Dallas Texas Accredited Investor Status Certificate is a specialized certification that denotes a person's eligibility and qualification to invest in certain private securities offerings. Accredited investors are individuals or entities with a high net worth or extensive investment experience, allowing them to participate in opportunities not available to the general investing public. The Dallas Texas Accredited Investor Status Certificate is specifically tailored to comply with the regulations and requirements set forth by the United States Securities and Exchange Commission (SEC) and the Texas State Securities Board (TSS). It serves as a vital document to prove the investor's accreditation status and gain access to restricted investment opportunities. Keywords: Dallas Texas, Accredited Investor Status, Certificate, private securities offerings, eligibility, qualification, high net worth, investment experience, private investments, regulations, requirements, compliance, SEC, TSS, investor accreditation, restricted investment opportunities. Different types of Dallas Texas Accredited Investor Status Certificates may include: 1. Individual Accredited Investor Certificate: This certificate is issued to individuals who meet the accredited investor criteria, such as having a net worth exceeding $1 million (excluding the value of their primary residence) or an annual income exceeding $200,000 ($300,000 for joint income with a spouse) for the past two years. 2. Institutional Accredited Investor Certificate: This certificate is issued to entities, such as corporations, partnerships, or organizations, that meet the accredited investor requirements. These entities must have assets exceeding $5 million or be entirely owned by accredited investors. 3. Regional Accredited Investor Certificate: This certificate is specific to individuals or entities residing in the Dallas Texas region who meet the accredited investor criteria. It signifies their eligibility to invest in private offerings within the Dallas Texas area. 4. Temporary Accredited Investor Certificate: This type of certificate may be issued to individuals or entities who temporarily meet the accredited investor requirements. For example, if an individual has experienced a significant increase in income or received a substantial windfall, they may seek temporary accreditation status. 5. Probationary Accredited Investor Certificate: This certificate is granted to individuals or entities who were previously accredited investors but no longer meet the criteria due to changes in their financial status. It allows them a limited time to adjust their investments or secure additional funds to regain their accredited investor status. It is important to note that the exact types of Dallas Texas Accredited Investor Status Certificates may vary based on specific state regulations and the policies implemented by local securities boards.

