The San Diego California Accredited Investor Certification is a prestigious designation awarded to individuals who meet certain financial requirements, allowing them to participate in private investment opportunities typically inaccessible to the public. This certification not only signifies an individual's financial status but also their knowledge and experience in making informed investment decisions. To acquire this certification, individuals must meet the criteria set forth by the Securities and Exchange Commission (SEC) in the United States. The SEC defines an accredited investor as someone who has a net worth exceeding $1 million (excluding the value of their primary residence) or an annual income of at least $200,000 (or $300,000 for joint income) for the past two consecutive years with a reasonable expectation of reaching the same income level in the current year. By obtaining the San Diego California Accredited Investor Certification, individuals gain access to various investment opportunities such as private equity, venture capital, hedge funds, and certain real estate ventures. These types of investments often have higher potential returns but also carry higher risks, making it crucial for potential investors to possess the necessary financial acumen and risk tolerance. While there may not be distinct types of San Diego California Accredited Investor Certification, the term itself encompasses a broad range of professionals, including high-net-worth individuals, angel investors, venture capitalists, and certain institutional investors. Each of these categories represents different segments within the accredited investor community, with varying levels of investment experience, financial resources, and risk appetites. To maintain their accredited investor status, individuals must ensure they continue to meet the SEC's financial criteria. Moreover, it is essential to note that the San Diego California Accredited Investor Certification is not a formalized program administered by a specific governing body. Instead, it is a recognition granted to individuals who meet the SEC's requirements, allowing them to engage in private investment opportunities. In summary, the San Diego California Accredited Investor Certification is a significant distinction that opens doors to exclusive investment opportunities. This certification ensures that individuals possess the financial means, experience, and risk tolerance to participate in high-risk, high-reward ventures. By meeting the rigorous criteria set by the SEC, individuals gain access to a world of investment options that can potentially accelerate wealth creation and diversify their portfolios.

