Riverside California Accredited Investor Certification is a recognized credential that verifies an individual's eligibility to invest in certain types of securities offerings that are typically reserved for high net worth individuals or institutional investors. This certification is necessary to qualify for investment opportunities that are subject to regulations under the Securities and Exchange Commission (SEC) guidelines. The Riverside California Accredited Investor Certification is designed to ensure that individuals possess a certain level of financial sophistication and knowledge to understand and evaluate the risks associated with private placements, hedge funds, venture capital investments, and other alternative investment opportunities. The certification process typically involves undergoing a detailed assessment of an individual's financial standing, including their income, net worth, and investment experience. The requirements vary depending on the specific type of accreditation, but generally, individuals need to meet one or more criteria established by the SEC to qualify as an accredited investor. There are various types of Riverside California Accredited Investor Certification, which include: 1. Net Worth Accredited Investor Certification: This certification is based on an individual's net worth, where they must possess a net worth exceeding a certain threshold (e.g., $1 million excluding their primary residence). This certification option allows individuals to invest in private placements, hedge funds, and other investment opportunities. 2. Income Accredited Investor Certification: This certification is based on an individual's annual income, where they must have earned a certain amount (e.g., $200,000 individually or $300,000 jointly with a spouse) for the past two years with the expectation of maintaining a similar income level in the future. This certification option enables individuals to participate in private placements, certain crowdfunding offerings, and other investment opportunities. 3. Professional Designation Accredited Investor Certification: This certification is reserved for individuals who hold specific professional designations, such as Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Chartered Alternative Investment Analyst (CIA). These individuals are deemed to have the necessary knowledge and expertise to evaluate investment opportunities and can access a wider range of investment options. By obtaining the Riverside California Accredited Investor Certification, individuals gain access to exclusive investment opportunities that are typically not available to the public. It allows them to diversify their portfolios and potentially take advantage of higher-risk, higher-reward investments under regulatory provisions set by the SEC. Note: It is essential to consult with a financial advisor or legal professional to understand the specific requirements and implications associated with Riverside California Accredited Investor Certification and its various types. Additionally, the SEC periodically updates the accredited investor definition, so it is crucial to remain informed about the latest regulations.

Riverside California Accredited Investor Certification

Description

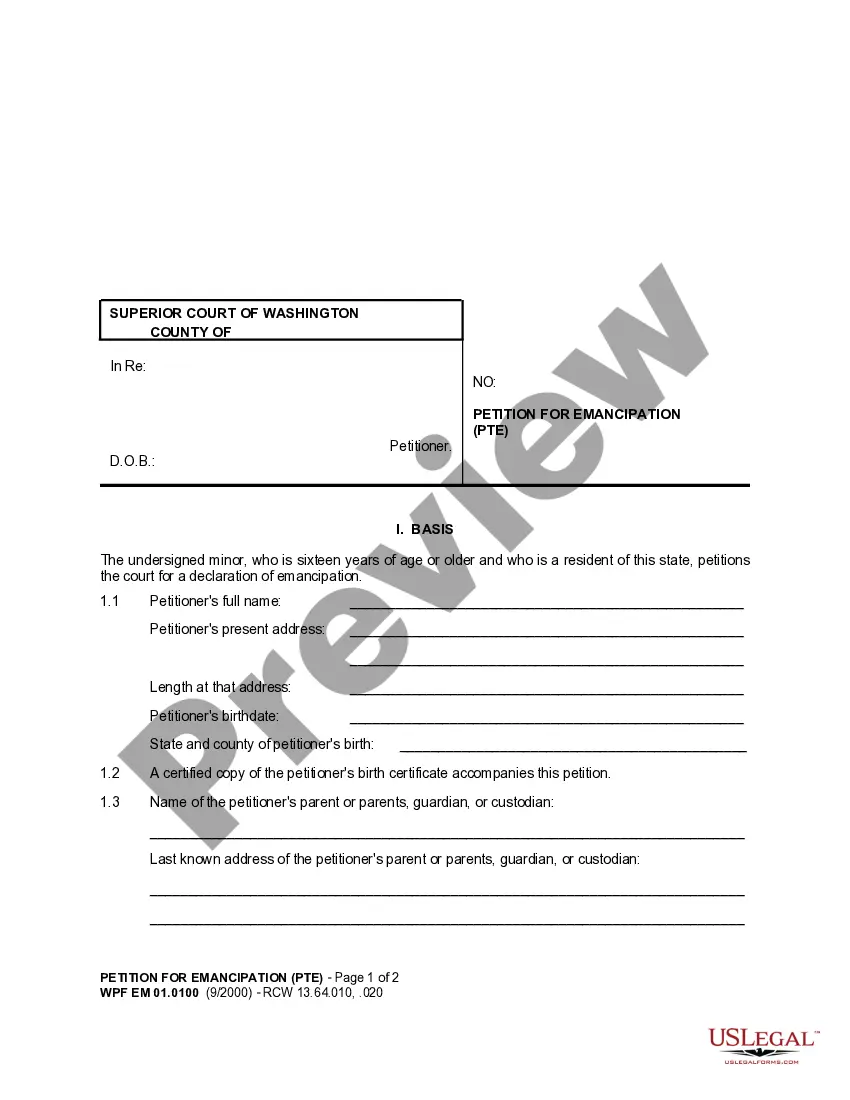

How to fill out Riverside California Accredited Investor Certification?

Draftwing forms, like Riverside Accredited Investor Certification, to manage your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for a variety of scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Riverside Accredited Investor Certification form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Riverside Accredited Investor Certification:

- Ensure that your document is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Riverside Accredited Investor Certification isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!