Orange California Certificate of Accredited Investor Status

Description

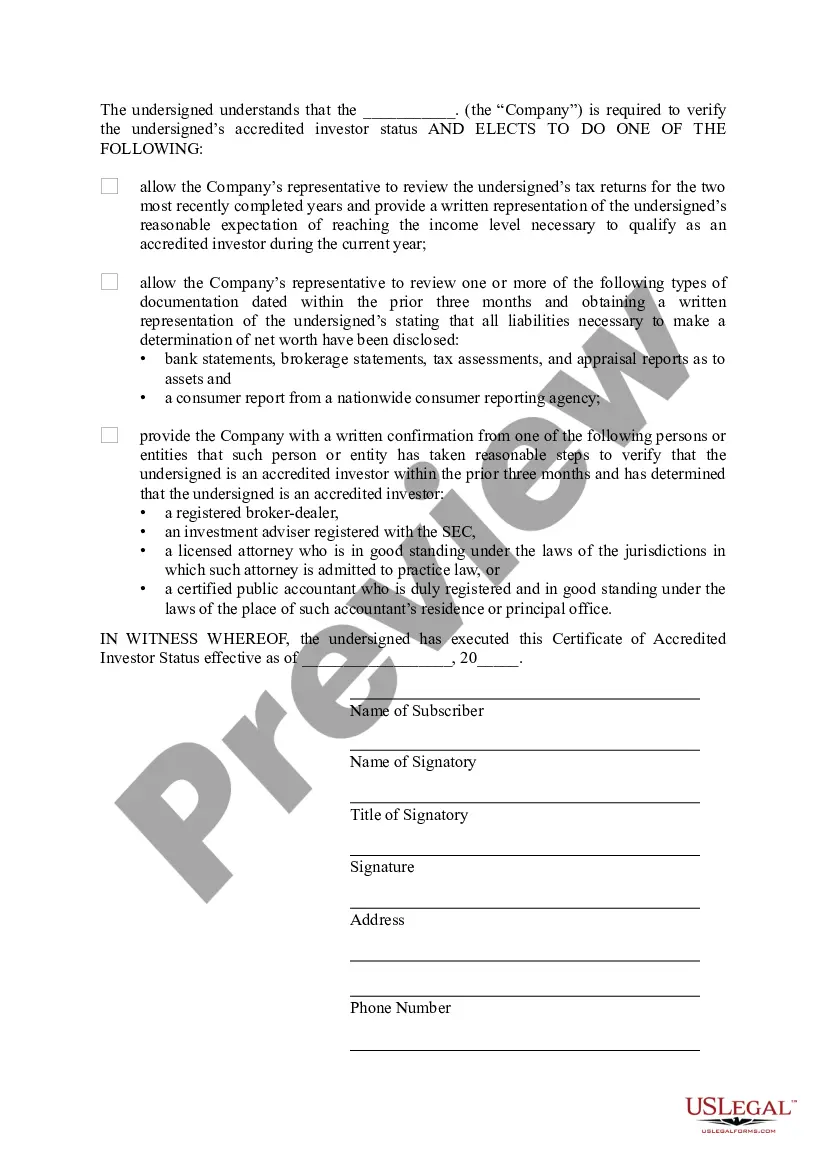

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Orange California Certificate Of Accredited Investor Status?

If you need to find a reliable legal form supplier to obtain the Orange Certificate of Accredited Investor Status, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to locate and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Orange Certificate of Accredited Investor Status, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Orange Certificate of Accredited Investor Status template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Orange Certificate of Accredited Investor Status - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

Individuals who want to become accredited investors, must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Accredited Investor Financial Criteria. Net worth over $1 million, excluding primary residence (individually or with spouse or partner)Professional Criteria.Investments.Assets.Owners as Accredited.Investment Advisers.Financial Entities.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

The SEC has discussed allowing persons with other professional credentials or licenses to qualify as accredited investors. Those with CFA and CFP designations have been considered as have licensed CPAs and attorneys.