Title: Understanding the Bronx New York Accredited Investor Status Certification Letter Introduction: Bronx, New York, hosts a thriving investment community that frequently requires individuals to prove their Accredited Investor Status before participating in certain investment opportunities. This article aims to provide a comprehensive understanding of the Bronx New York Accredited Investor Status Certification Letter, its purpose, and any potential variations or types associated with it. 1. Accredited Investor Status Certification Letter: The Bronx New York Accredited Investor Status Certification Letter is a formal document that verifies an individual's qualification as an accredited investor. This certification is primarily used to gain access to private investment opportunities, such as hedge funds, private equity funds, and certain restricted securities. 2. Purpose: The primary purpose of the Bronx New York Accredited Investor Status Certification Letter is to provide proof of an individual's financial and investment expertise, as mandated by various securities regulations. By obtaining this certification, eligible investors can participate in investment opportunities that are typically restricted to accredited investors only. 3. Content and Format: The certification letter typically includes essential information such as the investor's name, address, contact details, net worth, income, and any relevant financial details necessary to establish accredited investor status. It is important to include accurate information, as any misrepresentation may lead to legal consequences. 4. Types of Bronx New York Accredited Investor Status Certification Letter: a. Individual Certification Letter: This type of certification applies to individual investors who meet the specific requirements outlined by the U.S. Securities and Exchange Commission (SEC). It verifies an individual's income, net worth, or other qualifying criteria for accreditation. b. Institutional Certification Letter: Institutions, including corporations, partnerships, limited liability companies, and trusts, may also seek accreditation to engage in investment opportunities. The institutional certification letter confirms that the entity satisfies the necessary requirements to be considered an accredited investor. c. Consequent Updates or Renewals: In some cases, investors may need to update or renew their accreditation status periodically. This might involve providing updated financial information or evidence to maintain their accredited investor status. The specific requirements for updates or renewals may vary and should be identified based on the investor's unique circumstances. Conclusion: The Bronx New York Accredited Investor Status Certification Letter is a critical document used to verify an investor's eligibility for private investment opportunities within the Bronx, New York area. Understanding the purpose and potential types of this certification is crucial for individuals or institutions seeking to participate in exclusive investment opportunities that require accredited investor status. Proving eligibility through this certification letter showcases an investor's financial expertise and opens doors to a wider range of investment opportunities.

Bronx New York Accredited Investor Status Certification Letter

Description

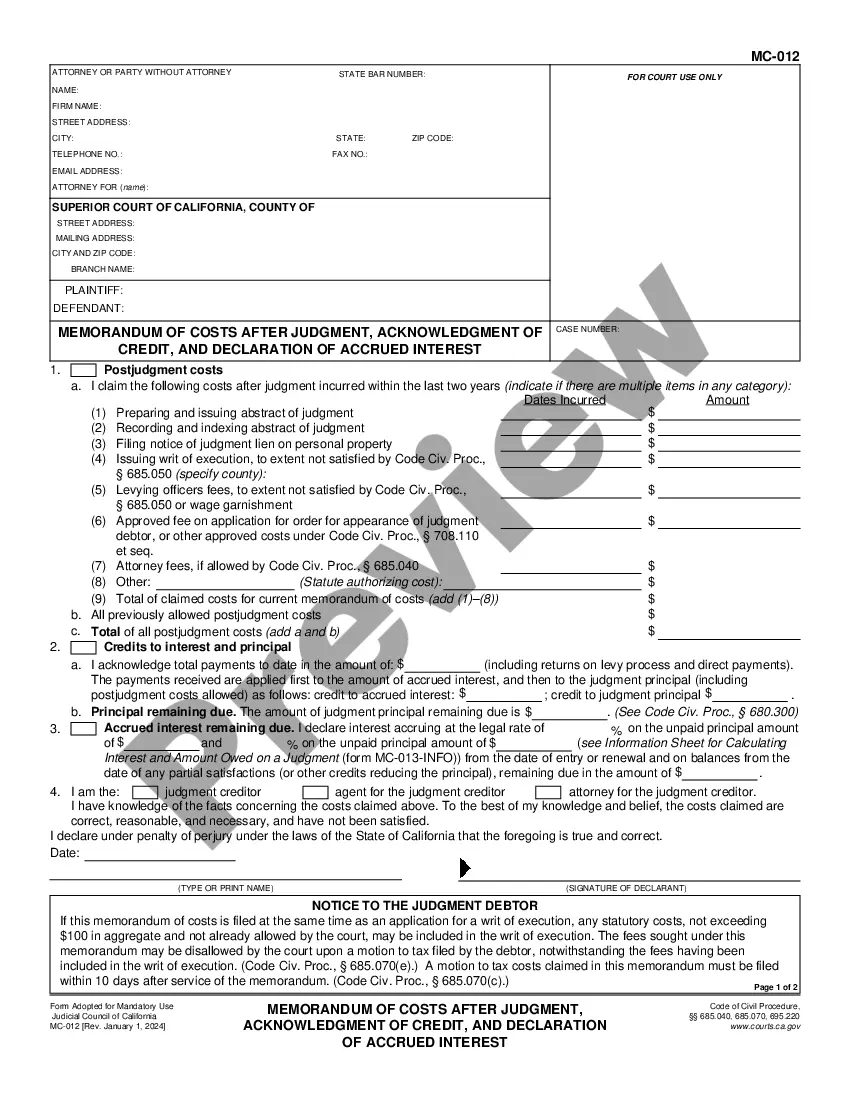

How to fill out Bronx New York Accredited Investor Status Certification Letter?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Bronx Accredited Investor Status Certification Letter, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the recent version of the Bronx Accredited Investor Status Certification Letter, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Bronx Accredited Investor Status Certification Letter:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Bronx Accredited Investor Status Certification Letter and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!