Maricopa, Arizona Accredited Investor Representation Letter is a legal document that outlines the terms and conditions of representing an accredited investor in the Maricopa, Arizona region. This letter is crucial for ensuring compliance with laws and regulations associated with securities investments. An accredited investor is an individual or entity who meets certain financial criteria, such as a high net worth or income, and is permitted to invest in private offerings and other investment opportunities not available to the public. Accredited Investor Representation Letter plays a vital role in establishing the professional relationship between the accredited investor and their chosen representative or advisor. The content of Maricopa Arizona Accredited Investor Representation Letter typically includes: 1. Introduction: The letter begins by identifying the party providing representation and the accredited investor seeking representation. It clearly states the purpose of the letter and the intention to establish a legal agreement. 2. Scope of Representation: This section outlines the specific services that the representative will provide to the accredited investor. It may include investment advice, due diligence, portfolio management, and any other relevant services specified by both parties. 3. Responsibilities of the Representative: The letter clearly defines the responsibilities of the representative, such as maintaining confidentiality, acting in good faith, and exercising due diligence while making investment decisions on behalf of the accredited investor. 4. Terms and Conditions: This section lays out the key provisions, including the duration of the representation agreement, termination clauses, compensation arrangements, and any applicable fees or expenses. 5. Investor Eligibility: The letter confirms that the accredited investor meets the criteria specified by regulatory bodies to qualify as an accredited investor, ensuring compliance with federal and state securities laws. 6. Risk Disclosure: It is essential to include a comprehensive risk disclosure section, informing the accredited investor about the potential risks associated with securities investments. This helps in setting realistic expectations and minimizing potential disputes in the future. Different types of Maricopa Arizona Accredited Investor Representation Letters may exist, depending on the specific circumstances and needs of the accredited investor. For instance: 1. General Representation Letter: This is the most common type, covering a wide range of investment activities and services. 2. Limited Representation Letter: In some cases, an accredited investor may require limited representation for specific investment opportunities or a fixed duration. 3. Trustee Representation Letter: If the accredited investor is acting as a trustee for a trust, there might be a separate representation letter designed to address the unique requirements and responsibilities associated with trust investments. In conclusion, the Maricopa, Arizona Accredited Investor Representation Letter is a significant legal document that establishes the professional relationship between an accredited investor and their representative. It ensures compliance with relevant securities laws and provides a framework for the provision of investment services. Different types of representation letters may exist, tailored to the specific needs and circumstances of the accredited investor.

Maricopa Arizona Accredited Investor Representation Letter

Description

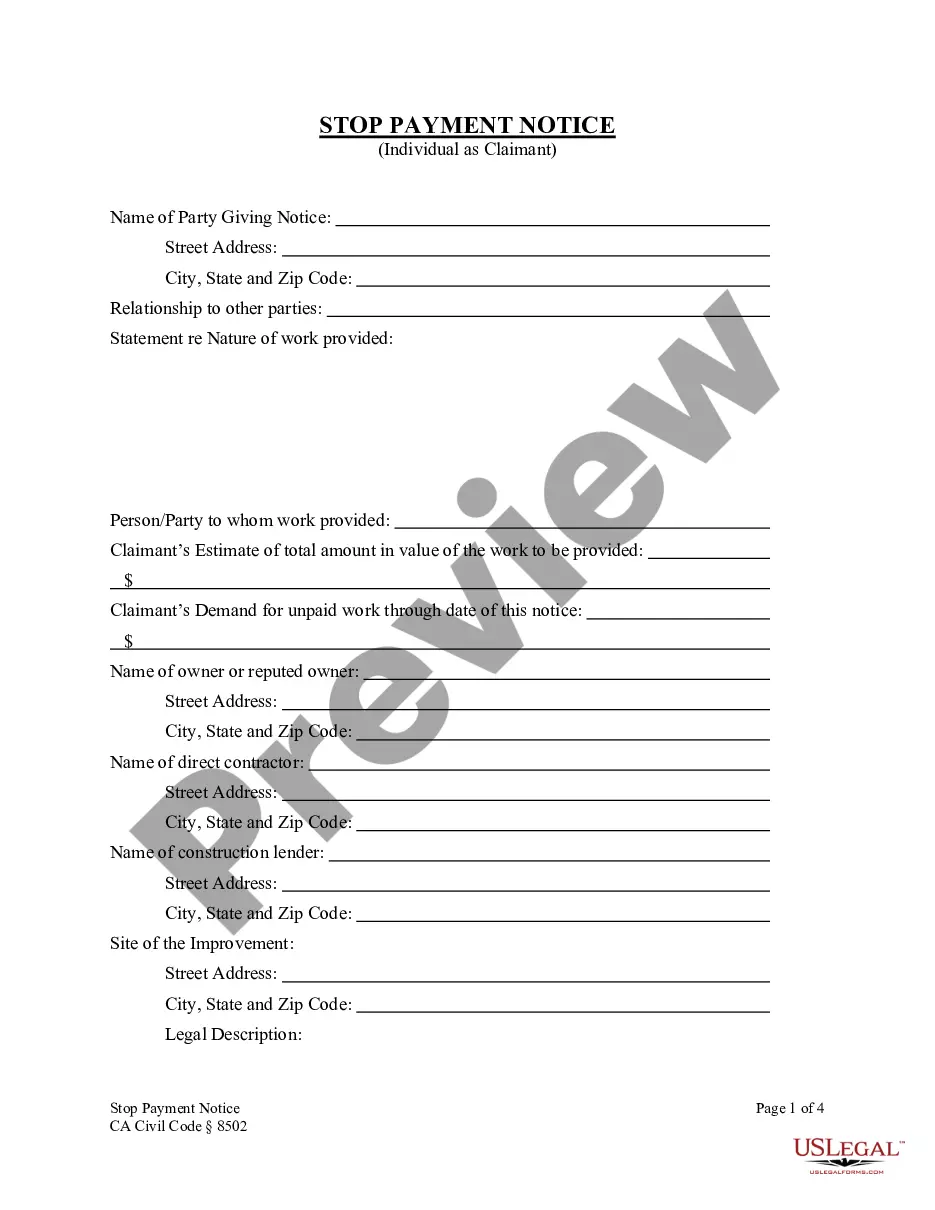

How to fill out Maricopa Arizona Accredited Investor Representation Letter?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Maricopa Accredited Investor Representation Letter, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Maricopa Accredited Investor Representation Letter.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy Maricopa Accredited Investor Representation Letter.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Accredited Investor Representation Letter, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you have to deal with an exceptionally challenging case, we recommend getting an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant documents with ease!