San Diego California Accredited Investor Certification

Description

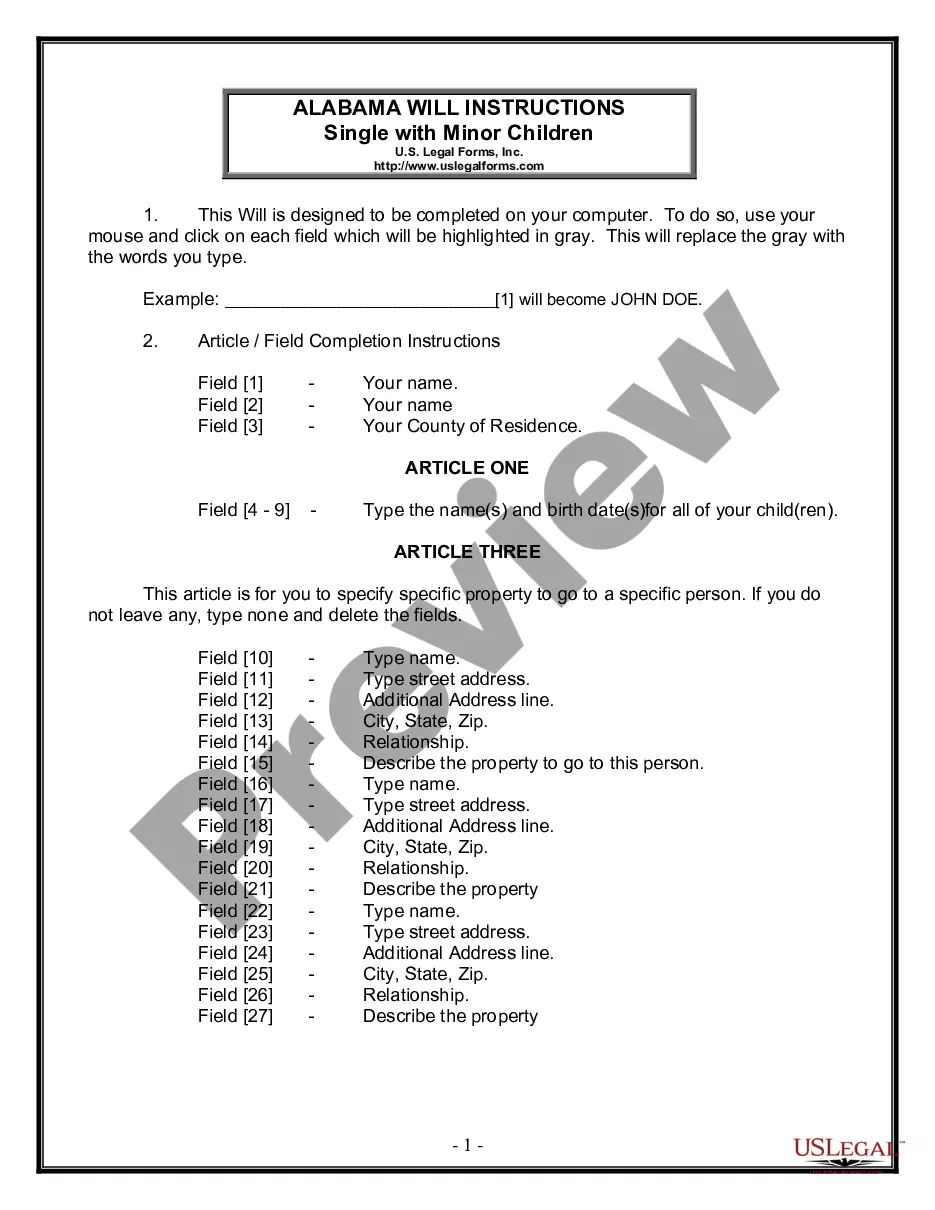

How to fill out San Diego California Accredited Investor Certification?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the San Diego Accredited Investor Certification, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Accredited Investor Certification from the My Forms tab.

For new users, it's necessary to make some more steps to get the San Diego Accredited Investor Certification:

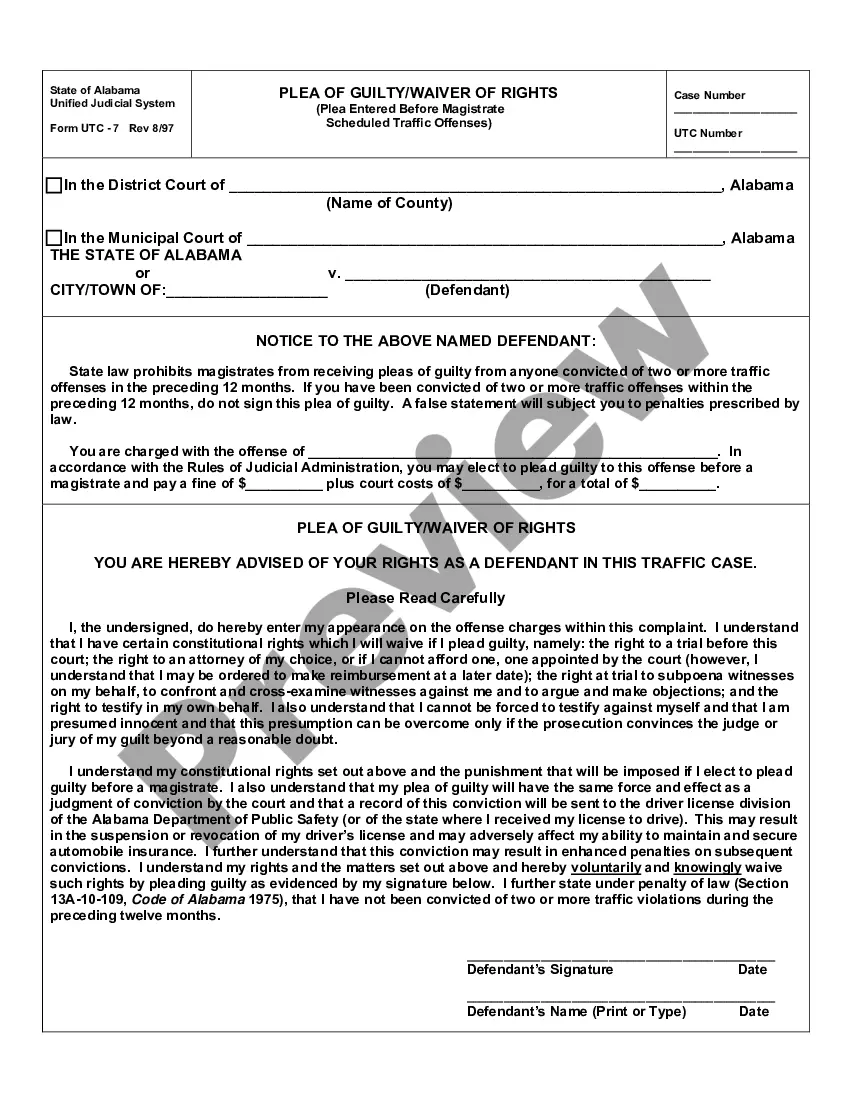

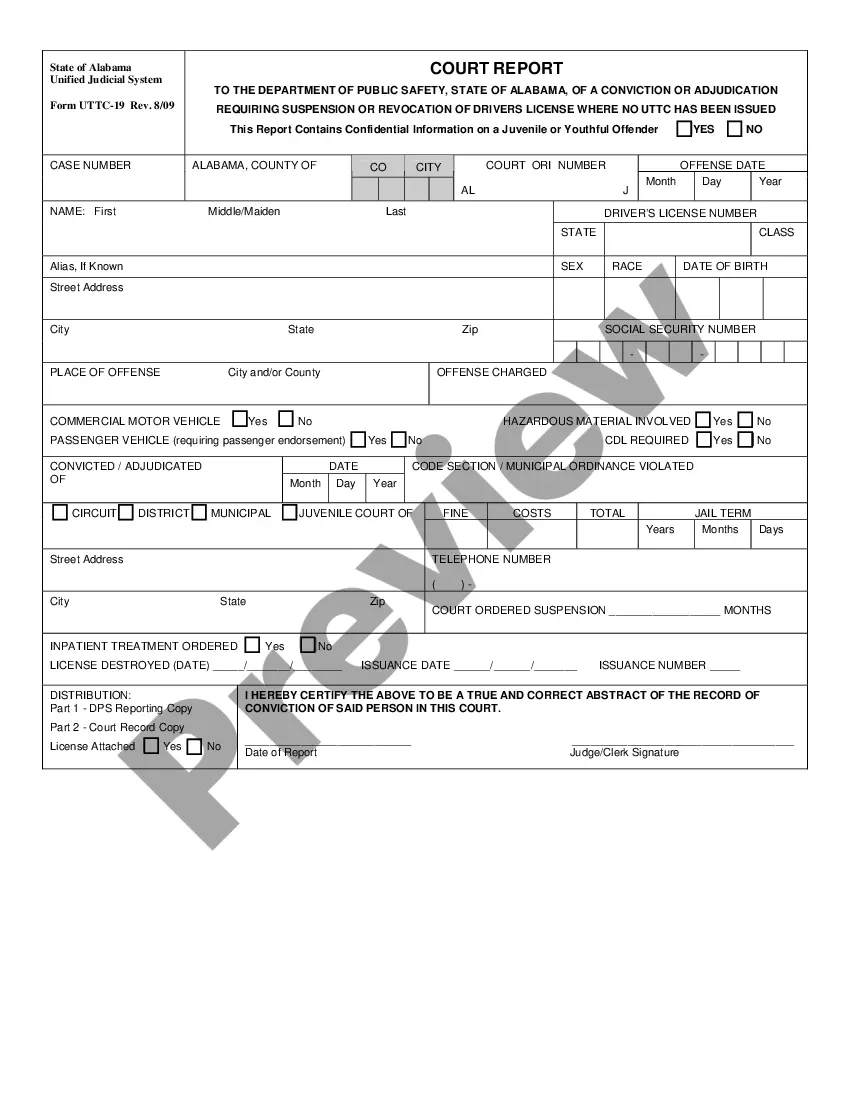

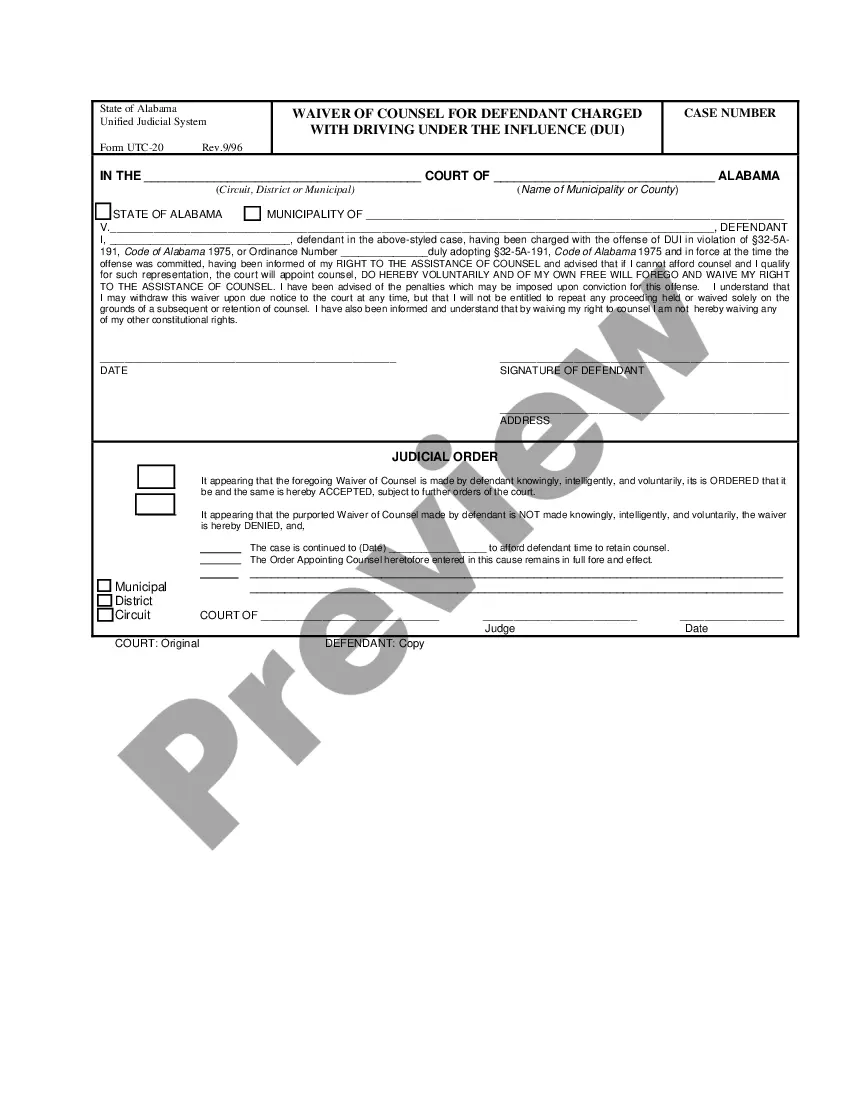