Dallas Texas Accredited Investor Status Certificate

Description

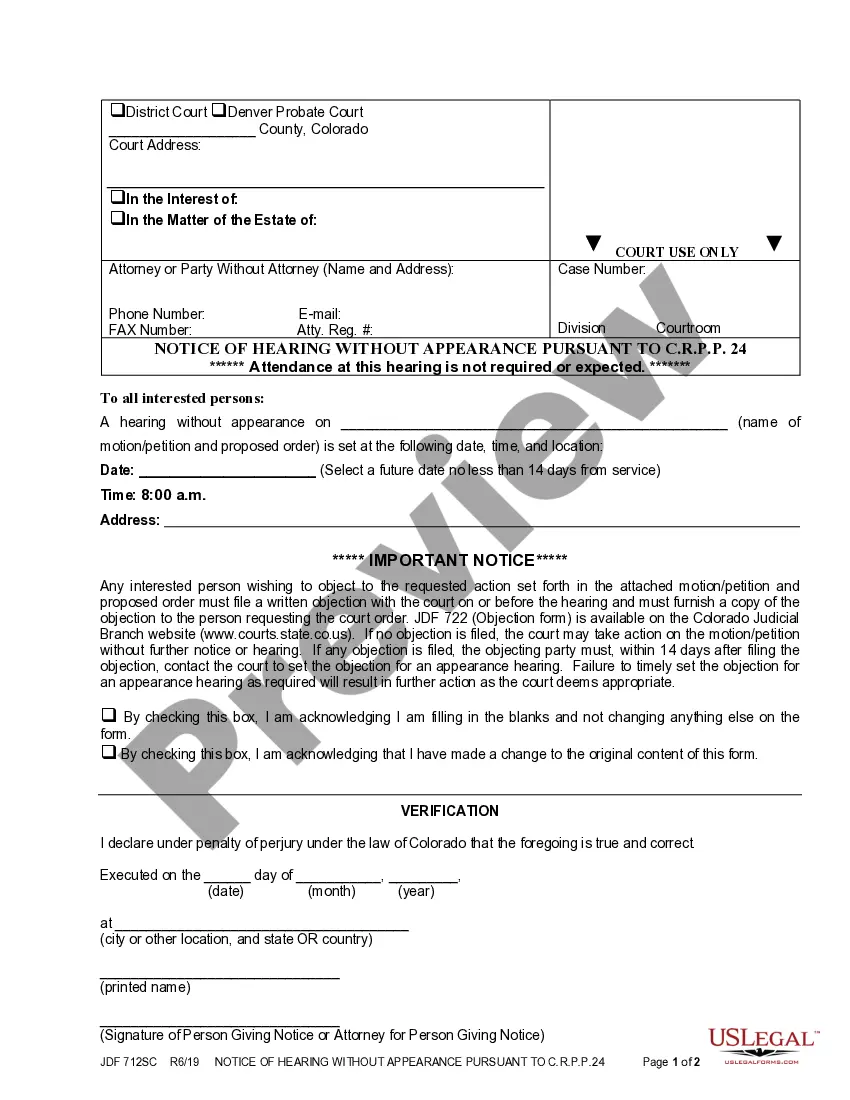

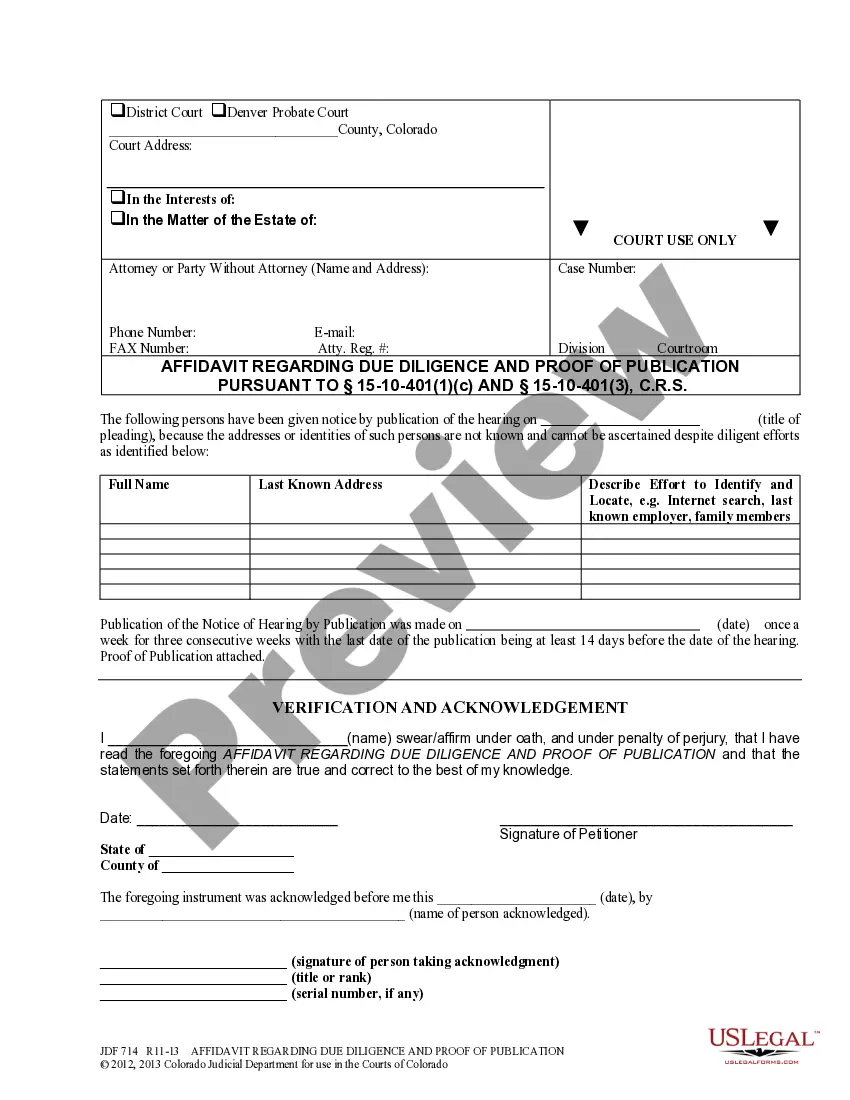

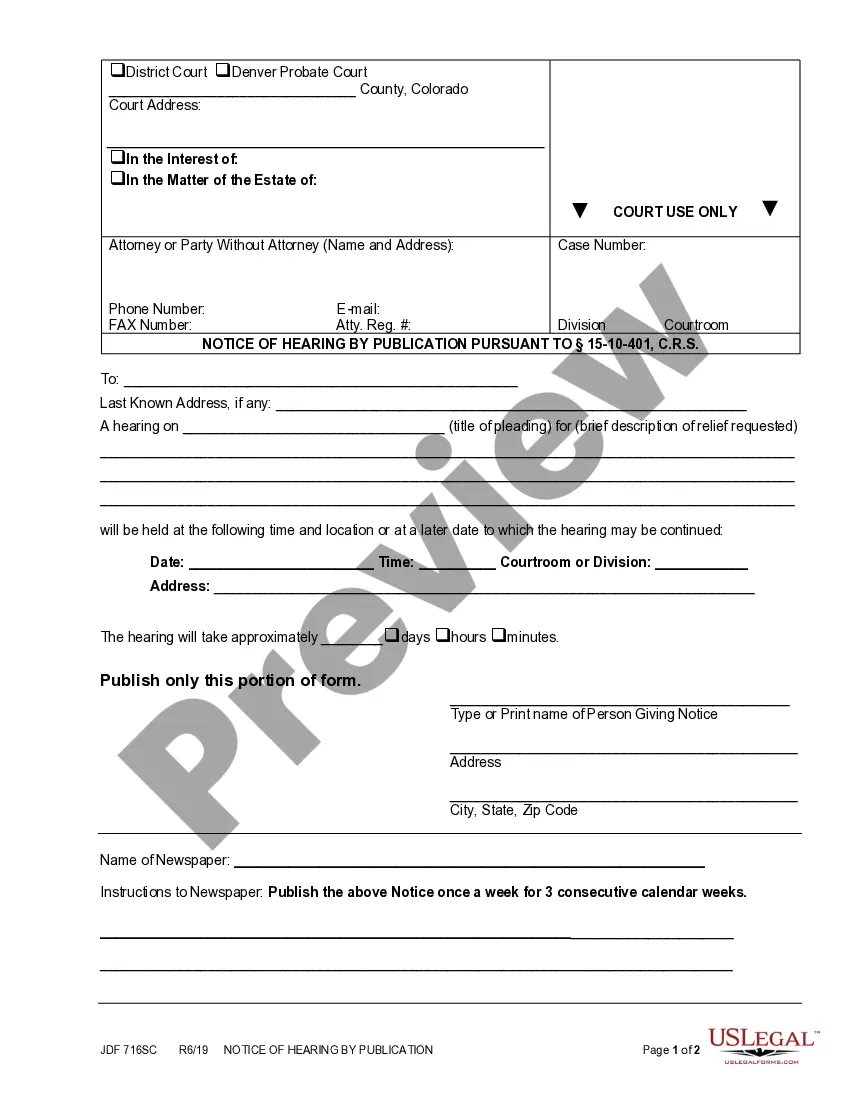

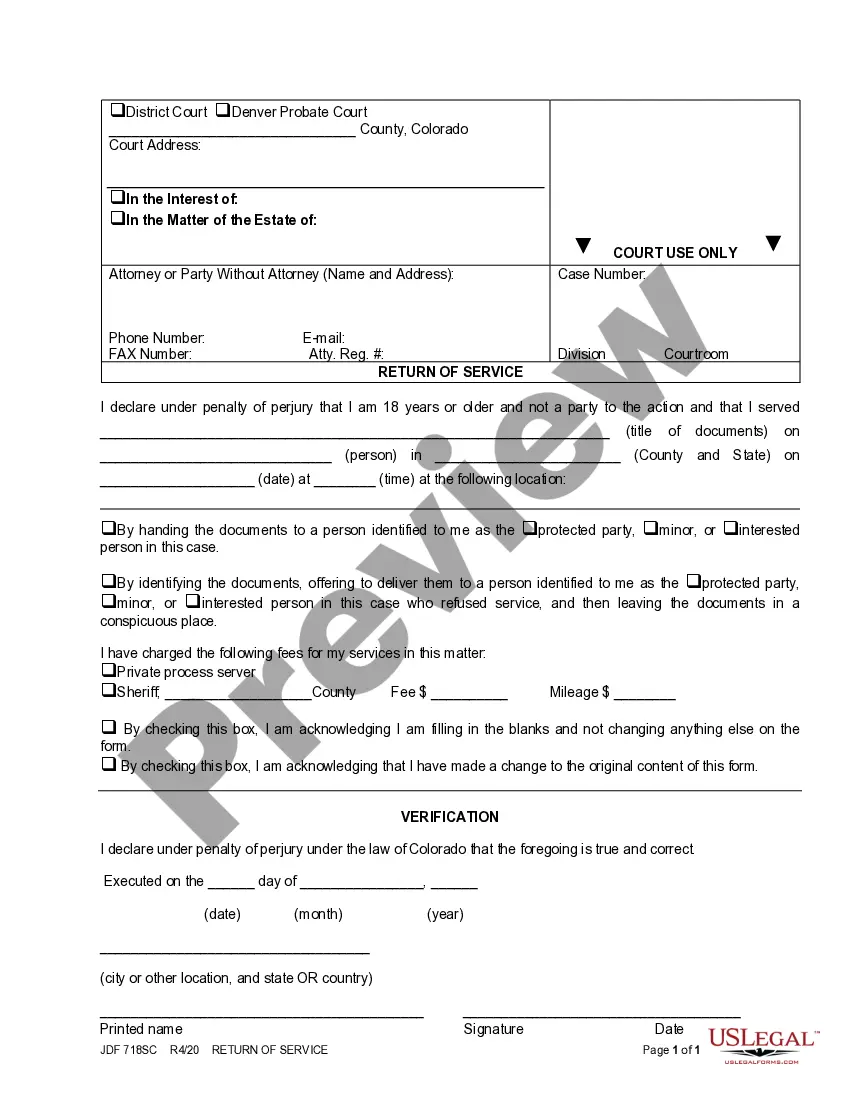

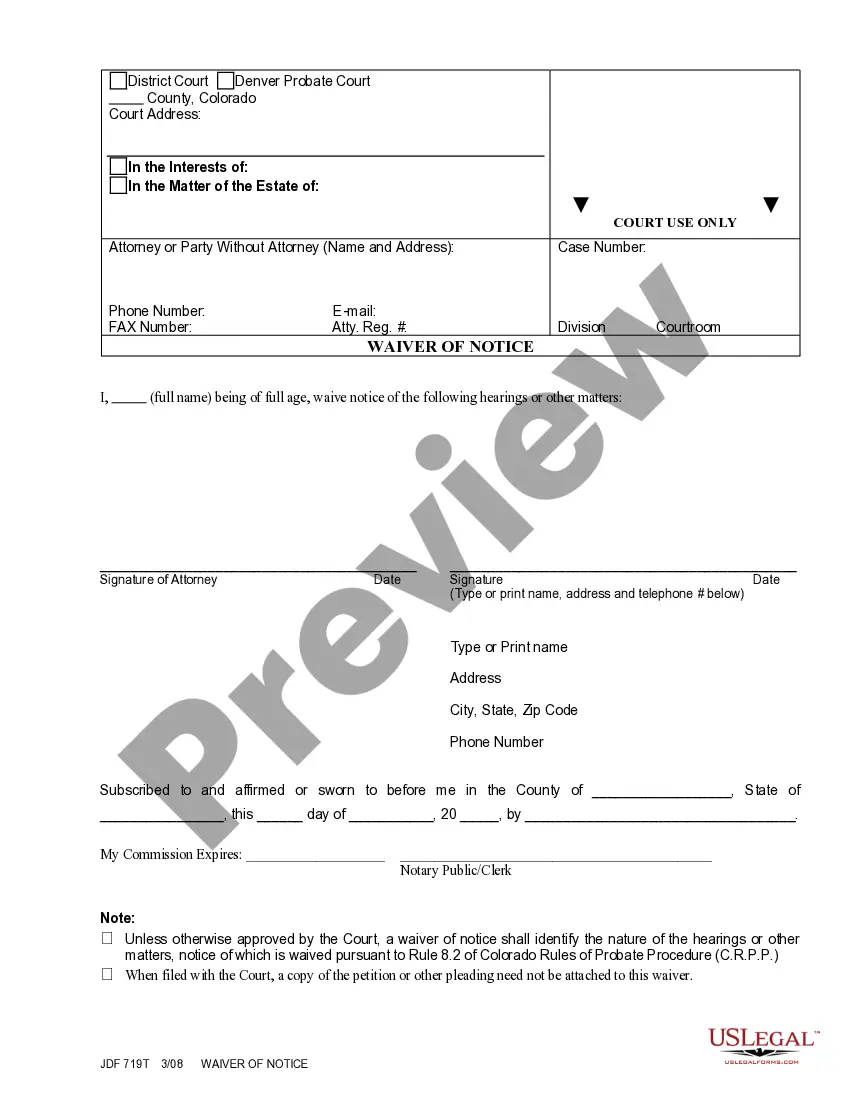

How to fill out Dallas Texas Accredited Investor Status Certificate?

Creating paperwork, like Dallas Accredited Investor Status Certificate, to take care of your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Dallas Accredited Investor Status Certificate form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Dallas Accredited Investor Status Certificate:

- Ensure that your template is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Dallas Accredited Investor Status Certificate isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and download the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!