Fulton Georgia Accredited Investor Certification is a recognized credential that verifies an individual's status as an accredited investor according to the guidelines set by the U.S. Securities and Exchange Commission (SEC). An accredited investor is an individual or entity that meets specific income or net worth thresholds and is permitted to invest in certain private offerings and alternative investment opportunities. This certification is particularly important for residents or entities located in Fulton County, Georgia, as it grants them access to specific investment options that may not be available to non-accredited investors. The Fulton Georgia Accredited Investor Certification is obtained by meeting the financial requirements outlined by the SEC. There are various types of Fulton Georgia Accredited Investor Certification, each with its own qualifying criteria. These can include: 1. Income-based Accredited Investor Certification: This certification is granted to individuals whose income exceeds a certain threshold. As of 2021, the income threshold for an individual is $200,000 annually (or $300,000 jointly with a spouse) for the past two years, with the reasonable expectation of achieving the same income level in the current year. 2. Net Worth-based Accredited Investor Certification: This certification is based on an individual's net worth, excluding their primary residence. To qualify, an individual's net worth must exceed $1 million, either individually or jointly with a spouse. 3. Entity-based Accredited Investor Certification: Certain entities, such as corporations, partnerships, LCS, and trusts, can also obtain the Fulton Georgia Accredited Investor Certification. These entities must meet specific criteria related to their assets or equity value to qualify. The SEC considers these entities to have the financial sophistication to participate in private investment opportunities. It is important to note that the accreditation certification process requires individuals or entities to provide evidence of their financial status through appropriate documentation, such as tax returns, financial statements, or verification from a certified public accountant. By obtaining the Fulton Georgia Accredited Investor Certification, individuals and entities gain access to a wider range of investment options, including private equity, venture capital, hedge funds, and other investment opportunities not available to non-accredited investors. This certification serves as a measure of financial capability and allows investors to engage in potentially higher-risk investments with the expectation of higher returns. Investors in Fulton Georgia who attain the Accredited Investor Certification can enjoy the advantages of diversification, access to exclusive investment offerings, and potential opportunities to participate in the growth of promising startups or innovative projects. However, it is crucial to conduct thorough due diligence and carefully consider the risks associated with these investment options before making any commitments. In summary, the Fulton Georgia Accredited Investor Certification is a credential that demonstrates an individual's or entity's financial qualification as an accredited investor. It allows access to a broader range of investment opportunities, promoting economic growth and innovation within Fulton County, Georgia.

Fulton Georgia Accredited Investor Certification

Description

How to fill out Fulton Georgia Accredited Investor Certification?

