The Harris Texas Certificate of Accredited Investor Status is a document that signifies an individual's qualification as an accredited investor based in Harris County, Texas. An accredited investor is a high-net-worth individual or entity with a specific financial status, allowing them to invest in certain securities and investment opportunities that are typically not available to non-accredited investors. Keywords: Harris Texas, Certificate of Accredited Investor Status, accredited investor, high-net-worth individual, financial status, securities, investment opportunities, non-accredited investors. There are various types of Harris Texas Certificates of Accredited Investor Status available, including: 1. Individual Accredited Investor Status: This type of certificate is issued to an individual who meets the strict financial criteria set forth by the Securities and Exchange Commission (SEC) and relevant regulatory bodies. To qualify, the individual must demonstrate a high net worth, typically exceeding $1 million in liquid assets or an annual income of at least $200,000 (or $300,000 jointly with a spouse) for the past two years, with a reasonable expectation of maintaining the same income level. 2. Institutional Accredited Investor Status: This certificate is provided to institutional entities, such as banks, insurance companies, registered investment advisors, and certain types of trusts and funds. To qualify, these institutions must meet specific criteria defined by regulatory authorities, showcasing their financial strength and expertise in managing investments. 3. Family Office Accredited Investor Status: This type of certificate is designated for family offices, which are private wealth management firms serving affluent families and high-net-worth individuals. Family offices typically offer comprehensive financial services, including investment management, estate planning, tax advising, and philanthropic support. To obtain this certificate, a family office must demonstrate its institutional-like status and meet the accredited investor requirements. 4. Angel Investor Accredited Investor Status: This certificate is meant for individuals or entities actively engaged in investing in early-stage startup companies, often referred to as angel investors. These individuals or entities provide vital funding to startups in exchange for equity or debt instruments. To qualify, angel investors need to meet the financial criteria established by regulatory bodies, ensuring their ability to assume the risks associated with early-stage investments. Obtaining a Harris Texas Certificate of Accredited Investor Status involves a thorough evaluation of an individual's or entity's financial records and compliance with applicable rules and regulations. These certificates play a crucial role in allowing accredited investors in Harris County, Texas, to access exclusive investment opportunities, alternative asset classes, and participate in private placements and securities offerings not available to non-accredited individuals. In summary, the Harris Texas Certificate of Accredited Investor Status is a document that certifies an individual or entity as an accredited investor based in Harris County, Texas. It signifies their eligibility to pursue investment opportunities reserved for high-net-worth individuals and institutions, allowing them to diversify their investment portfolios and potentially access higher returns.

Harris Texas Certificate of Accredited Investor Status

Description

How to fill out Harris Texas Certificate Of Accredited Investor Status?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Harris Certificate of Accredited Investor Status without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Certificate of Accredited Investor Status on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Harris Certificate of Accredited Investor Status:

