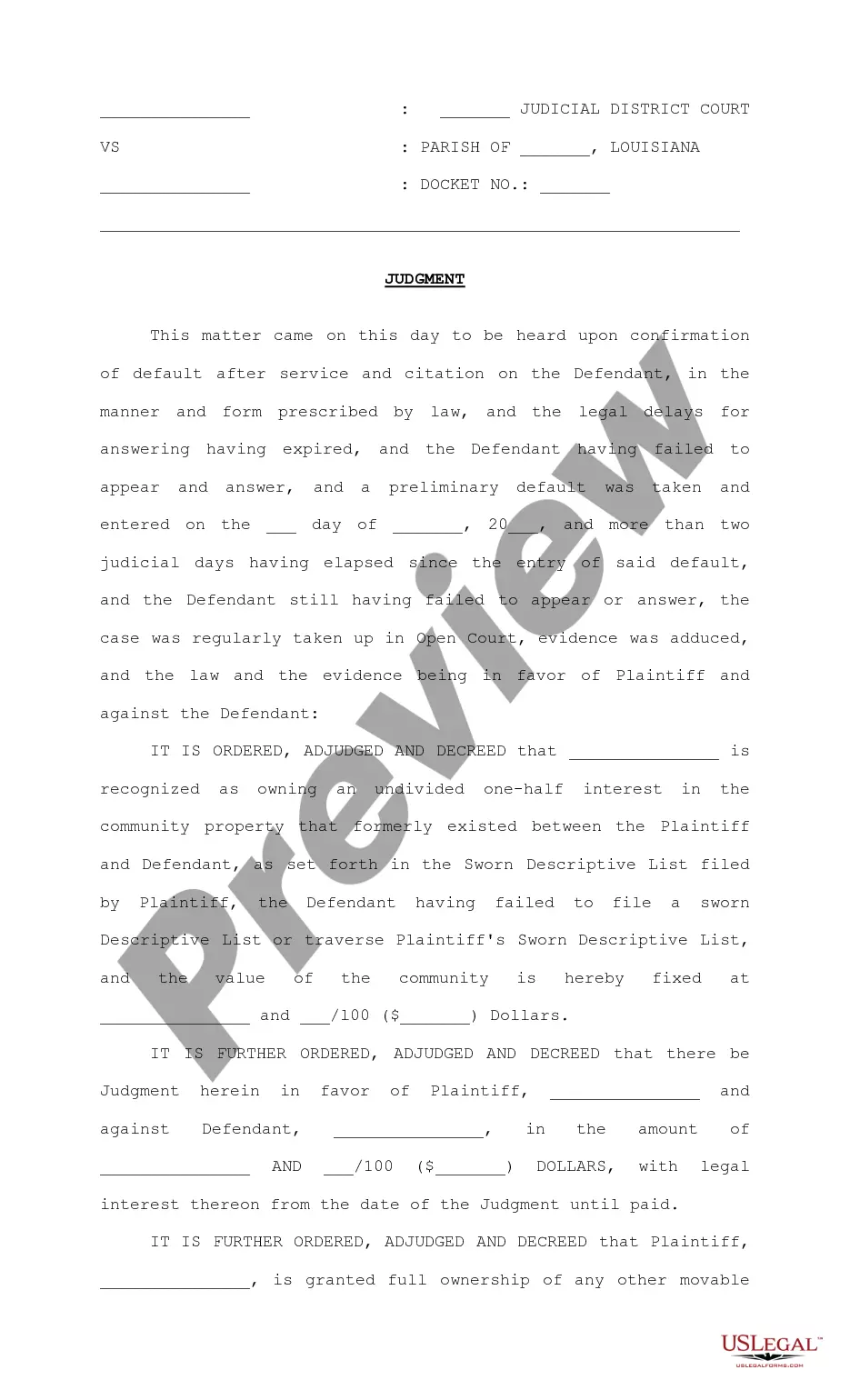

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!