To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

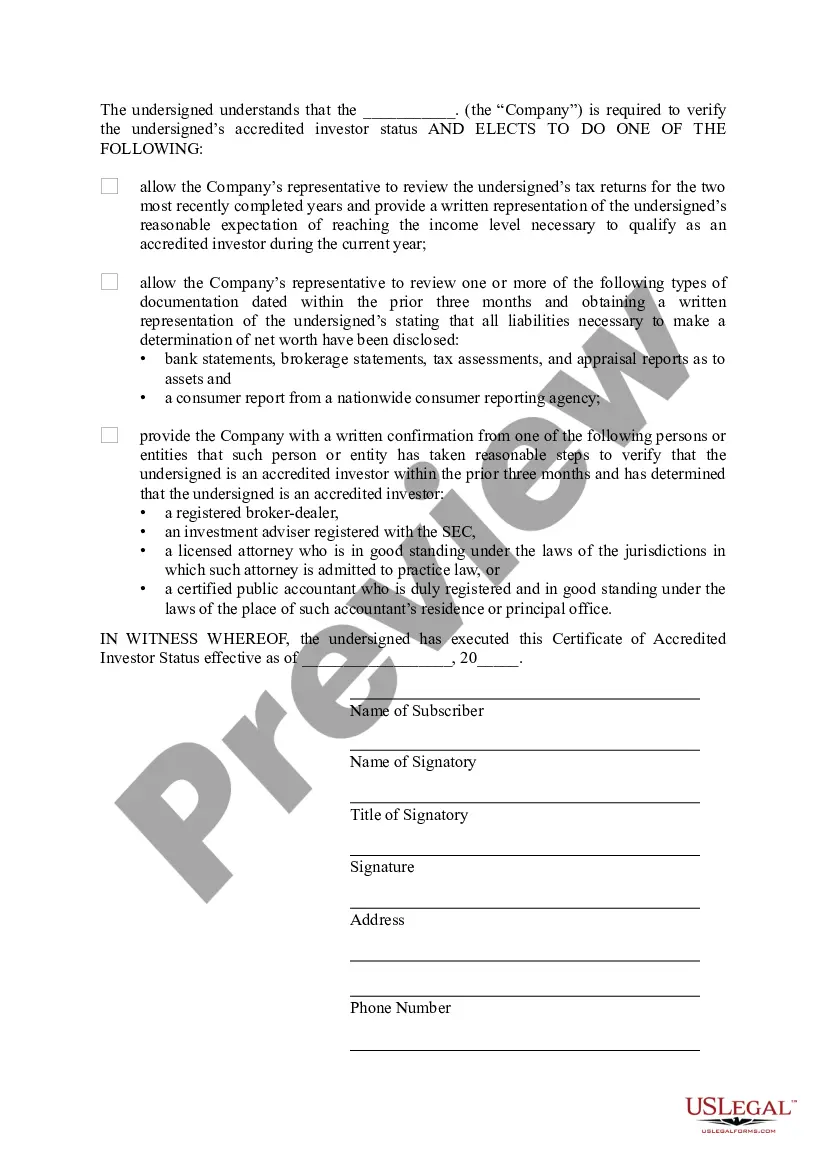

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

The Suffolk New York Certificate of Accredited Investor Status is a document that certifies an individual or entity's status as an accredited investor in Suffolk County, New York. Accredited investor status indicates that the individual or entity meets certain financial criteria, allowing them to invest in certain securities that are restricted to non-accredited investors. The Suffolk New York Certificate of Accredited Investor Status serves as proof of an individual or entity's eligibility to participate in private offerings, venture capital investments, hedge funds, and other investment opportunities that are typically available only to accredited investors. This certificate is issued by the appropriate authorities in Suffolk County and is required when engaging in certain investment activities. To obtain the Suffolk New York Certificate of Accredited Investor Status, individuals or entities must meet specific financial thresholds set by the Securities and Exchange Commission (SEC). These thresholds include: 1. Income Requirement: An individual must have earned an annual income of at least $200,000 in each of the previous two years ($300,000 for joint income with a spouse) and must reasonably expect to reach the same income level in the current year. 2. Net Worth Requirement: An individual must have a net worth exceeding $1 million, either alone or jointly with a spouse, excluding the value of their primary residence. 3. Entity Classification: Entities such as banks, insurance companies, registered investment companies, charitable organizations, and employee benefit plans with assets exceeding $5 million are also considered accredited investors. It is important to note that the Suffolk New York Certificate of Accredited Investor Status may have variations based on the specific requirements set by Suffolk County. However, the overarching objective remains the same — validating an individual or entity's eligibility to engage in investment opportunities restricted to accredited investors. In summary, the Suffolk New York Certificate of Accredited Investor Status is a crucial document for individuals or entities in Suffolk County seeking to participate in exclusive investment opportunities. Meeting the prestigious accredited investor status requirements ensures access to a wider range of investment possibilities, allowing successful investors to potentially grow and diversify their portfolios in a more substantial manner.