Fairfax Virginia Accredited Investor Verification Letter is a formal document used to verify an individual's accredited investor status in accordance with the regulations set by the Securities and Exchange Commission (SEC). Accredited investors are individuals or entities with a higher net worth or income who are qualified to invest in certain types of private offerings, startups, hedge funds, and other alternative investment opportunities. The letter serves as proof that an individual meets the criteria outlined in SEC regulations to be considered an accredited investor. It ensures compliance and is typically required by investment firms, private companies, or other entities offering investment opportunities. The letter may be requested during the investment process, subscription, or membership application. Keywords for the content: Fairfax Virginia, Accredited Investor Verification Letter, SEC regulations, investment firms, private offerings, hedge funds, net worth, income, compliance, investment opportunities, subscription, membership application. Types of Fairfax Virginia Accredited Investor Verification Letters: 1. Personal Accredited Investor Verification Letter: This type of letter is issued to individuals to verify their accredited investor status based on their personal financial information, such as net worth and income. 2. Institutional Accredited Investor Verification Letter: This letter is issued to institutions, such as corporations or pension funds, to verify their accredited investor status based on their financial strength and regulatory compliance. 3. Foreign Accredited Investor Verification Letter: For foreign investors seeking to participate in US investment opportunities, this letter verifies their accredited investor status according to the SEC regulations and may require additional documentation for cross-border investments. 4. Limited Partnership Accredited Investor Verification Letter: This specific letter is used to verify an individual's accreditation status when investing in a limited partnership, typically in the real estate or private equity sector. 5. Family Office Accredited Investor Verification Letter: Family offices, which manage investments for affluent families, may require this letter to confirm their accredited investor status for various investment opportunities. In conclusion, the Fairfax Virginia Accredited Investor Verification Letter is a crucial document used to verify an individual or entity's accredited investor status according to SEC regulations. It ensures compliance and is requested by investment firms, private companies, or other entities offering investment opportunities. There are various types of verification letters depending on the nature of the investment and the investor's profile.

Fairfax Virginia Accredited Investor Verification Letter

Description

How to fill out Fairfax Virginia Accredited Investor Verification Letter?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Fairfax Accredited Investor Verification Letter meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Fairfax Accredited Investor Verification Letter, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Fairfax Accredited Investor Verification Letter:

