Title: Understanding the Allegheny Pennsylvania Accredited Investor Verification Letter: Types and Requirements Introduction: The Allegheny Pennsylvania Accredited Investor Verification Letter serves as a crucial document in the financial realm, allowing individuals or entities to prove their accredited investor status. This status is crucial for accessing certain investment opportunities that may be restricted to accredited investors only. In this article, we delve into the intricacies of this verification letter, exploring its purpose, different types, and necessary requirements. 1. Purpose of the Allegheny Pennsylvania Accredited Investor Verification Letter: The primary objective of the Allegheny Pennsylvania Accredited Investor Verification Letter is to provide tangible evidence that an individual or entity meets the criteria of an accredited investor. This letter serves as a confirmation, underscoring the financial stability necessary to engage in investments and transactions that are only available to accredited investors. 2. Types of Allegheny Pennsylvania Accredited Investor Verification Letters: a) Individual Investor Verification Letter: Designed for individual investors, this letter requires the investor to meet certain conditions outlined by the Securities and Exchange Commission (SEC). Individuals may qualify as accredited investors based on their income, net worth, or professional certifications. b) Entity Investor Verification Letter: This type of letter is intended for entities, such as corporations, partnerships, or limited liability companies. It verifies the accredited investor status of the entity based on specific criteria determined by the SEC. 3. Key Requirements for Obtaining the Verification Letter: To obtain the Allegheny Pennsylvania Accredited Investor Verification Letter, individuals or entities must fulfill specific requirements imposed by the SEC. Though the requirements may slightly differ for individual and entity investors, some common factors include: — Minimum income thresholds: Individuals must demonstrate a high income level, often exceeding a specified amount (e.g., $200,000 annually). — Net worth requirements: Investors may qualify based on their net worth, which should surpass a minimum threshold (e.g., $1 million, excluding their primary residence). — Professional certifications: Certain professional certifications, such as licensed attorneys, chartered financial analysts, or certified public accountants, may also grant accredited investor status. Conclusion: The Allegheny Pennsylvania Accredited Investor Verification Letter is an essential document that validates an individual or entity's accredited investor status. By fulfilling specific criteria set by the SEC, investors can gain access to exclusive investment opportunities. Thus, ensuring proper verification and adherence to regulatory requirements is vital for participants in the financial market.

Allegheny Pennsylvania Accredited Investor Verification Letter

Description

How to fill out Allegheny Pennsylvania Accredited Investor Verification Letter?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Allegheny Accredited Investor Verification Letter is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Allegheny Accredited Investor Verification Letter. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

