Harris Texas Accredited Investor Verification Letter is an important document utilized in the world of finance and investment to verify an individual's status as an accredited investor. Harris County, Texas, being a prominent hub for financial activities, necessitates the need for such verification letters to ensure compliance with regulatory requirements. Keywords: Harris Texas, Accredited Investor Verification Letter, finance, investment, regulatory requirements, compliance. Types of Harris Texas Accredited Investor Verification Letters: 1. Individual Accredited Investor Verification Letter: This type of verification letter is issued to individuals who meet specific criteria set forth by the U.S. Securities and Exchange Commission (SEC) to qualify as accredited investors. The letter confirms the individual's financial capacity, knowledge, and experience in making high-risk investments. 2. Entity Accredited Investor Verification Letter: This category of verification letter is issued to entities, such as corporations, partnerships, limited liability companies, or trusts, which meet the standards defined by the SEC to qualify as accredited investors. The letter verifies the entity's financial status, assets, and expertise in managing investment risks. 3. Spousal Accredited Investor Verification Letter: In situations where a couple wants to combine their financial resources to meet the accredited investor criteria, a spousal verification letter is useful. It validates the combined financial capacity of both spouses as accredited investors, allowing them to participate in investment opportunities as a unit. 4. Foreign Accredited Investor Verification Letter: For individuals or entities residing outside the United States but seeking to invest in Harris County, Texas, a foreign accredited investor verification letter is essential. This letter certifies that they meet the relevant criteria set by the SEC, enabling them to engage in investment activities within the county. It is crucial to promptly obtain an accurate Harris Texas Accredited Investor Verification Letter to ensure compliance with applicable laws and regulations and to participate in investment opportunities tailored for accredited investors.

