San Antonio Texas Accredited Investor Certification is a prestigious financial qualification that signifies an individual's high net worth and sophisticated financial knowledge, granting them access to exclusive investment opportunities. Aspiring investors looking to obtain this certification must meet specific criteria established by the U.S. Securities and Exchange Commission (SEC) to ensure they possess the necessary financial acumen and resources to engage in high-risk investments. The San Antonio Texas Accredited Investor Certification includes several types, each tailored to different investor profiles and financial capabilities. These certifications are designed to cater to investors at various stages of their financial journey, enabling them to align their investment choices with their goals and risk tolerance. The common types of San Antonio Texas Accredited Investor Certifications are: 1. Net Worth Certification: This certification requires individuals to have a net worth of at least $1 million, excluding the value of their primary residence. Net worth includes assets such as real estate, investments, retirement accounts, and personal property. 2. Income Certification: Investors can also qualify for accreditation by demonstrating an annual income of at least $200,000 for the past two consecutive years (or $300,000 combined income with a spouse), with the expectation of maintaining a similar income level in the future. 3. Professional Designation Certification: This certification is tailored to professionals who possess specific licenses, certifications, or educational qualifications. Examples include Certified Financial Planners (Caps), Chartered Financial Analysts (CFA), and licensed broker-dealers. 4. Entity Certification: Certain organizations or entities, such as corporations, partnerships, trusts, and charities, can also obtain accreditation if they satisfy specific SEC requirements. To qualify, entities must have at least $5 million in assets or be owned by accredited investors. Earning a San Antonio Texas Accredited Investor Certification opens the door to a wide range of investment opportunities, including hedge funds, private equity, venture capital, and angel investments. However, it is crucial for investors to carefully evaluate the risks associated with such investments and conduct thorough due diligence before committing their capital. The certification serves as a mark of credibility and expertise within the investment community, attracting potential investment partners and enhancing an individual's reputation in the financial industry.

San Antonio Texas Accredited Investor Certification

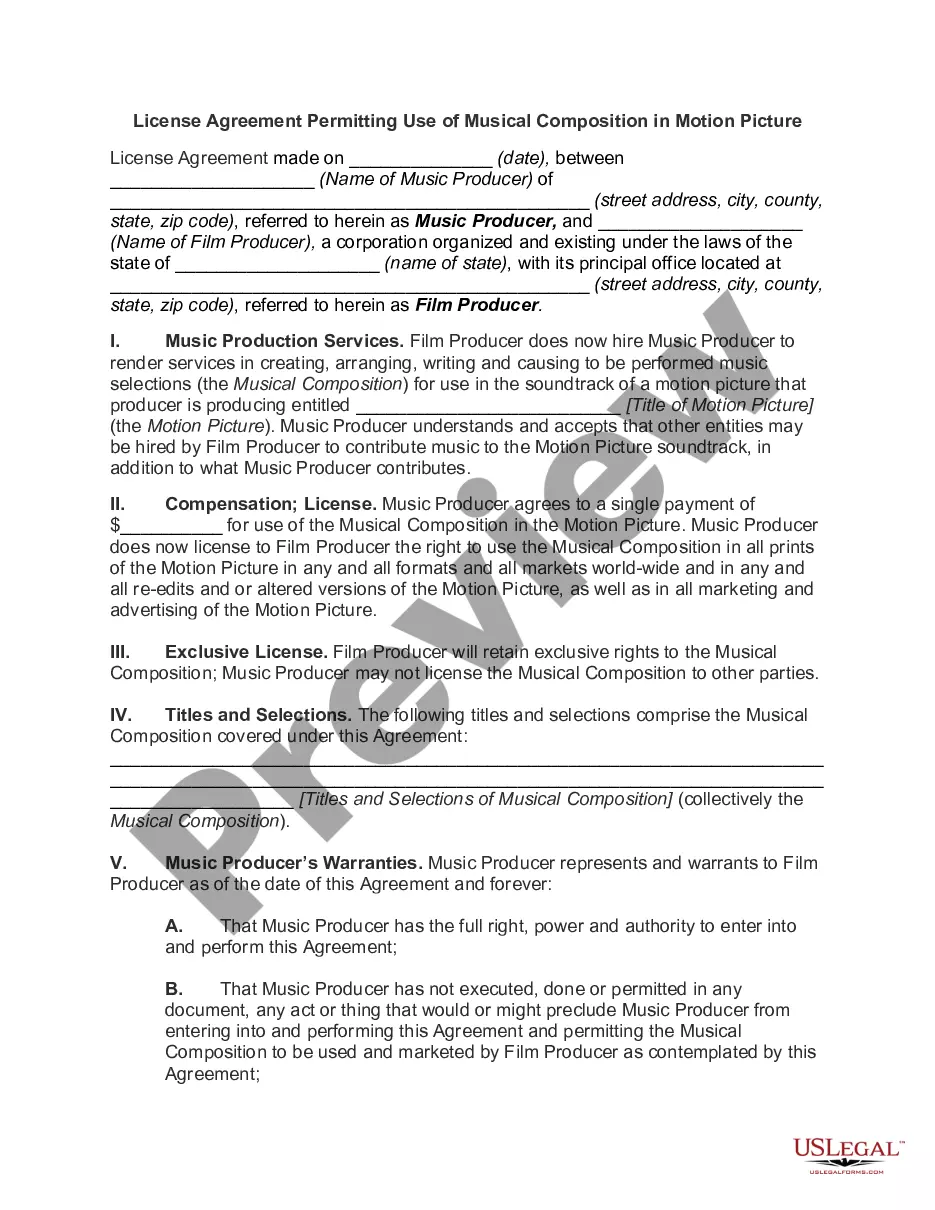

Description

How to fill out San Antonio Texas Accredited Investor Certification?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, finding a San Antonio Accredited Investor Certification suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Aside from the San Antonio Accredited Investor Certification, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your San Antonio Accredited Investor Certification:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Antonio Accredited Investor Certification.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!