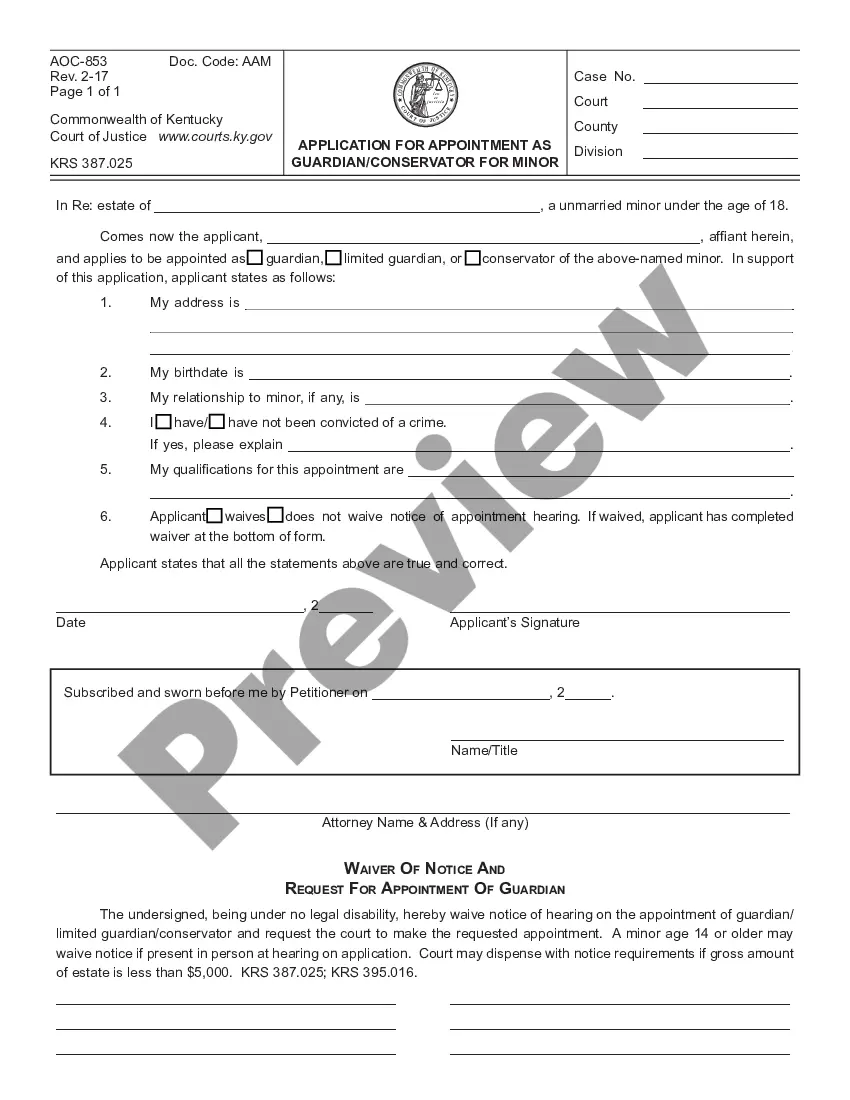

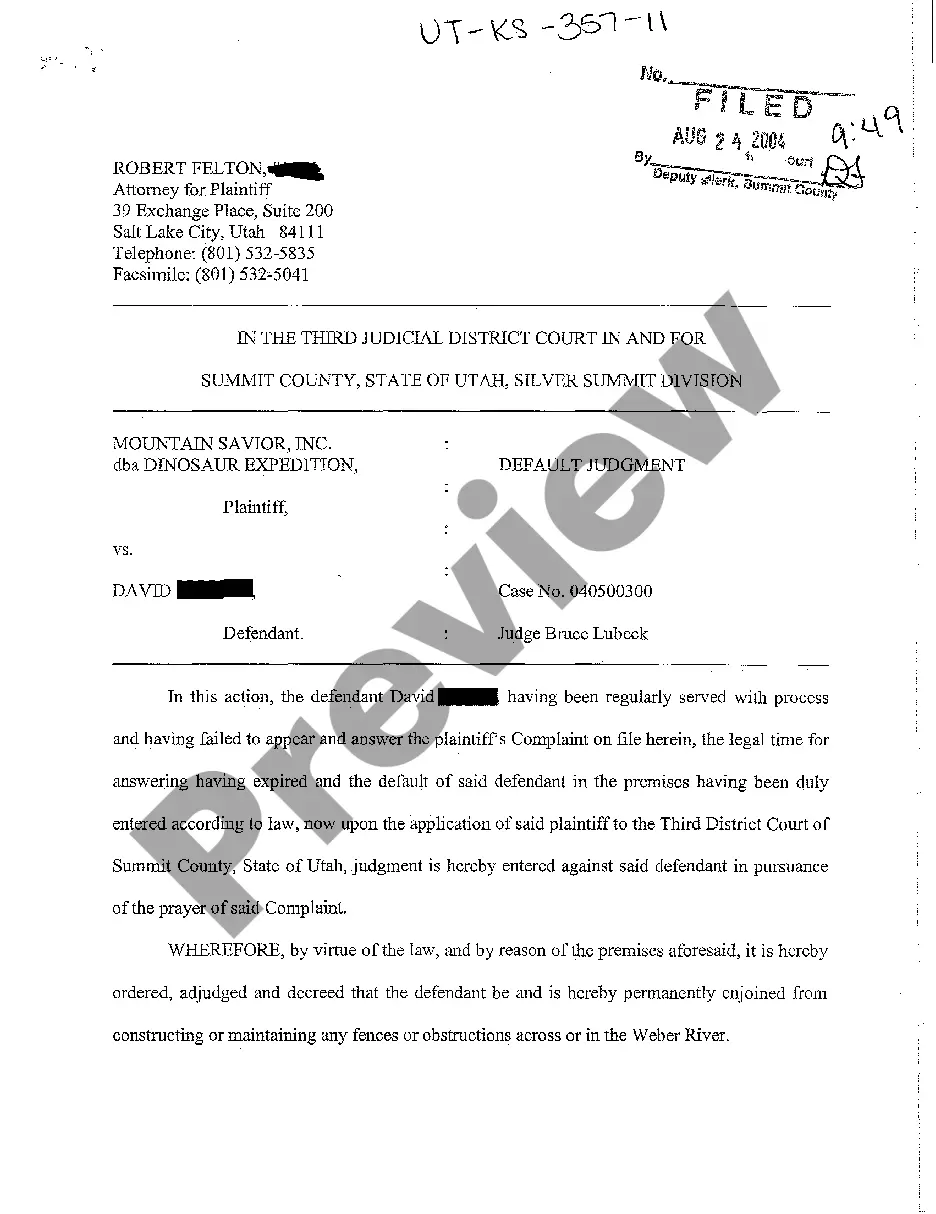

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Fulton Accredited Investor Certification suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Fulton Accredited Investor Certification, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Fulton Accredited Investor Certification:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fulton Accredited Investor Certification.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!