Harris Texas Accredited Investor Verification Letter

Description

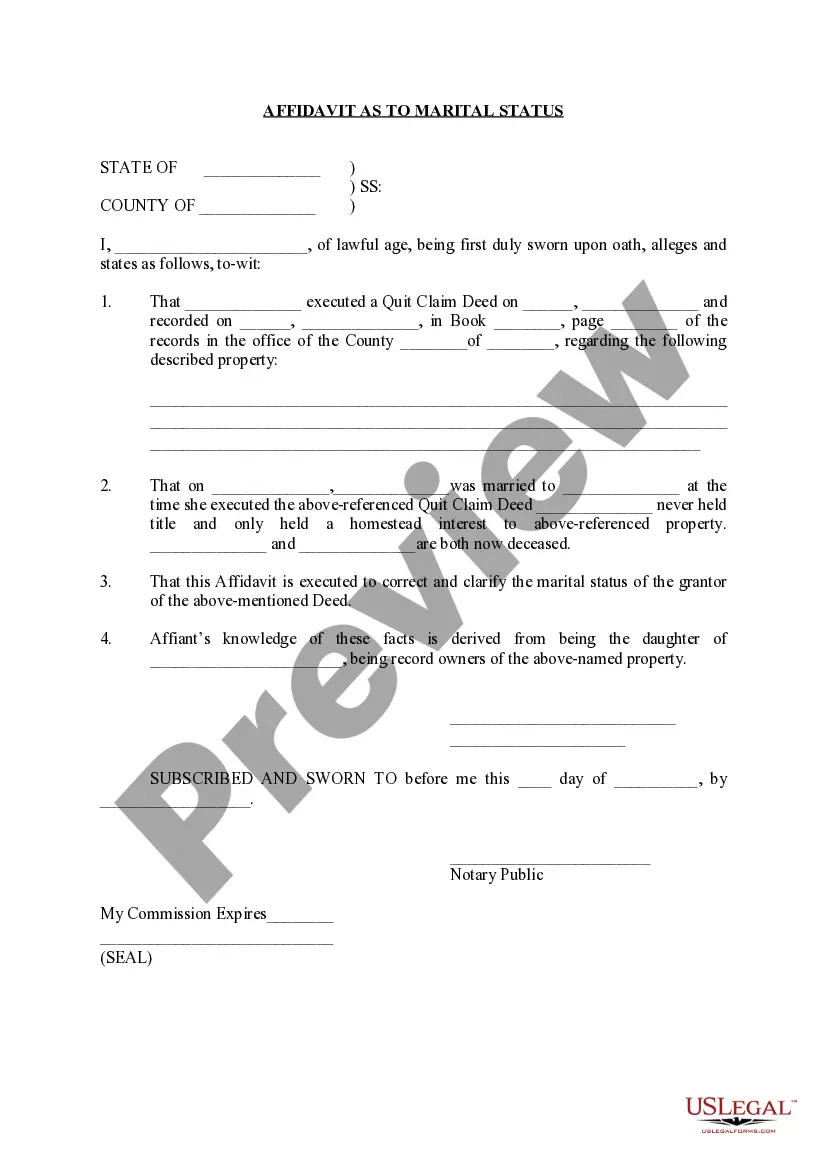

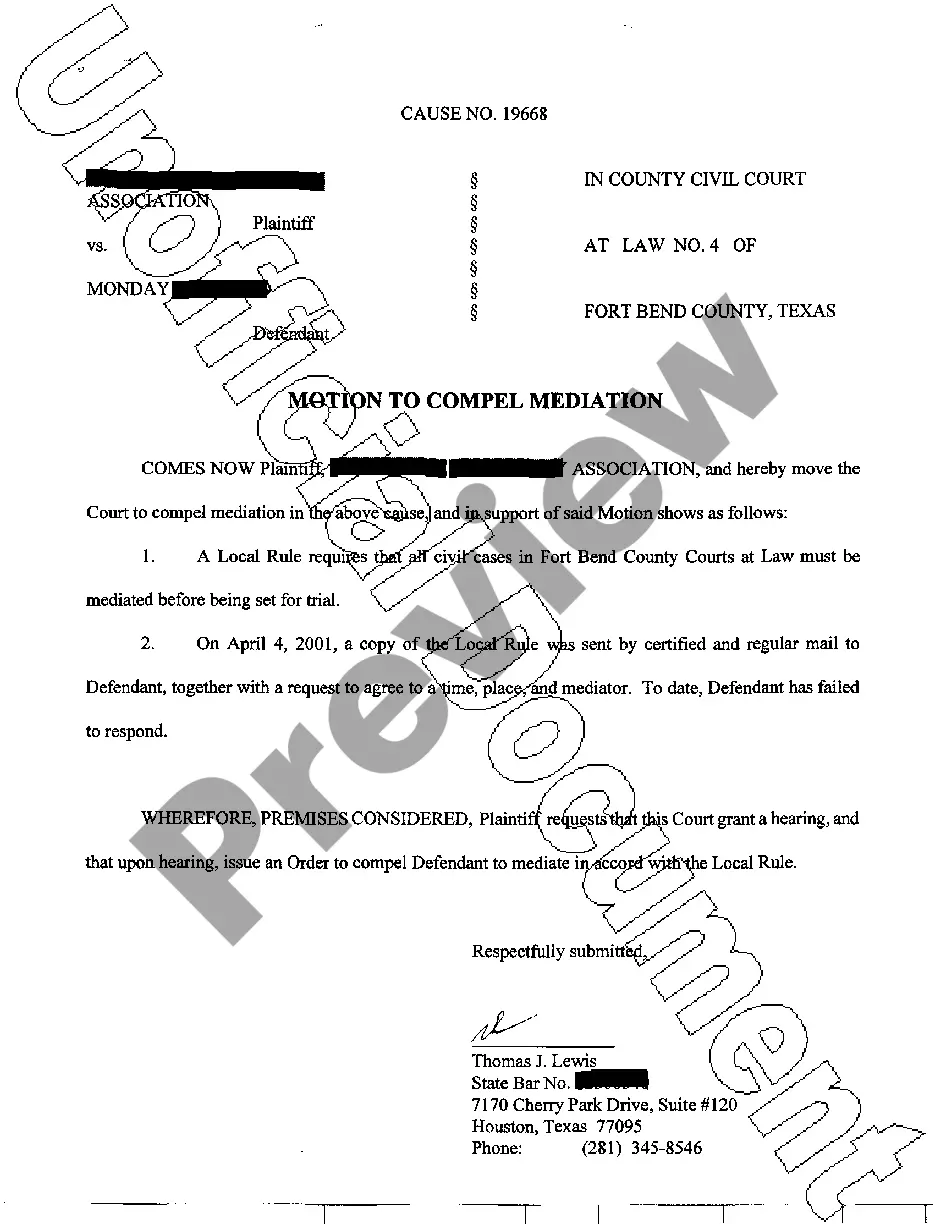

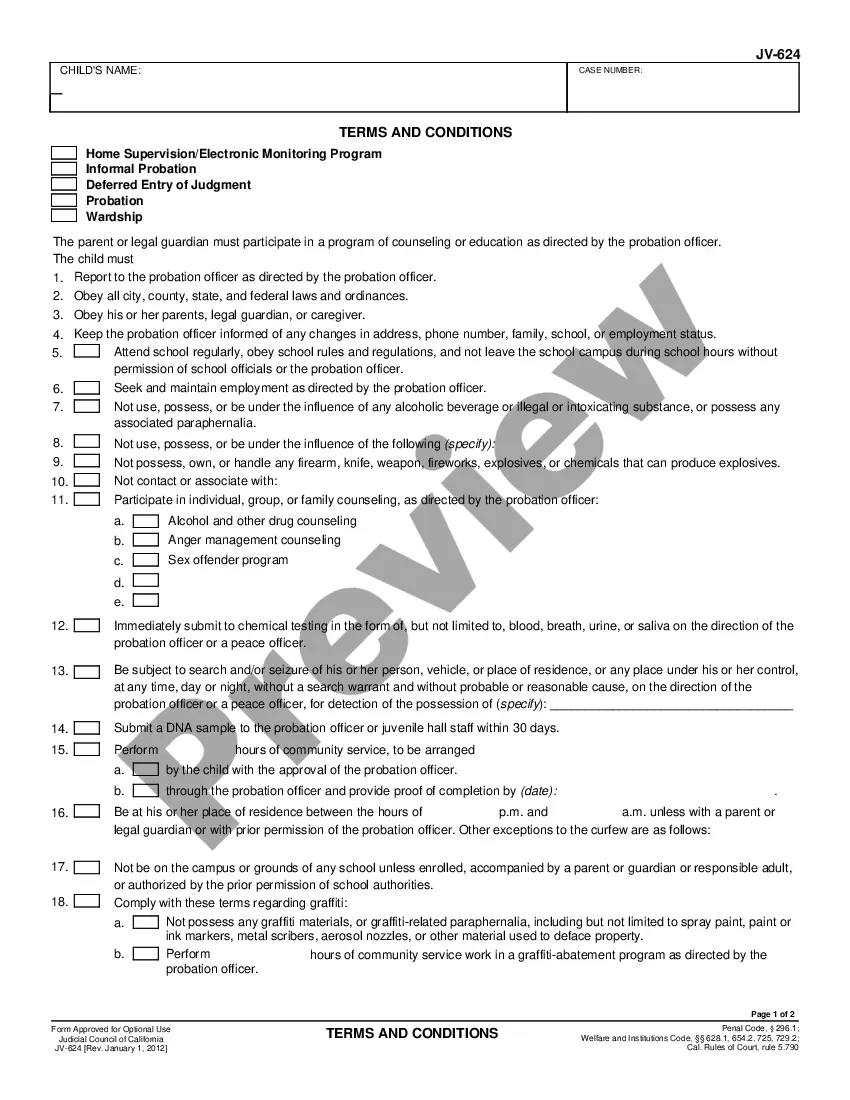

How to fill out Harris Texas Accredited Investor Verification Letter?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Harris Accredited Investor Verification Letter is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Harris Accredited Investor Verification Letter. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Accredited Investor Verification Letter in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!