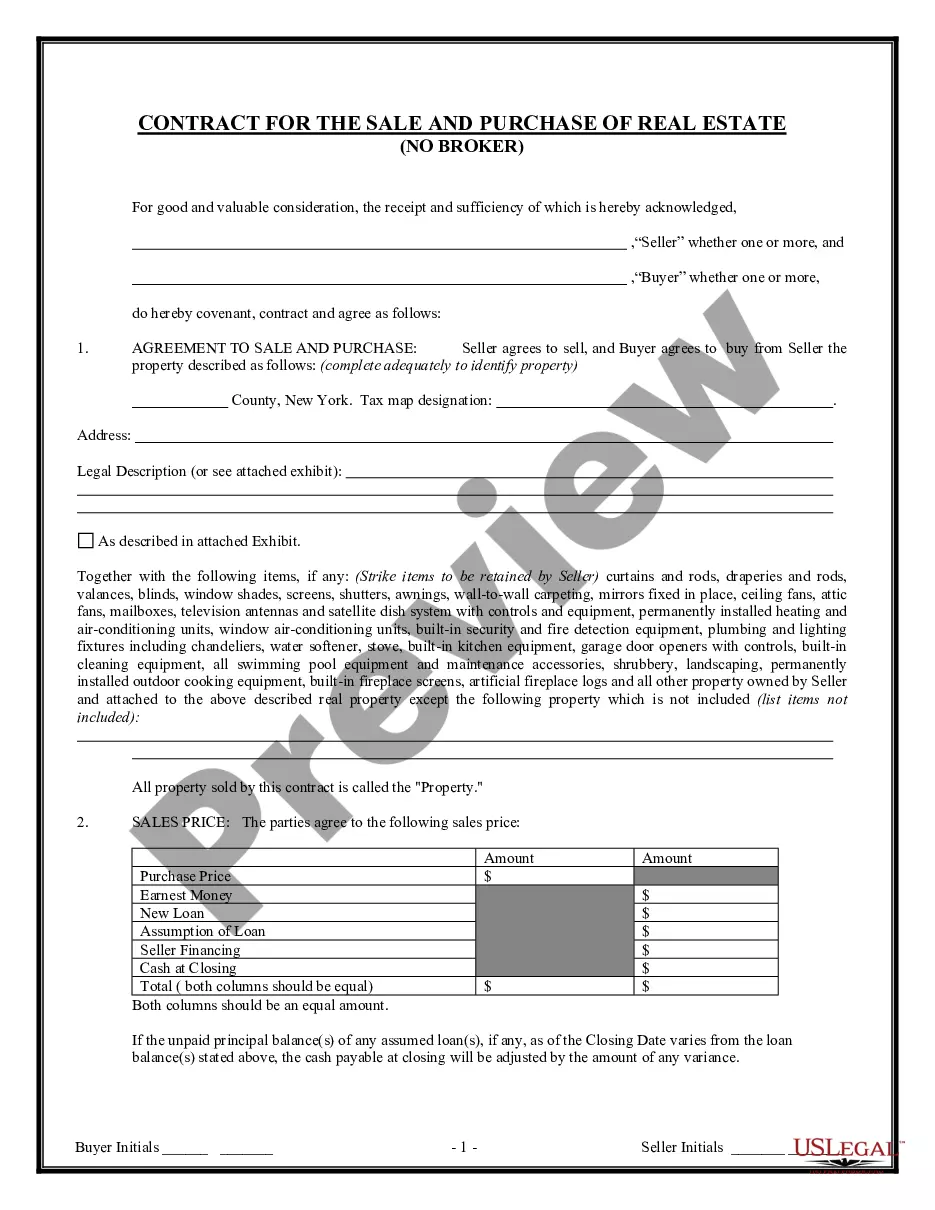

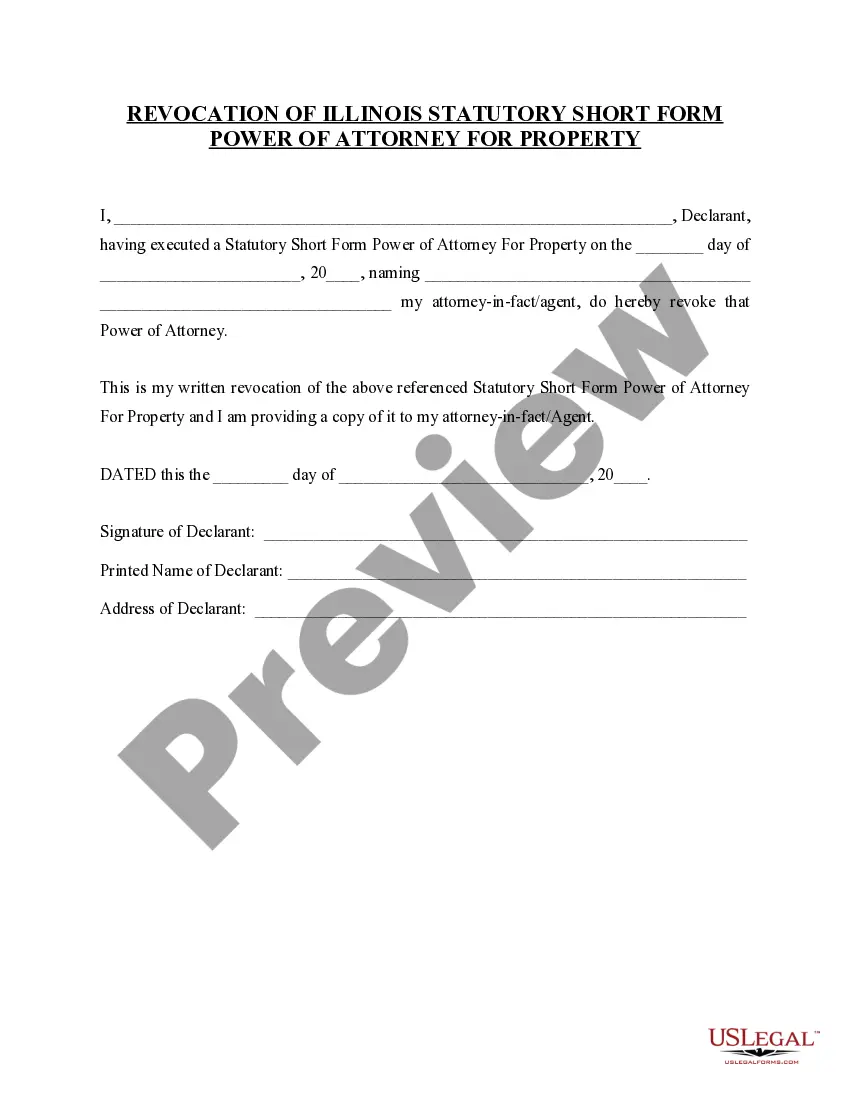

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Fairfax Accredited Investor Verification Letter.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!