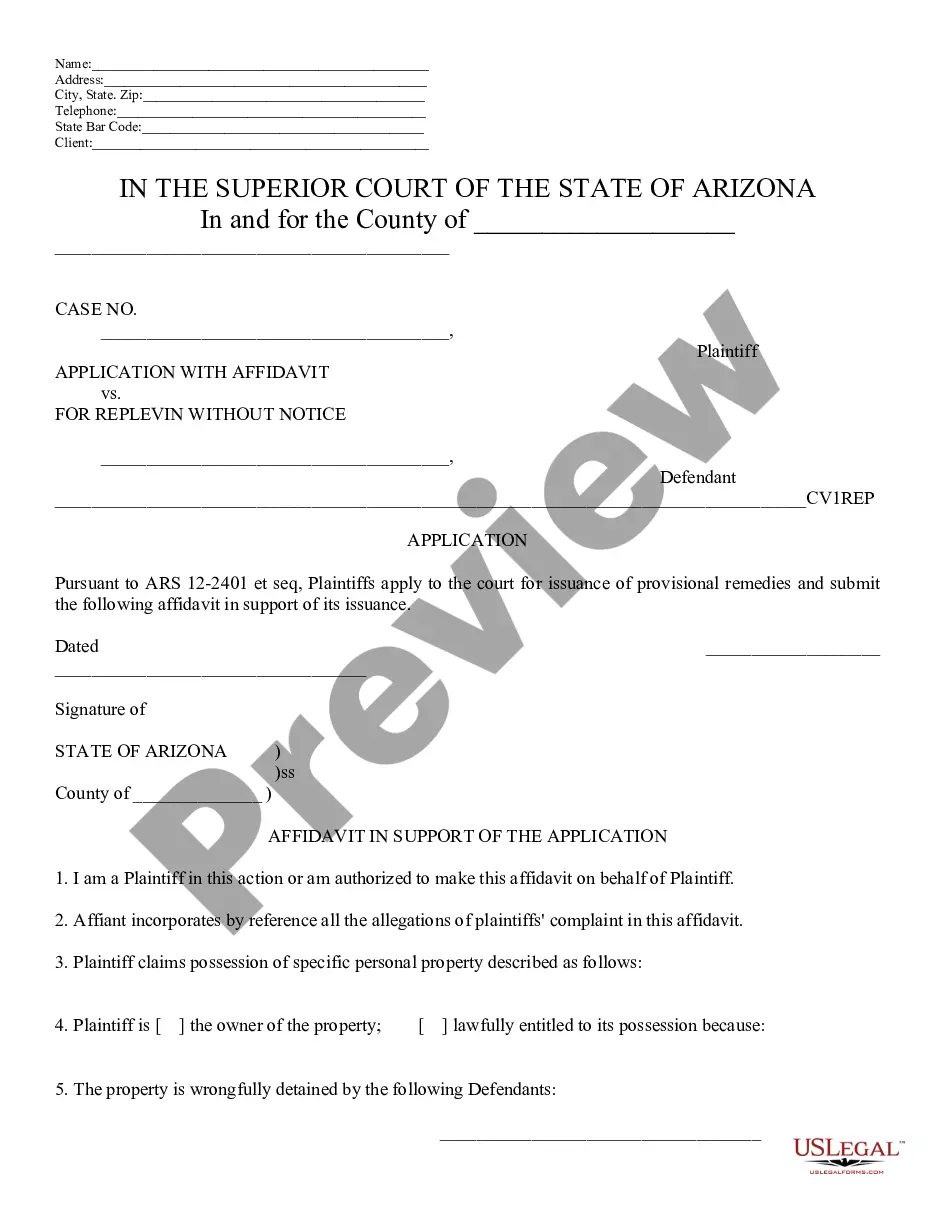

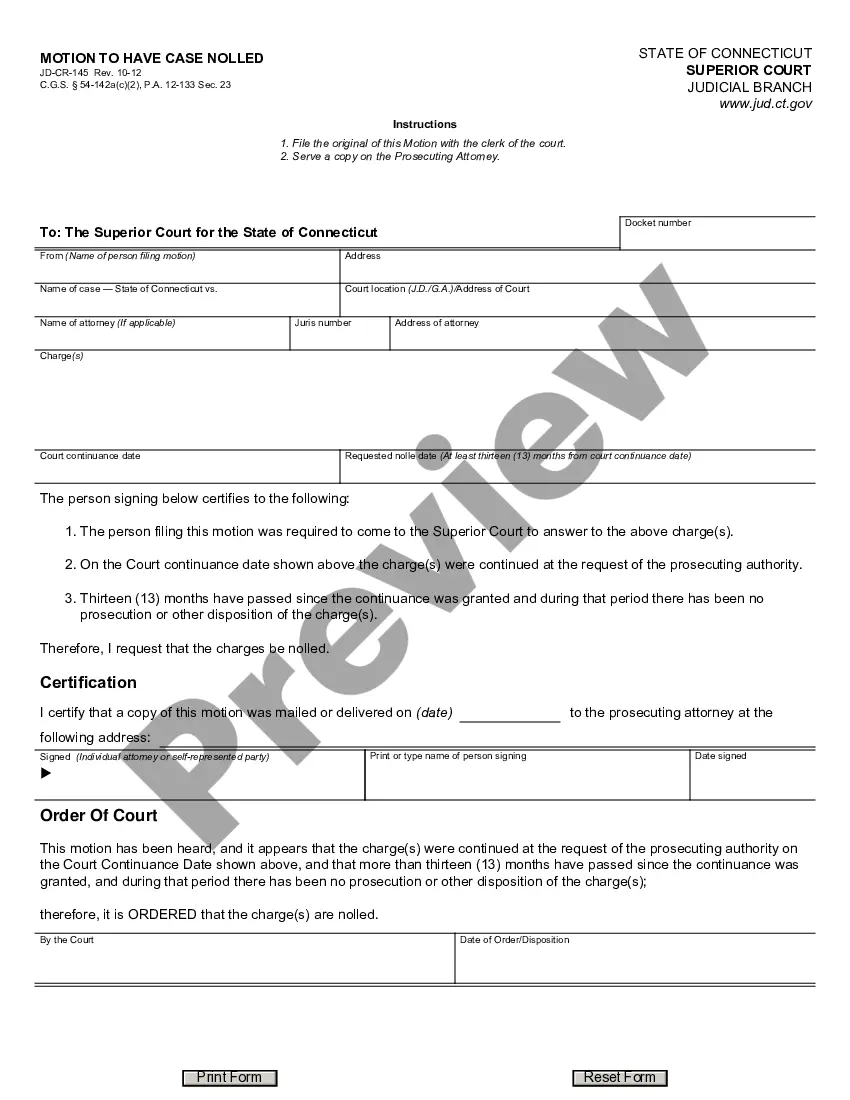

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!