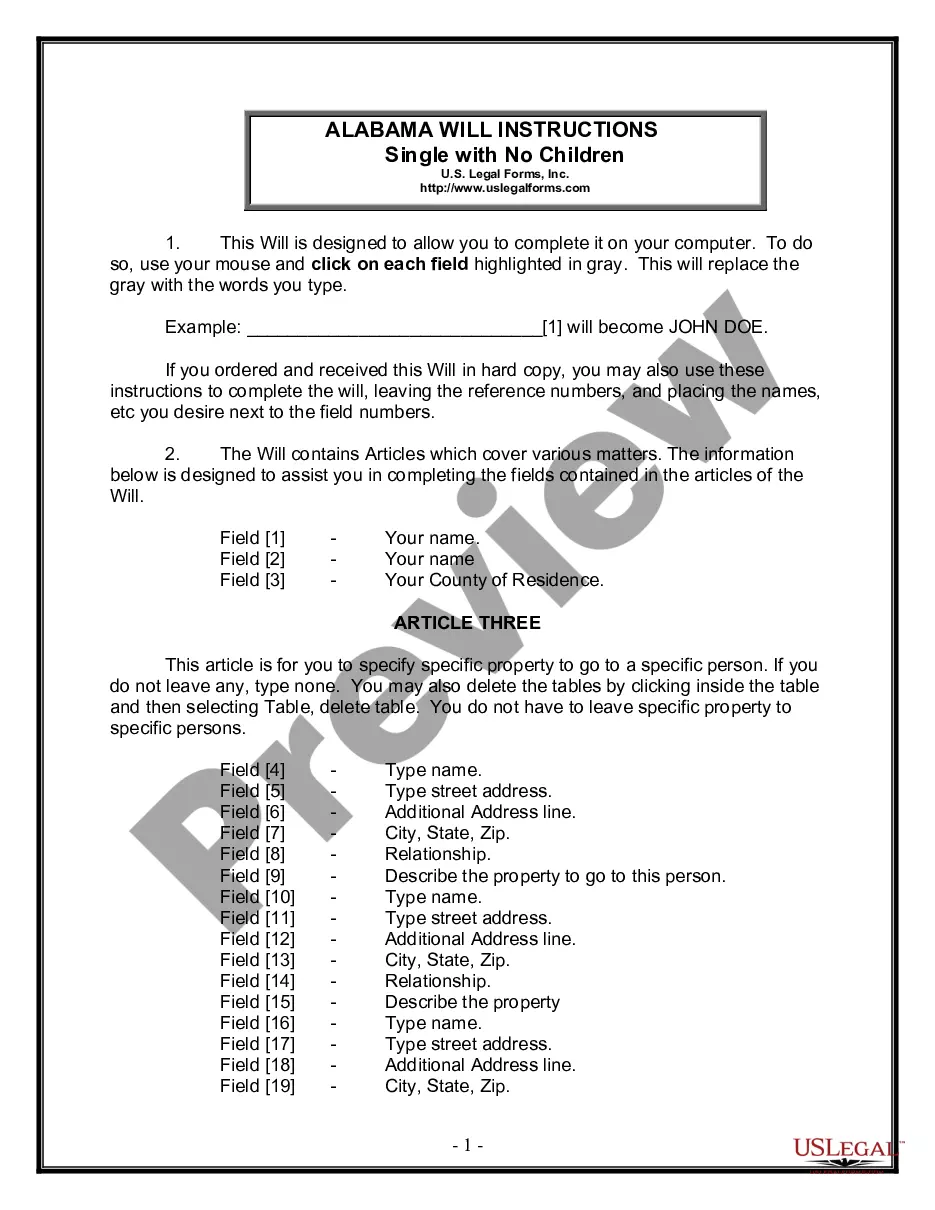

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!