Clark Nevada Accredited Investor Verification Letter — Individual Investor: A Comprehensive Review In the world of investment, it is essential for businesses to identify accredited investors, as their participation can often be critical for solicitation and financing purposes. One way to ensure compliance with regulatory standards is through the Clark Nevada Accredited Investor Verification Letter — Individual Investor. What is Clark Nevada Accredited Investor Verification Letter — Individual Investor? The Clark Nevada Accredited Investor Verification Letter — Individual Investor is a document designed to authenticate an individual's status as an accredited investor based on the requirements set forth by the Securities and Exchange Commission (SEC) and specifically tailored for individuals residing in Clark County, Nevada. This verification letter plays a vital role in confirming an individual's eligibility for participating in certain investment opportunities. Types of Clark Nevada Accredited Investor Verification Letter — Individual Investor: There are several types of Clark Nevada Accredited Investor Verification Letters tailored for different scenarios and purposes: 1. Initial Accredited Investor Verification Letter: This type of verification letter is utilized when an individual is required to prove their accredited investor status for the first time. It is typically sought by investment firms, private placements, or crowdfunding platforms to ensure compliance with SEC regulations and attract potential investors. 2. Periodic Accredited Investor Verification Letter: Periodic verification letters are requested on a regular basis to ensure continued compliance with accredited investor status. Often demanded by investment firms and financial institutions, these letters help maintain accurate records of an investor's eligibility throughout their engagement in investment opportunities. 3. Alternate Verification Letter — Individual Investor: The alternate verification letter is suitable for situations where an investor cannot provide standard documentation of their financial status, net worth, or annual income to meet the typical accredited investor thresholds. This letter employs alternative methods to assess the individual's financial sophistication and experience, expanding the opportunities for potential investors. Key Components of the Clark Nevada Accredited Investor Verification Letter — Individual Investor: - Personal Information: The verification letter commences with the investor's complete name, contact details, and any other pertinent information distinguishing them as an individual. — Eligibility Criteria: This section outlines the specific criteria by which an individual's accredited investor status is assessed. Common categories include income, net worth, professional experience, or holding specific professional certifications. — Supporting Documentation: This portion highlights the required supporting documents an individual must submit to verify their accredited investor status. These documents may include tax returns, bank statements, brokerage statements, or certifications from professionals such as accountants or lawyers. — Certification and Signature: The verification letter concludes with a statement certifying the accuracy of the information provided, endorsing the individual's accredited investor status, and providing space for the investor's signature and date. In summary, the Clark Nevada Accredited Investor Verification Letter — Individual Investor is a crucial document that helps investment entities in Clark County, Nevada to ensure compliance with SEC regulations when soliciting investments. Whether it is the initial verification letter or periodic verification, the objective remains the same — to confirm an individual's eligibility as an accredited investor, opening doors to diverse investment opportunities.

Clark Nevada Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Clark Nevada Accredited Investor Veri?cation Letter - Individual Investor?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Clark Accredited Investor Veri?cation Letter – Individual Investor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Clark Accredited Investor Veri?cation Letter – Individual Investor from the My Forms tab.

For new users, it's necessary to make several more steps to get the Clark Accredited Investor Veri?cation Letter – Individual Investor:

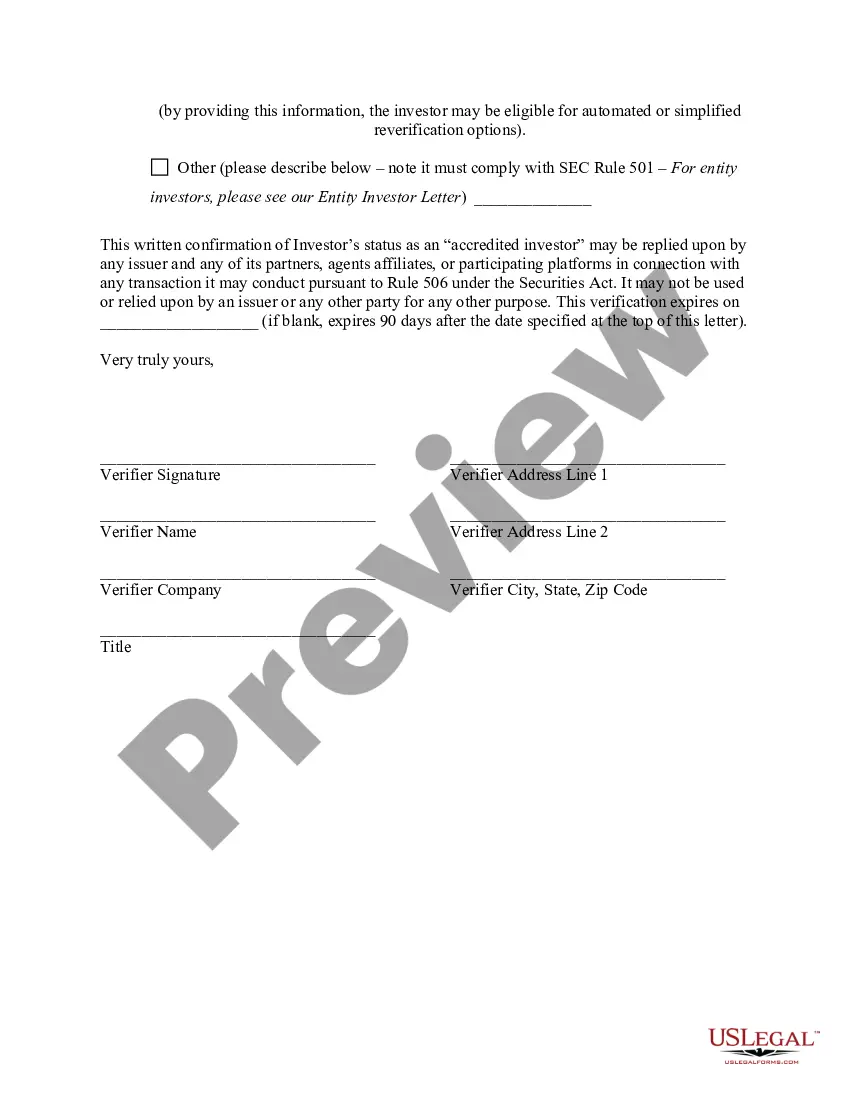

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!