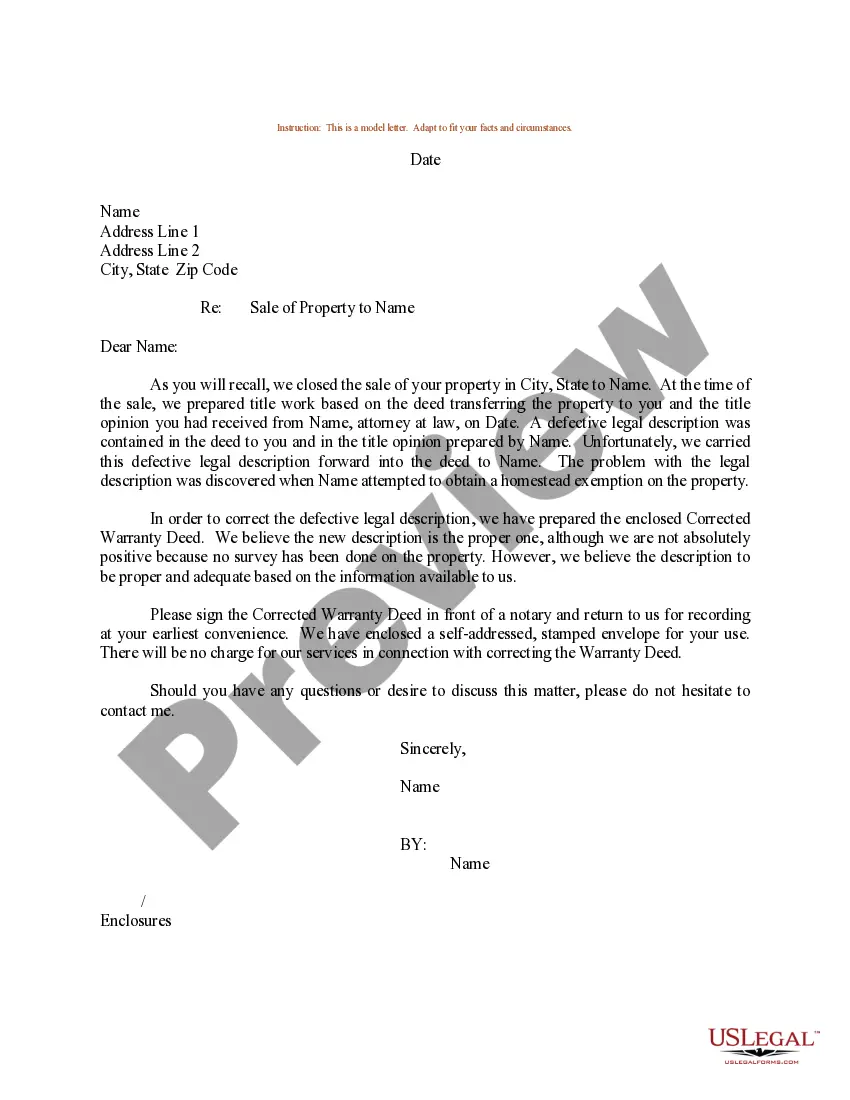

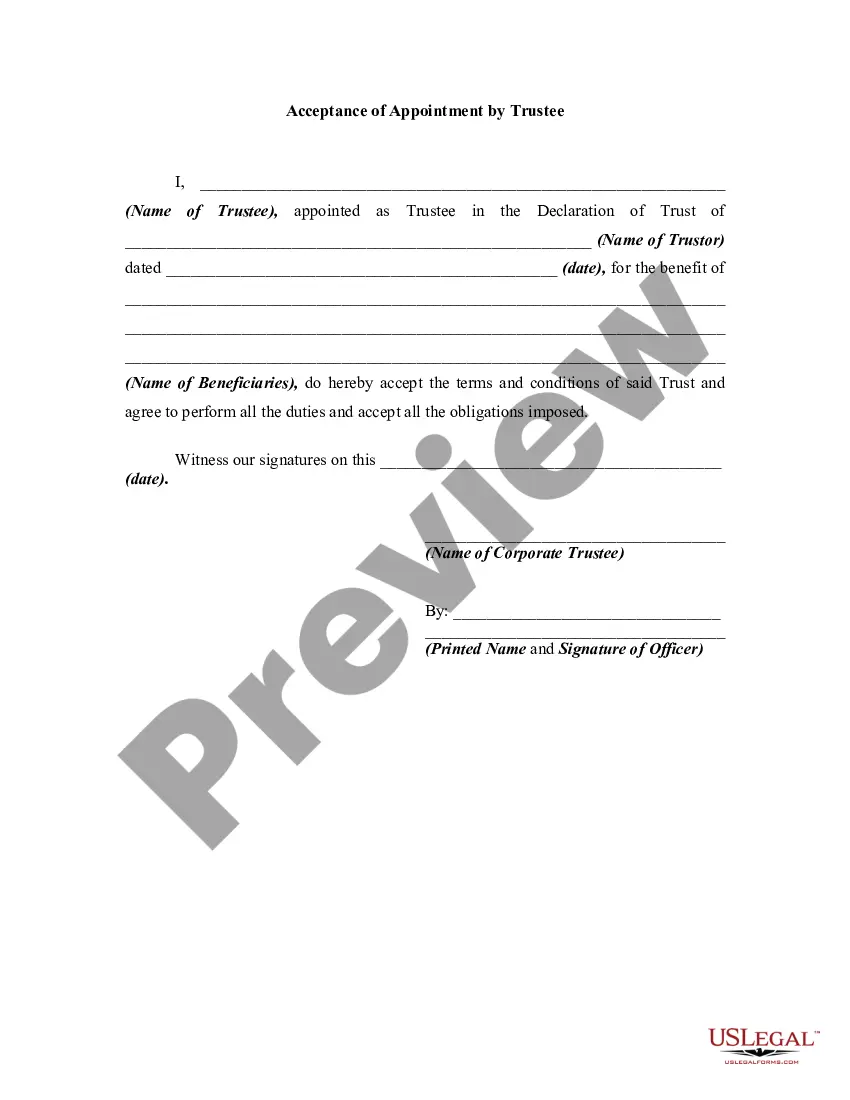

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Accredited Investor Verification Letter in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!