The Cook Illinois Accredited Investor Verification Letter — Individual Investor is a legally recognized document that serves as proof of an individual investor's status as an accredited investor. This letter is typically required by financial institutions, investment firms, and crowdfunding platforms as part of their compliance procedures and ensures that only accredited investors are granted access to certain investment opportunities. Keywords: Cook Illinois, accredited investor verification letter, individual investor, proof, compliance procedures, investment opportunities. Different types of Cook Illinois Accredited Investor Verification Letters for individual investors may include: 1. Cook Illinois Accredited Investor Verification Letter — Income-Based: This type of letter focuses on an individual's income as the primary criterion for determining their accredited investor status. It involves verifying the investor's income sources, earnings history, and annual income level to establish their eligibility. 2. Cook Illinois Accredited Investor Verification Letter — Net Worth-Based: The net worth-based letter considers an individual's total net worth as the basis for accrediting their investor status. It involves assessing the investor's assets, liabilities, and determining if their net worth exceeds a certain threshold set by the Securities and Exchange Commission (SEC). 3. Cook Illinois Accredited Investor Verification Letter — Professional Experience-Based: This type of letter acknowledges an individual's qualifications, experience, or position in a specific profession, allowing them to qualify as an accredited investor. It may require verifying licenses, certifications, or employment history to validate their expertise and professional standing. 4. Cook Illinois Accredited Investor Verification Letter — Joint Investors: In situations where multiple individuals jointly invest in a project or fund, a joint investor verification letter is required. This letter confirms the accredited investor status of each individual involved in the joint investment and outlines their respective contribution percentages. 5. Cook Illinois Accredited Investor Verification Letter — Special Circumstances: For unique cases, such as inheritors, trustees, or individuals with other exceptional circumstances, special verification letters may be necessary. These letters serve to demonstrate how the individual satisfies the criteria for an accredited investor, taking into account their specific situation. It is important to note that the specific types of Cook Illinois Accredited Investor Verification Letters may vary based on the regulatory requirements, the investment platform, or the financial institution involved.

Cook Illinois Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Cook Illinois Accredited Investor Veri?cation Letter - Individual Investor?

Drafting papers for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Cook Accredited Investor Veri?cation Letter – Individual Investor without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Cook Accredited Investor Veri?cation Letter – Individual Investor by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Cook Accredited Investor Veri?cation Letter – Individual Investor:

- Look through the page you've opened and verify if it has the sample you require.

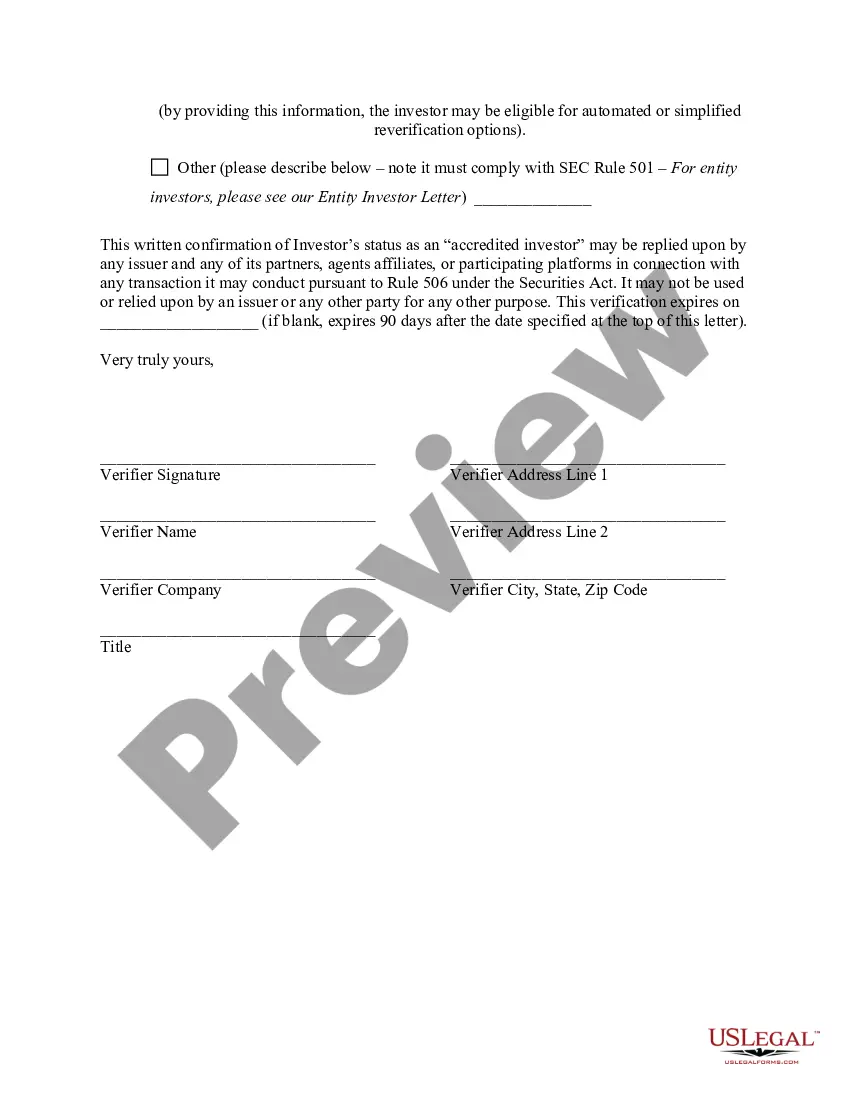

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!