Chicago Illinois Accredited Investor Verification Letter — Individual Investor is a document that certifies the status of an individual as an accredited investor in the state of Illinois, specifically in Chicago. This letter is crucial for investors who wish to participate in private investment opportunities that are only available to accredited investors. Accredited investors are individuals who meet certain financial thresholds set by regulatory bodies such as the Securities and Exchange Commission (SEC) to qualify for participation in certain types of high-risk investments. These investments may include private equity offerings, hedge funds, venture capital funds, and other private securities offerings. The Chicago Illinois Accredited Investor Verification Letter — Individual Investor serves as proof of an individual's eligibility to invest in such opportunities. It is a formal document that confirms that the investor meets the requirements to be considered an accredited investor under federal and state securities laws. The contents of the verification letter will include pertinent information about the individual investor, including their full name, contact details, and relevant financial information that demonstrates their qualification as an accredited investor. This information may include details about the individual's income, net worth, and investment experience. In addition to the standard Chicago Illinois Accredited Investor Verification Letter for individual investors, there may be different types or variations of this document that cater to specific situations or requirements. These variations may include: 1. Chicago Illinois Accredited Investor Verification Letter — Active Investor: This type of verification letter is issued to individuals who are actively investing in private offerings and require proof of their accredited investor status on an ongoing basis. It may be requested by investment firms or other parties before allowing the investor to participate in specific offerings. 2. Chicago Illinois Accredited Investor Verification Letter — Previous Investor: This variation of the verification letter is issued to individuals who have previously invested in private offerings and require proof of their accredited investor status for record-keeping or future investment opportunities. It may be necessary when an investor wants to show their investment history and eligibility for future investments. 3. Chicago Illinois Accredited Investor Verification Letter — Joint Investors: In cases where multiple individuals, such as spouses or business partners, jointly invest in private offerings, this variation of the verification letter may be required. It confirms that both individuals meet the accredited investor requirements and are eligible to participate in investments as joint investors. Obtaining a Chicago Illinois Accredited Investor Verification Letter is a crucial step for individual investors looking to access high-risk investment opportunities. It demonstrates their financial eligibility and provides reassurance to investment firms and issuers that they meet the necessary qualifications.

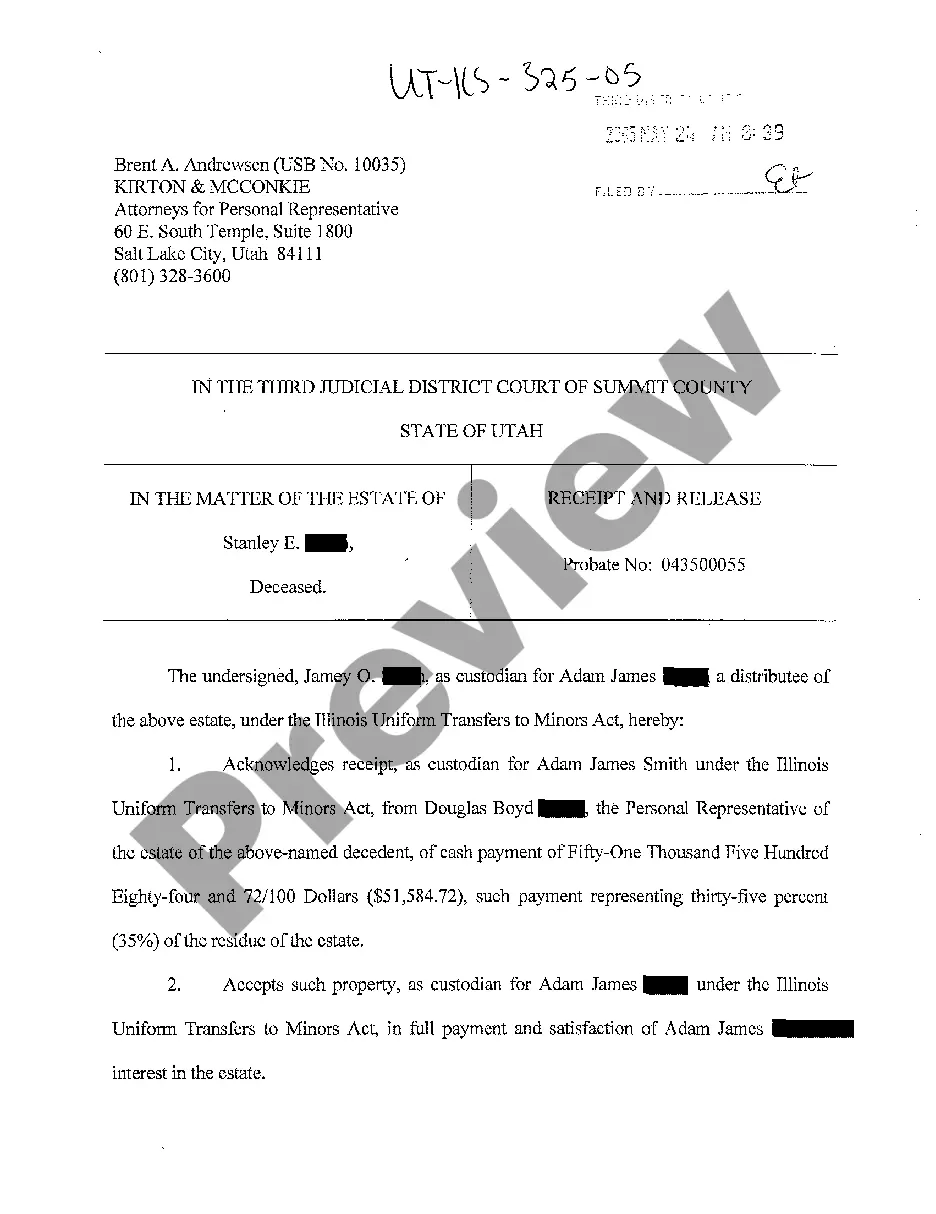

Chicago Illinois Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Chicago Illinois Accredited Investor Veri?cation Letter - Individual Investor?

Draftwing forms, like Chicago Accredited Investor Veri?cation Letter – Individual Investor, to take care of your legal affairs is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for different scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Chicago Accredited Investor Veri?cation Letter – Individual Investor form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Chicago Accredited Investor Veri?cation Letter – Individual Investor:

- Ensure that your document is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Chicago Accredited Investor Veri?cation Letter – Individual Investor isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our service and get the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!